Key events in developed markets next week

Jam-packed week ahead for developed markets, but with no end in sight for the US government shutdown and a Federal Reserve likely to hit the brakes, our main focus turns towards Eurozone data - particularly growth and inflation, which in our view is going to give the ECB a lot to think about

US: Taking its time

The US government shutdown continues, and unfortunately, there is no end in sight. For the 800,000 workers not receiving their paycheck, the pain is obvious, but we are now seeing broader implications with private sector enterprise increasingly feeling the strain. Government contractors are not getting paid and will not be compensated, while new business permits and travel visas are not being approved and airport security lines continue to grow in length. This in itself is not enough to significantly hurt the US economy, but when combined with other headwinds such as the lagged effects of higher interest rates, the stronger dollar, and ongoing trade worries, it certainly adds to the economic uncertainty.

In this environment, the Federal Reserve is widely expected to sit on its hands with a no policy change announcement on 30 January. The fact that the government shutdown has limited the data flow also argues for a pause, until there is more clarity. Indeed, 4Q GDP data, scheduled for Wednesday, won't be released unless the government reopens imminently.

The Federal Reserve only raised rates last month, we continue to expect just two rate rises in 2019 versus the four we saw in 2018. Financial markets are pricing the risk of rate cuts, but we think the strength of the jobs market makes this unlikely. This week’s payrolls report won’t be anywhere near as strong as the December report, but the key themes of companies struggling to fill vacancies with wages being bid higher still holds – note the Bureau for Labour Statistics is fully funded until 30 September so will be publishing economic data. Moreover, if the US-China trade tensions start to soften, this will boost the case of a rate hike in June.

Eurozone: A lot for the ECB to mull over

An important week for the Eurozone as a lot of eagerly awaited data will be coming out. Data on the Eurozone economy in the fourth quarter has been dismal, and next week the final report card will be presented as we obtain the flash estimate for GDP.

Inflation is another key figure that has been moving south recently as petrol prices have come down significantly. Inflation is now moving away from the target as uncertainty about economic growth mounts. Coming week’s data will, therefore, be a lot for the ECB to chew on.

German labour market watched closely for slowdown signs

On the back of lower oil prices, headline inflation should come in lower once again. As regards the labour market, it will be interesting to watch whether the recent economic slowdown has started to leave some marks already, or whether the strong labour market remains an important growth driver for the entire economy.

Scandi PMI's in focus

In another fairly quiet week, the key figures in the Nordic countries will be the January manufacturing PMI surveys, as well as the National Institute of Economic Research (NIER) economic sentiment survey in Sweden.

We expect a continuation of the recent weakening trend that has been evident globally over recent months. Sweden is likely to see a PMI print close to - but still above - the 50 level that marks the difference between expansion and contraction. The NIER survey is also likely to indicate further weakening ahead. In Norway, the domestic economy has held up better, and while we expect a fall in the PMI figures in January, they will remain at healthier levels (around 54).

Canada: November GDP, upside surprise unlikely

After a few months’ of weariness in Canadian growth, a much-needed boost arrived in October (0.3% MoM). That said, we aren’t expecting much of an upside surprise in November. Canada’s energy-sector is suffering from transportation constraints and inventory build-ups, which is supressing oil extraction and exports. Trade data in November confirms this as the deficit widened further, and yet again was largely fuelled by another decline in exports (-2.9% MoM).

Coupling this with significant November declines in wholesale and manufacturing sales, we forecast growth to be muted at 0.0% MoM, bringing the annual figure to 1.8%. In our view, this below par performance of the energy sector is expected to persist into 2019 – on the back of this, we revised down our growth expectations this year from 2.1% to 1.8%.

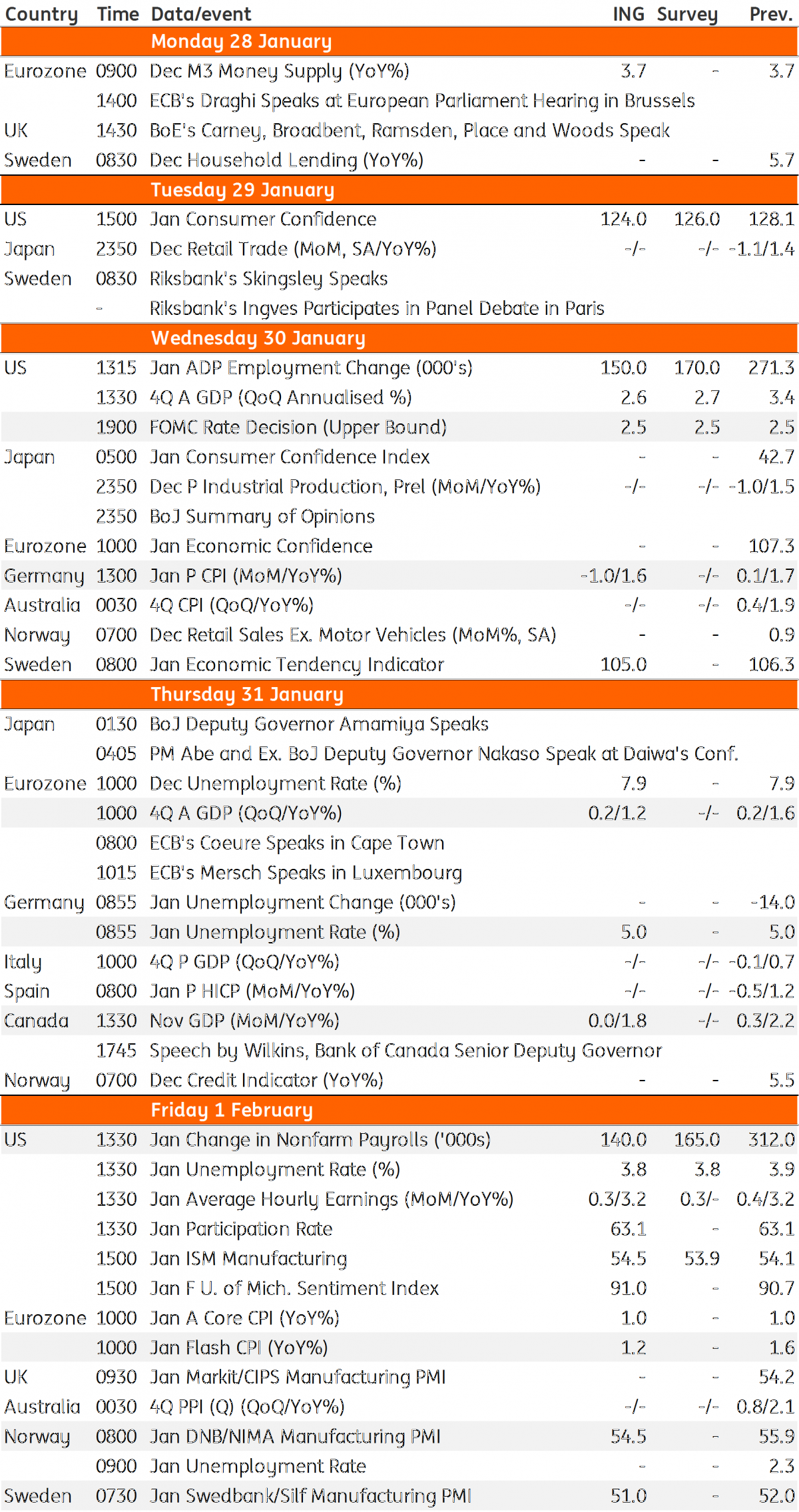

Developed Markets Economic Calendar

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

25 January 2019

Our view on next week’s key events This bundle contains 3 Articles