Key events in developed markets next week

Will UK MPs finally be happy with May's Brexit negotiations? Unlikely, but we're keeping a close eye out for the Cooper-Boles amendment in case it re-emerges as an alternative. Aside from Brexit, we turn towards the Eurozone's labour market data to see if it has sustained its recent strength

Eurozone: Labour market, still strong?

After slightly better survey data from the Eurozone – although manufacturing PMI did dip below 50, which is yet another growth warning sign, this week will be about inflation and unemployment. With higher oil prices, the question is whether inflation will continue its decline or whether it stabilises around current readings of 1.4%.

Also, we turn towards the question of whether the labour market continued to improve at the start of the year despite the sluggish growth signals? As manufacturing continues to be weak, the strong labour market continues to be the driving force of the economy and therefore labour market data increases in importance.

Possible Article 50 extension as Britain prepares for another Brexit vote?

Two weeks on from the last Brexit vote in mid-February, reports suggest little has changed. The UK has not secured the legal concessions it's after on the Irish backstop, so at the time of writing, it looks like there won’t be a repeat ‘meaningful vote’ on May’s deal next week.

Instead, the Prime Minister will update lawmakers on progress, which will be followed by a vote on Wednesday to determine whether MPs are happy with May’s current negotiating strategy. The key thing to watch will be the so-called Cooper-Boles amendment, a measure designed to kick-start the process of extending the Article 50 negotiating period beyond 29 March. A similar proposal was rejected by MPs at the end of January, but only by a relatively slim margin. With lawmakers beginning to run out of patience, it has a better chance of succeeding this time and we think there is a fairly high chance now that the Brexit deadline will be pushed back. The question nobody really has the answer to is how long might an extension last?

Sweden: Growth to remain weak

Next week’s Swedish 4Q18 GDP data is likely to show a modest rebound from the surprise negative figure we saw in the third quarter, but the growth trajectory remains firmly on a downward trend. Forward-looking surveys from the NIER due on Wednesday and the manufacturing PMI due on Friday are likely to fall further as the economy slows down at the start of 2019. A combination of a housing slump (damaging domestic demand) and a worsening global environment (hitting exports) means Sweden looks likely to underperform peers in 2019.

Meanwhile, Norway’s PMI survey is likely to come in stronger as the Norwegian economy remains robust, and the upswing in oil investment will at least partly offset the global slowdown.

Canada 4Q18 GDP: It ain't pretty

The highlight next week will be Canada’s growth results for the fourth quarter of 2018, and the news here isn't good. Low oil prices, weakness in the manufacturing sector and a housing market correction are likely to be some of the more significant factors that will drag on growth and contribute to our 1.4% QoQ (annualised) forecast - down from the 2% we saw back in the third quarter.

That said, this dip is largely anticipated, and we expect certain downside factors – such as low oil prices and poor manufacturing data, to dissipate in the medium-term. By no means will these suspected upsides avoid an economic slowdown this year, but they should help to keep the slowdown mild – not major.

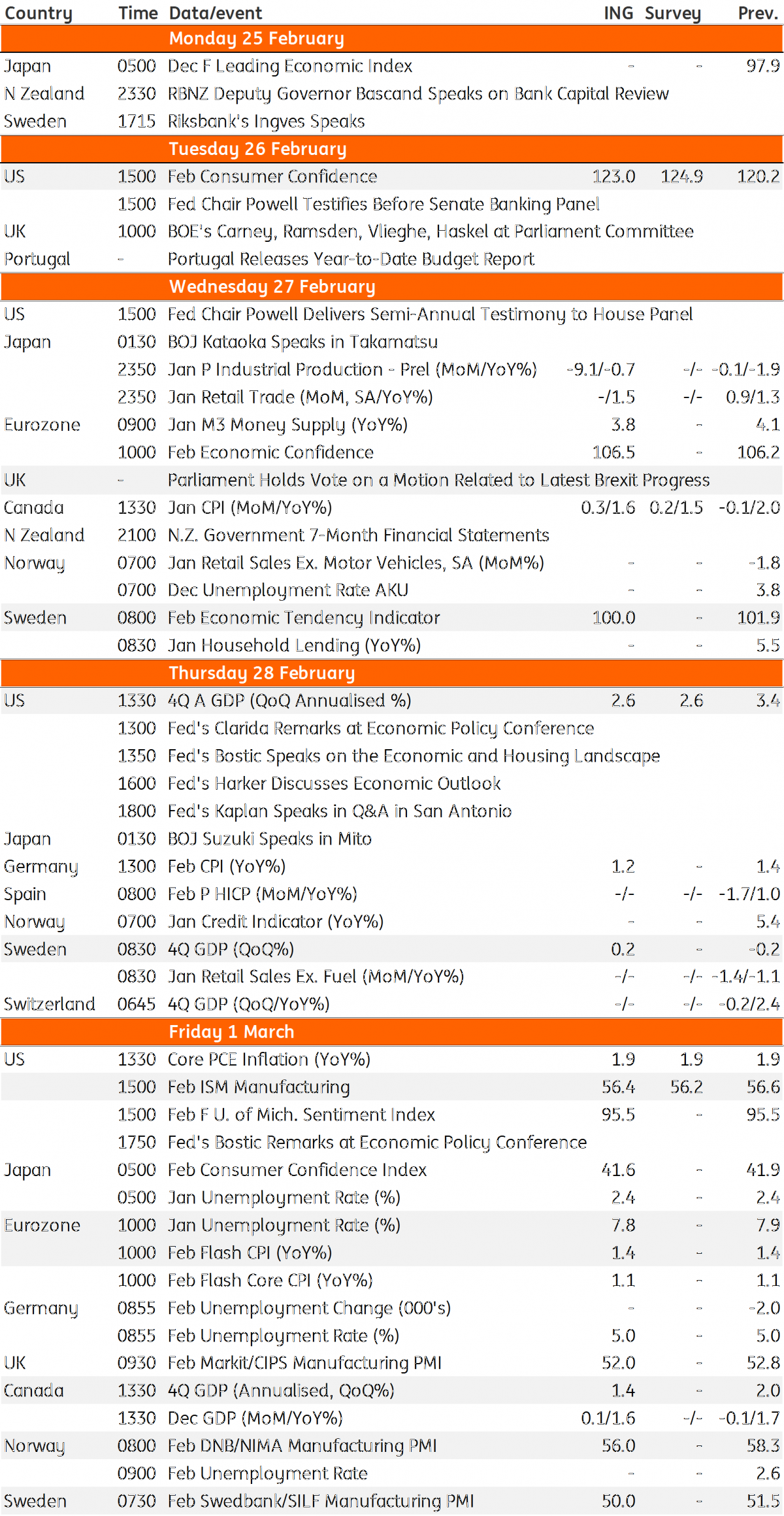

Developed Markets Economic Calendar

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

22 February 2019

Our view on next week’s key events This bundle contains 3 Articles