Key events in developed markets next week

Swedish politics, Bank of England speakers and a Fed meeting - which should conclude in a 25bp rate hike - are among next week's highlights for developed markets

US: Gradually climbing

The US highlight will be the Federal Reserve meeting, which looks set to conclude with a 25 basis point interest rate rise. The economy is booming - The Atlanta Fed's Nowcast model suggests 3Q GDP growth is set to accelerate to 4.4% annualised growth - and inflation is at or above the Fed's 2% target on all of the main measures. At the same time, the jobs market is incredibly strong, with growing signs that wages are picking up and asset markets are buoyant. This suggests to us that the Fed will stick with its policy guideline of "gradual" interest rate increases.

While there is nervousness about the intensification of global trade tensions and the imposition of additional tariffs, the economy is showing little sign of slowing. As such, a December rate rise remains on the cards, but we do expect a slower pace of tightening next year. The fading fiscal stimulus, trade tensions, a strong dollar, rising interest rates and concerns about emerging markets will increasingly exert headwinds that will slow growth. We look for the Fed to follow up 2018's four 25bp rate rises with only two further moves in 2019.

In terms of US data, 2Q GDP could be revised marginally higher from the 4.2% rate originally reported, while consumer confidence and housing numbers should be underpinned by the strong jobs market and tax cuts. Durable goods orders should rebound thanks to strong Boeing aircraft orders in August.

Improvements in core inflation are yet to be seen

Eurozone inflation will be watched closely after last month’s drop in core inflation. Even though wage growth continues to improve, core inflation has yet to accelerate. Cautious improvements could be expected in the coming months on the back of labour market improvements and second-round effects of higher oil prices, but with uncertainties about the global economy, increasing it could well be that businesses are cautious in pricing through increased input costs.

Eyes on Bank of England speakers as policymakers enter tricky period

In a light data week in the UK, the focus will be on four different Bank of England (BoE) speakers including Governor Carney. While the run of UK data has been a little better recently, it’s hard to see BoE policymakers offering any firm hints on their tightening plans as ‘no deal’ uncertainty builds. We think there is a risk that consumer and business sentiment takes a further hit towards the end of the year if the perceived risk of ‘no deal’ remains high. This will make it complicated for the Bank of England to hike again before Brexit, and we don’t expect another rate rise before May 2019.

Separately, we are also entering a busy period in the UK political calendar as the two major parties meet for their annual conferences. First up this weekend is the Labour conference, where the key question for markets is whether the opposition party hint further that they could vote down PM May’s deal when it is voted upon by MPs. Remember that even if the UK and EU agree on a deal this autumn, the odds of a ‘no deal’ really hinge on lawmakers passing it when it goes to a House of Commons vote in January. Some senior Labour MPs have hinted they could reject the deal, as it could raise the likelihood of an early election.

There have also been hints that the Labour party may offer more support to a second referendum on the deal. However, given the time required to legislate for such a vote, we still think the probability of another referendum taking place is relatively low.

Positive news expected from German Ifo's

After the encouraging rebound in August, hold your breath for the September Ifo index. Will trade tensions and market volatility in emerging markets be a renewed set-back, or will German businesses rather focus on strong domestic fundamentals? We expect another increase in the Ifo, pointing to solid growth in the remaining months of the year.

Swedish politics grabs the limelight in Scandinavia - again

In Scandinavia, attention will shift back to the Swedish political situation, as the new Parliament opens on Monday. The mainstream parties still appear far from reaching a compromise on how to govern the country following a very close election result, and this week will see continued manoeuvring, initially around choosing a new speaker for parliament and a likely vote of no confidence in the current centre-left government. August retail sales and the September economic tendency survey will give first read on economic momentum after the summer.

In Norway, the market will be digesting the surprisingly dovish communication from Norges Bank September meeting (both Governor Olsen and his two deputy governors will be speaking during the week), while the data flow (credit growth, retail sales, and unemployment) remains on the light side.

Small bout of energy brought back into Canadian growth

On the back of a flat June, a minor uptick of 0.1% MoM is expected from July's GDP print. Although a factor weighing down on June's figure will still prevail, namely reduced oil and gas output; Canada's oil facility, Syncrude, was still experiencing a power outage in July, causing it to be in an 'offline' mode and thus reducing production.

That said, an expected pick up in July retail sales, from the -0.2% MoM downfall in June, along with the narrowing trade deficit seen in August to 0.11 billion, means we should regain some minor momentum on June.

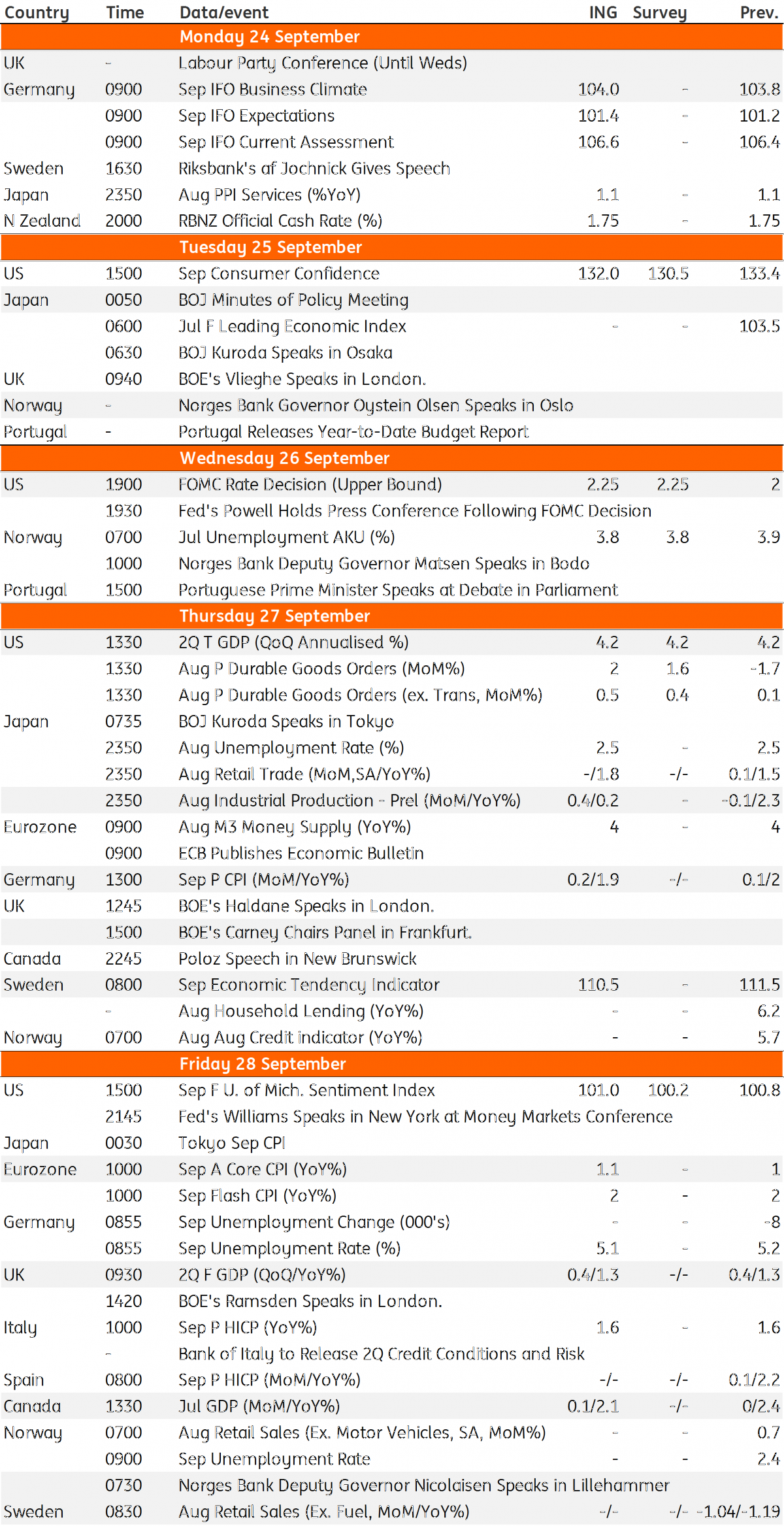

Developed Markets Economic Calendar

Download

Download article

21 September 2018

Our view on next week’s key events This bundle contains 3 ArticlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more