Key events in developed markets next week

In the US, Federal Reserve Chairman Jerome Powell’s testimony to Congress will be a key focus to see how monetary policy is set to develop. Across the pond, the UK’s roadmap out of lockdown will be unveiled on Monday

US: All eyes on Chairman Powell’s testimony

The undoubted highlight next week will be Powell’s testimony to Congress. This is a big one as it is tied to the publication of the Federal Reserve’s semi-annual monetary policy report so there should in theory be substantive guidance on how the Fed is seeing the path of monetary policy developing. The recent blowout retail sales and industrial production reports, progress on President Biden’s $1.9tn stimulus plan, clear positive momentum in the vaccine programme and a growing sense that inflation is about to pick up meaningfully mean it will be a tricky path for Powell to tread. It will be difficult to argue that the economy remains weak and risks are skewed to the downside, but he won’t want to sound too upbeat either as that could trigger further sharp moves higher in Treasury yields, which could impede the recovery and result in broader market volatility. Consequently, we look for a cautiously positive tone, which also emphasises risks in terms of potential vaccine rollout issues and the potential threat from virus mutations. He will likely look to dampen talk of a QE tapering anytime soon and we suspect that if the testimony passes without significant market reaction he and his Fed colleagues will view that as a “successful” outcome.

In terms of data there are GDP revisions, consumer confidence and the Fed’s favoured measure of inflation, the core personal consumer expenditure deflator. Given the huge retail sales figure, the consumer spending numbers will be fantastic, although not as strong given services are included – retail sales account for a little over 40% of personal consumption. Confidence may dip a little given January was likely buoyed by the $600 stimulus payment. GDP could be revised a touch higher, but it will be marginal at best.

UK: Reopening in focus; unemployment set to rise

UK Prime Minister Boris Johnson will unveil the roadmap for reopening the economy on Monday, and caution is likely to be the name of the game. The good news is the vaccination programme continues apace, and all priority groups are likely to have had their first dose by Easter. But unless capacity increases considerably (which is possible), it will be another few months before all adults have been partially vaccinated given the switch towards giving second doses from April. In the meantime, the government will be wary about keeping community transmission down, out of concern for the new, more vaccine-resistant strains. Aside from schools, most of the reopening is likely to be concentrated in April and May, and even then there are likely to be some ongoing distancing measures to keep transmission down (the hope is the vaccine will increasingly do some of the work here).

Separately we’ll also get the UK jobs report, which is likely to show that the unemployment rate has stabilised since the furlough scheme was fully extended back in November. However, a further rise in the jobless rate is inevitable when support is unwound (a further extension to the summer seems likely), although the hope is that returning demand for services later in the year will help drive up employment again in the hardest-hit consumer service sectors. Nevertheless we expect the unemployment rate to stay above pre-virus levels for the foreseeable future, and this will be a factor limiting the return of the overall economy to its early-2020 size before mid/late 2022.

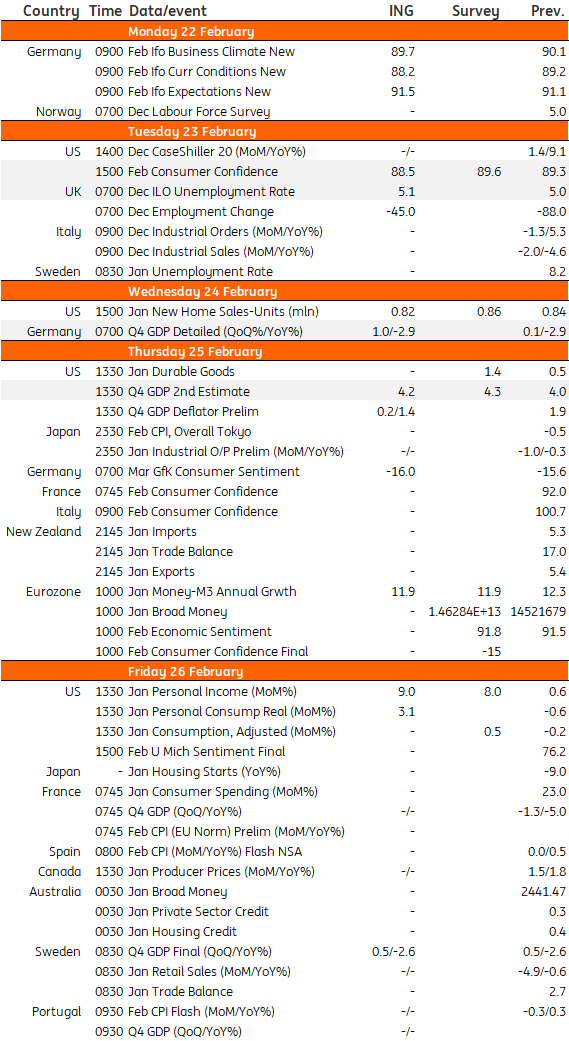

Developed Markets Economic Calendar

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

19 February 2021

Our view on next week’s key events This bundle contains 3 Articles