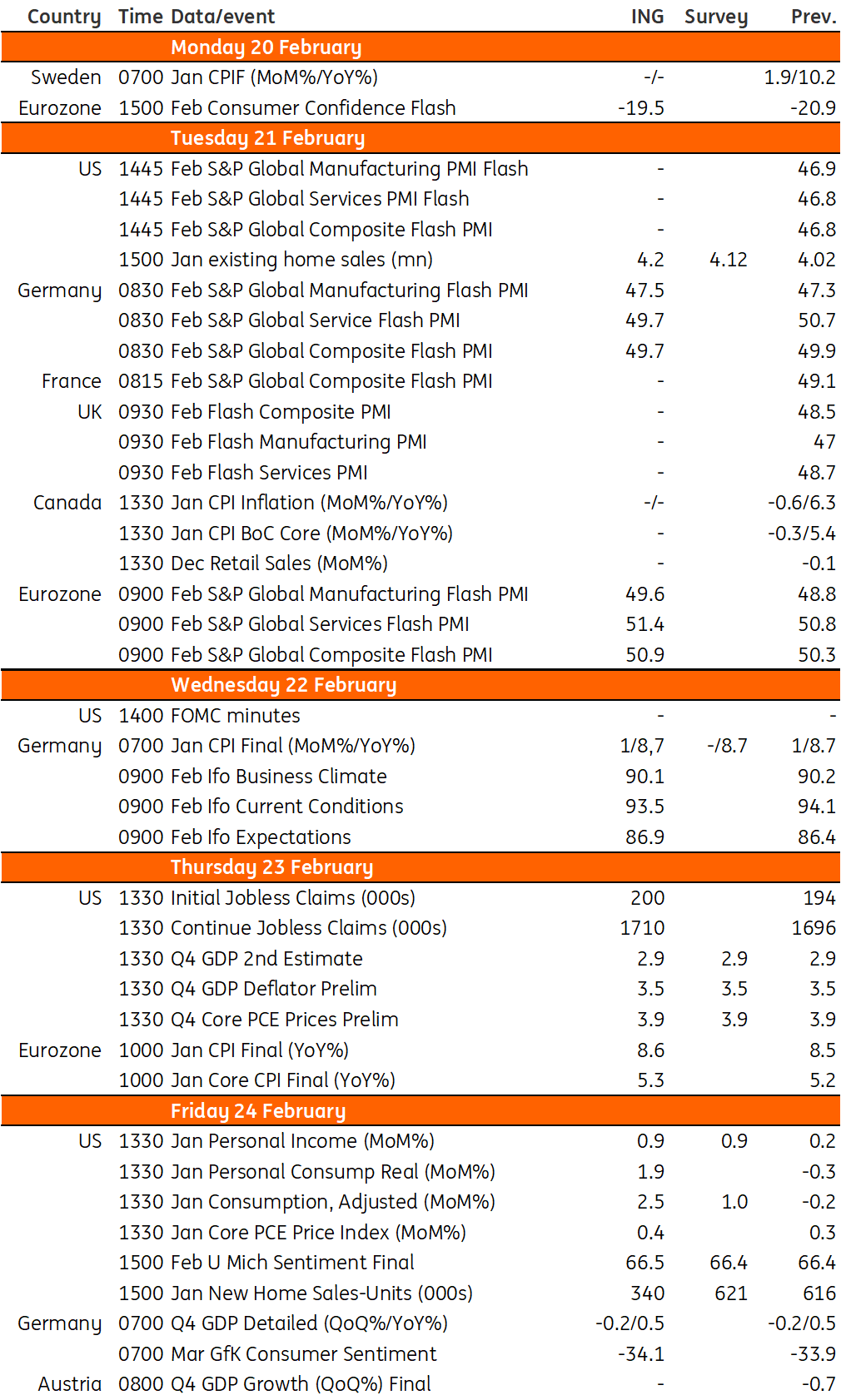

Key events in developed markets next week

With milder weather, we expect further improvements in activity data in the US. Consumer spending will have jumped 2% in real terms, however we remain sceptical as to whether this indicates true strength. The Fed's favoured measure of inflation looks set to rise 0.4% month-on-month, more than twice what's required to produce 2% year-on-year inflation

US: Nothing stopping the Fed from hiking rates in March

The warm weather in January, which contrasted starkly with the cold, wintery conditions of December, will continue to boost US activity data over the coming week. Home sales are likely going to get a lift with more people out and about early in the year home hunting, while we have got a very strong idea that consumer spending will have jumped by 2% in real terms given the 3% month-on-month increase in retail sales over the same period. However, we remain a little sceptical as to whether this indicates true strength given the big shifts in weather may have simply meant that spending that would have been done in February and March may have been brought forward, leaving open the possibility of a correction over the next couple of months. This won’t stop the Federal Reserve from hiking interest rates in March and in all probability May too. Indeed, the Fed’s favoured measure of inflation, the core personal consumer expenditure deflator, looks set to rise by 0.4%MoM, more than twice the 0.17%MoM required over time to produce year-on-year inflation of 2%.

Indeed, there will be several more Fed speakers over the coming week with the minutes of the February Federal Open Market Committee meeting also likely to reveal that they were not terribly far away from hiking rates by 50bp. Having done 25bp in February, we think this will be the standard incremental move from now on.

Eurozone: Recoveries in sentiment data

Lots of sentiment data out of the eurozone next week, which will shed light on how the economy is performing in February. Both consumer confidence and PMIs have been showing slight recovery in recent months and are expected to continue recovery at low levels. This should be in line with economic activity broadly stalling as it did in the fourth quarter.

Key events in developed markets next week

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

17 February 2023

Our view on next week’s key events This bundle contains 3 Articles