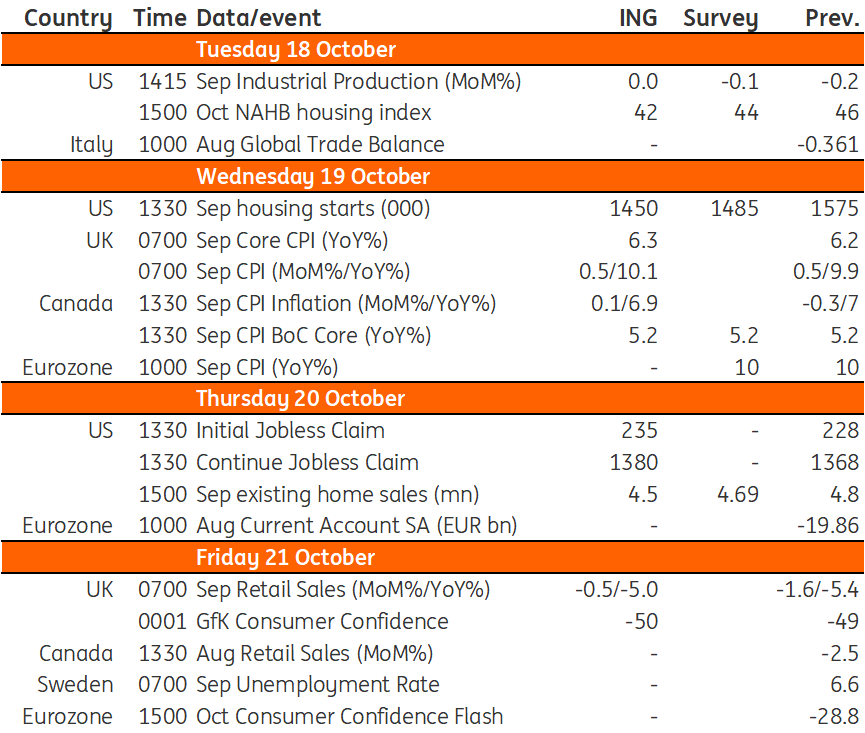

Key events in developed markets next week

US house prices fell for the first time in more than 10 years in July – we expect the market will slow further with declines in both existing home sales and house starts. For the UK, we see headline and core inflation rates edging higher. However, we believe we are now very close to the peak, given the government's decision to cap household energy bills

US: Housing market showing weakness

The latest job and inflation readings have cemented expectations of a 75bp hike from the Federal Reserve on 2 November and heightened the chances of a fifth consecutive 75bp hike in December. However, we still favour the Fed slowing the pace of hikes to 50bp on 14 December given the intensifying economic headwinds that should allow inflation to fall quickly through 2023. The housing market is going to be a key factor in this. House prices fell for the first time in over 10 years in July as the surge in mortgage rates prompted a collapse in housing demand. Things have got much worse since then with mortgage applications for home purchases at the lowest level since the housing bear market of 2010-13. With more supply coming on the market the challenge to sell homes is going to increase, which will weigh further on prices and lead to another sharp fall in home builder sentiment this week. Homebuilding looks set to slow further with existing home sales declining too.

This is bad news for construction, confidence, job creation and retail sales tied to housing transactions such as building supplies, furniture, home furnishings and household appliances. However, it may well help to get inflation lower more quickly and allow the Fed to reverse course on its aggressive interest rate increases next year. Shelter accounts for a third of the inflation basket by weight and historically the shelter series lags behind movements in house prices by around 12-14 months. Over the past couple of weeks rent.com, apartments.com and CoStar Group have all been reporting rent price falls in major cities so this could imply a quicker transmission. We will see how this develops, but with surveys suggesting that corporate pricing and vehicle prices are showing signs of softening, we think the risks are skewed towards inflation falling more quickly through 2023 than the consensus.

UK: Fiscal U-turn in focus as Bank of England intervention ends

Markets have been buoyed by reports that the UK government is preparing a major U-turn on its tax cut plans, which were announced in September and brought widespread disruption to UK bond markets. On paper, the resumption of the planned hike in corporation tax – if done in full – coupled with a revenue cap/windfall tax on renewable and perhaps nuclear energy producers, could materially reduce the government’s borrowing requirement over the next couple of years. But with the Bank of England ending its temporary bond buying scheme, investors will need to see these press reports crystalise into concrete and far-reaching plans this weekend to avoid a renewed sell-off in gilts next week. Further volatility is likely in either case, and we still think there’s a fair chance the BoE will at the very least need to further postpone its plans to start selling bonds later this month – not least because of the challenging environment created by ongoing Fed tightening. Further bond buying also shouldn’t be ruled out.

All of this will also help determine just how aggressively the BoE will need to hike rates in early November. By that point we’ll have had the government’s Medium-Term Fiscal Plan (ie the full extent of any U-turns) and depending on whether we see a renewed period of sterling weakness between now and then, there’s a chance the BoE may be able to get away with a 75bp hike rather than the 100bp move we’ve been pencilling in. Next week’s CPI data is unlikely to be the main decider here, but for what it’s worth we see both the headline and core rates edging higher. However, we think we are now very close to the peak, given the government’s decision to cap household energy bills.

Key events in developed markets next week

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

14 October 2022

Our view on next week’s key events This bundle contains 3 Articles