Key events in developed markets next week

There's talk that next Tuesday could see PM May's third (and likely final) attempt at getting her deal through parliament, but we remain sceptical. The Brexit debate is likely to dominate the EU summit next week too and the main question will be how long will be the delay to the 29 March Brexit deadline?

More of the same from the Fed, but don't rule out a hike

The Fed has taken a decidedly more cautious stance since the start of the year. Pointing to various "cross-currents" - a reference to trade uncertainty, the recent government shutdown and financial market volatility, among other things - the central bank has signalled it's prepared to be patient when it comes to further tightening. We suspect there will be more of the same next week.

Markets seem to have interpreted this as the Fed won't hike again this cycle. However there are a few reasons why we think a hike in the third quarter of this year remains likely. Firstly, while the economy will undoubtedly slow from its strong 2018 performance, the outlook remains solid. The jobs market continues to fuel higher wage pressures, which when coupled with the fall in gasoline prices, better equity prices and an easing in long-term mortgage rates, makes for a decent consumer backdrop.

A lot depends on trade policy, and despite previous positive signals, talks appear to have stalled more recently. But if a deal can be struck between the US and China, then we suspect the Fed would be inclined to look at a rate hike later in the year.

Brexit: Get ready for ‘Meaningful Vote 3 - the ultimatum’

Despite having been decisively rejected again by parliament, UK Prime Minister Theresa May is hoping the combined threat of a long Brexit delay and the likelihood of ‘indicative votes’ on different Brexit options will be enough to bring her opponents on-side. Reports suggest she may stage a third meaningful vote on Tuesday, although we are sceptical that it will be any more successful than the previous two attempts.

European Council Meeting: Likely a Brexit takeover, but key points will still be discussed

It will be a very light week for German data, but don’t forget that we will have the big European summit next week. Obviously, the summit will once again be hijacked by Brexit, and here the focus is on whether the EU is prepared to offer the UK an extension to the Article 50 period - and assuming it is, how long would it actually last.

Brexit aside, European leaders will also officially appoint Philip Lane as the new member of the ECB’s executive board, succeeding Peter Praet, and will discuss a new European strategy vis-à-vis China.

Canada: Inflation, back on its feet?

Transitory pressures from service-related components, such as travel tours and transportation, prompted an upside surprise in December. But this wasn’t the case in January and, in turn, weak gasoline prices took a toll on price levels. As a result, headline inflation sunk to 1.4%.

In February the story should be somewhat better. The adverse effect of energy prices should begin to dissipate, and – although we still expect a below-target headline figure (1.5%) number, we reckon this is the beginning of an upward trend. Our commodity team reinforces this view that oil prices should edge slightly higher throughout 2019 and 2020 unless we see a negative twist in the trade story.

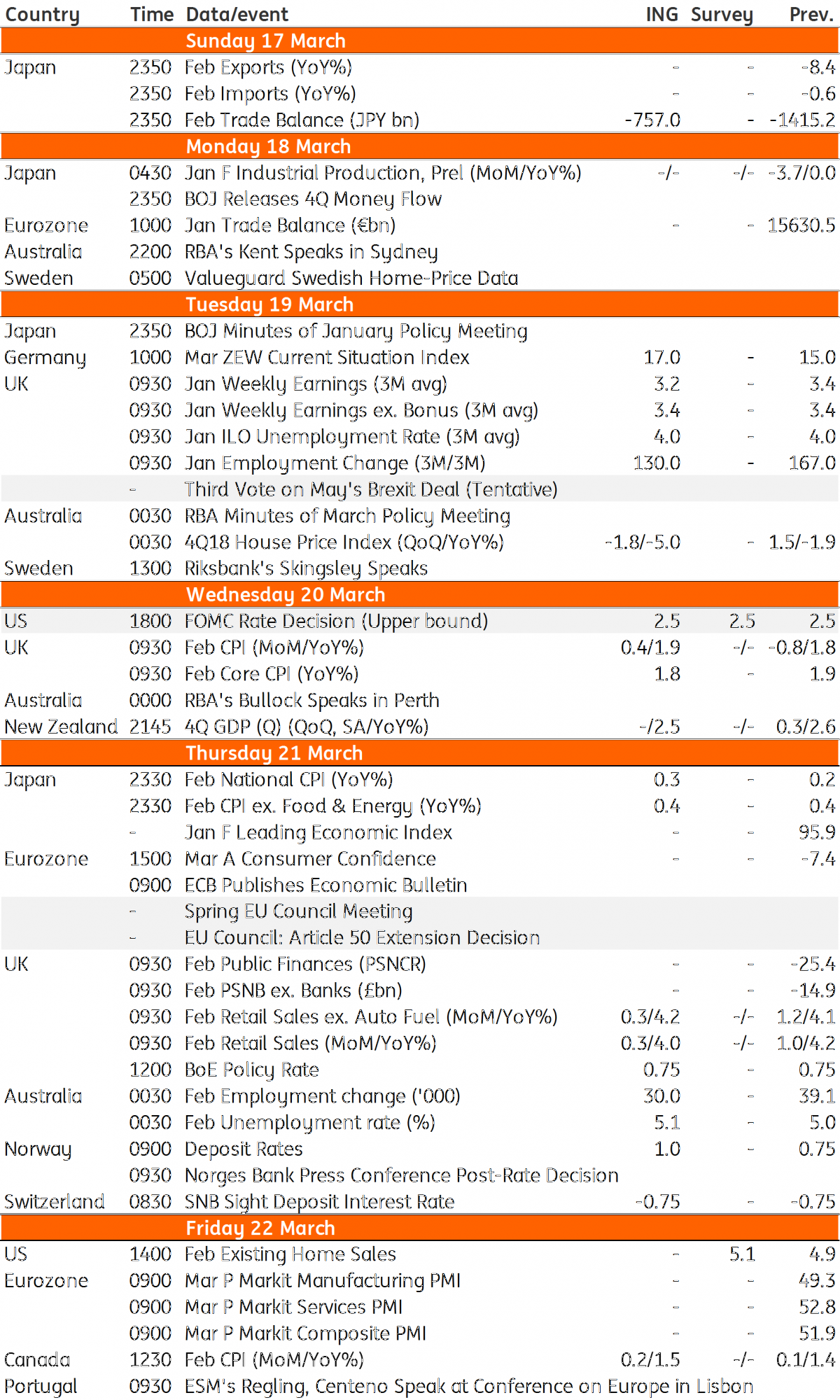

Developed Markets Economic Calendar

Download

Download article15 March 2019

Our view on next week’s key events This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more