Key events in developed markets next week

Housing data from the US, Eurozone PMI readings and UK retail sales data next week will provide more clarity on the extent of the rebound for developed markets

US: Building on the recovery

While we wait to see if politicians have the willpower to agree a new fiscal package that can help support the economy in its next phase of recovery we continue to watch high-frequency data on jobs and credit and debit card transaction that currently suggest employment growth and consumer spending stalled through mid-July into early August. This suggests we should be braced for some disappointment in the August jobs and retail sales reports that are published on 4 and 16 September respectively.

For the upcoming week, it is all about housing data, which should look good. We know mortgage applications are strong thanks to low mortgage rates with anecdotal evidence suggesting demand is led by older buyers looking for a second or vacation home. This story has been in play for around four months now and should help fuel transactions, which in turn has historically been well correlated with consumer spending on related sectors such as furniture, home furnishings, garden equipment and building supplies.

Meanwhile, the minutes to the July Federal Reserve meeting may reveal a little bit more on the potential for yield curve control, which will be of interest to market players given the recent bout of yield curve steepening. There may be some discussion in the context of the Fed’s long-awaited strategy review of monetary policy where they are increasingly expected to be more tolerant of periods of above-target inflation in order to provide some compensation for significant periods of undershooting.

An announcement on this could come in September.

Eurozone: PMI data to reflect the extent of the rebound

Next week will give another snapshot at the state of the Eurozone recovery. The PMI should give a good sense of where things are headed and especially if the recent fast pace of the rebound has been maintained through August. Some slowing is to be expected, but so far the Eurozone has seen encouraging numbers come out that indicate that the start of the rebound has at least been strong.

UK retail sales to stay around pre-virus levels in July, although this may not reflect a wider ‘V shape’ recovery

It didn’t take long for UK retail sales to return to their pre-crisis levels, although there are reasons to question whether they imply a broader ‘V-shape’ recovery in spending.

High-frequency payment data cited by the Bank of England shows that delayable spending has fallen again through July, which we think indicates some of the initial rebound reflected unsustainable pent-up demand. Retail sales are also only one part of the consumer spending story, and social spending (pubs, restaurants etc) has been much slower to recovery as individuals remain cautious about the safety risks of returning to old haunts. Of course in the medium-term, the concerning signs of rising unemployment also pose a clear risk to spending, particularly given that the rise in joblessness is likely to be initially concentrated among lower-paid workers.

We expect retail sales to be essentially flat in July (relative to the big gains seem over the past two months). Separately, we may see another mild uptick in the PMI readings, although as we’ve noted previously, these may not be the best barometers of GDP performance in these current volatile times.

Norges Bank set to maintain cautious optimism

In contrast to many other global central banks, Norges Bank struck a fairly upbeat tone at its last meeting in June, upgrading its GDP forecast and loosely pencilling in a rate hike into its projection for 2022. Since then, neither oil prices nor the trade-weighted NOK have changed materially enough to shift that view when the committee meets next week.

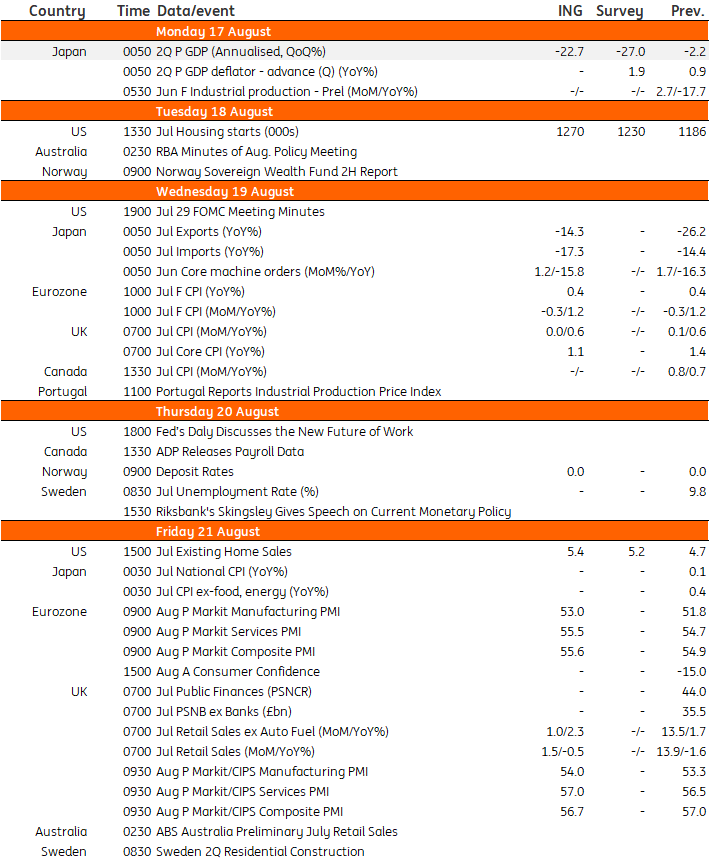

Developed Markets Economic Calendar

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

14 August 2020

Our view on next week’s events This bundle contains 3 Articles