Key events in developed markets next week

Plenty of UK data next week. The jobs market is no longer tightening and we believe that core inflation has peaked. The expectation is for headline inflation to close in on 10%. In the US, with falling gasoline prices and rising order books, we expect a rebound in both industrial production and retail sales numbers

US: Industrial production and retail sales should both point to a rebound in 3Q economic activity

Financial markets are currently favouring the Federal Reserve’s September FOMC meeting delivering a 50bp rate hike rather than a third consecutive 75bp move. However, there is a lot of data to go between now and then, plus there is the annual Fed symposium in Jackson Hole at the end of this month. In terms of the imminent data, the highlights will be industrial production and retail sales and both should point to a rebound in third-quarter economic activity. Retail sales at the headline level will be modestly depressed due to falling gasoline prices weighing on gas station sales as it is a nominal dollar figure. However, this frees up cash to spend on other goods and services so the “core” rate of retail sales growth should rebound and help to translate into rising real consumer spending. At the same time, the manufacturing sector continues to experience rising order books with business surveys pointing to rising output. This should be further boosted by increased oil and gas drilling activity, which should lift overall industrial production more. At this early stage, we expect third-quarter GDP to grow at a 3% annualised rate.

UK: data to keep Bank of England on track for another 50bp hike in September

There’s plenty of UK data next week to digest, but there are two things to watch out for. Firstly, look out for further signs that the jobs market is no longer tightening – and potentially at the margin beginning to weaken. Online job adverts point to a gradual fall in unfilled vacancies over the coming months, while there have been hints that the number of people unemployed for less than six months has begun to rise (even if redundancies are still ultra-low). Still, various surveys suggest labour shortages remain a key issue for businesses, and that’s a key part of why the Bank of England is concerned about inflationary pressures staying elevated, even as the impact of higher energy bills eventually begins to fall out of the inflation numbers towards the end of next year.

Speaking of inflation, expect headline inflation to close in on 10%, reflecting a further rise in fuel costs (which have since reversed in August) and higher food prices. But core inflation appears to have peaked, not least because goods price pressures are fading as consumer demand wanes and supply constraints gradually ease. All-in-all, we suspect the Bank of England will hike again by 50bp in September, though we think we are nearing the end of this tightening cycle.

Norway: Norges Bank set to hike again – but will it be 25 or 50bp?

Having hiked rates by 50bp in June, on paper there are good reasons for Norway’s central bank to do the same again next week. Crucially the latest inflation readings have come in above the bank’s forecasts again. Then again, Norges Bank literally said in the first line of its monetary policy statement last month that it plans to hike rates by 25 basis points this month. Indeed the overall message was, having previously hiked once per quarter, it now intends to do 25bp rate rises at both of the quarterly meetings going forward. And while the bank will be nervous about inflation, its models will also be acknowledging the fact that global market rates have fallen since June, which in isolation would be interpreted as a dovish factor. Bottom line: it’s a close call next week, though we narrowly favour a 25bp move. As other central banks have found in recent weeks, Norges Bank faces a choice between sticking to its "forward guidance", or adapting to the latest economic data.

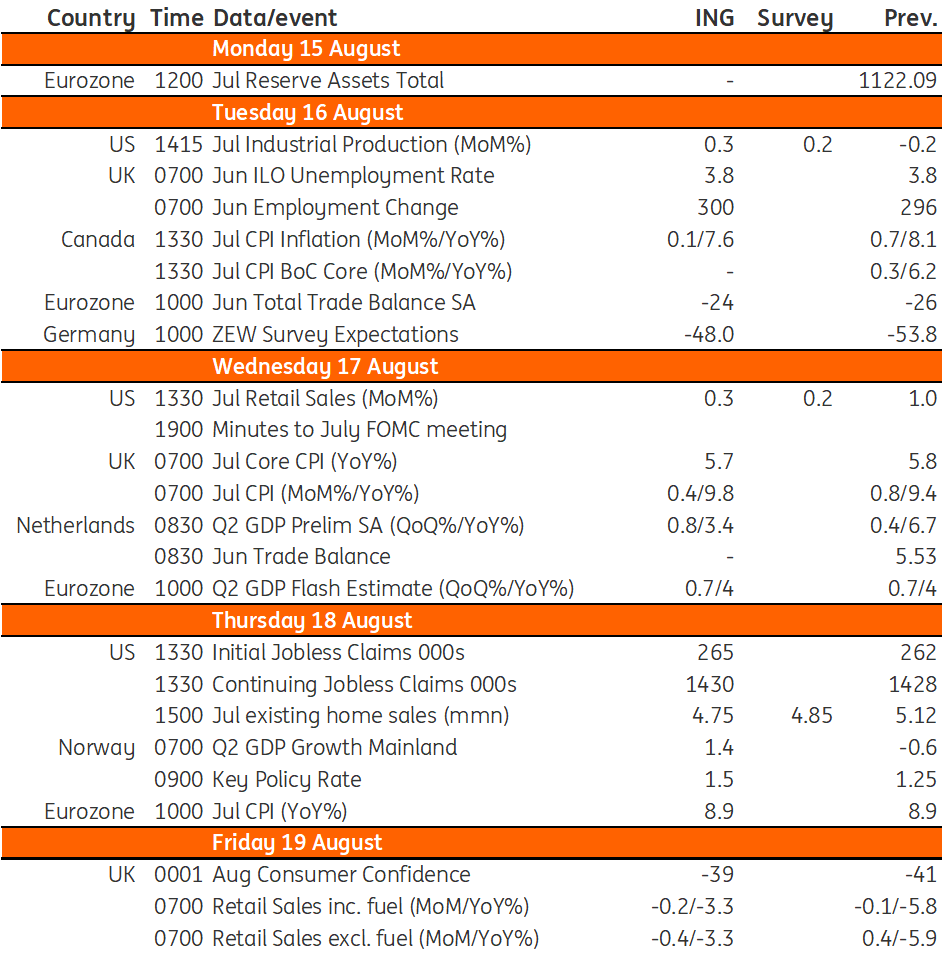

Developed Markets Economic Calendar

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

12 August 2022

Our view on next week’s key events This bundle contains 3 Articles