Key events in developed markets next week

Another eventful week, with lots of things happening that weren't really pencilled in the diary, but the spotlight is firmly on the Fed meeting next week while Brexit talks take a pause

US: The Fed is ready to go 'all in'

With it looking increasingly likely that both US GDP growth and headline inflation will plunge into negative territory in 2Q20, the pressure is mounting on authorities to try and provide support for the economy and for those most impacted by Covid-19.

The Federal Reserve has already cut its policy rate by 50 basis point and is expected to imminently test the lower bound of 0-0.25%. There is likely to be some pushback from some officials, but the Fed will also be wary of disappointing those expectations on the basis that it could lead to a tightening of financial conditions that compound the downside risks to growth. The problem is that the Fed hasn’t got much ammunition in terms of interest rates so they may prefer to split it with two 50bp moves – one next week and another in April. However, given their massive liquidity injections in response to wild market gyrations, the Fed has signalled it is prepared to go “all in”. Moreover, what benefit would waiting another month provide?

We also have to be open to the risks that the Fed proposes some form of quantitative or credit easing. Indeed, It would make sense to implement targeted liquidity/credit measures in the coming months, similar to what the Bank of England announced on Wednesday, given the possibility of more distress in high yield markets and concerns about access to credit for small - and medium-sized firms.

We will also get the result of more Democrat primaries in which Joe Biden appears to be moving clear of his progressive rival, Bernie Sanders.

Brexit talks take a pause amid coronavirus

The UK and EU have cancelled their scheduled trade talks for next week, and it is likely that the coronavirus will continue to disrupt face-to-face discussions over the coming weeks.

What does this mean for the prospects of a deal? Well in a way, not much – talks were never realistically going to yield much progress before the summer anyway. But the government is under increasing pressure to apply for an extension to the 11-month transition period to allow for a more realistic timeline. After all, the timeline for talks was already looking ambitious given the time it has taken to strike other free-trade agreements in the past.

For now though, the UK government is resisting such calls and we assume that the transition will end this year, with or without a free-trade deal in place.

Swiss central bank facing another headache

In this period of extreme uncertainty and falling markets, Switzerland's central bank's decision will be closely watched next week.

We know that the SNB regularly intervenes in the markets to push the Swiss franc down and that it would like to continue to do so when necessary, without lowering its interest rates even further. The question now is whether this position is still tenable in the current environment.

Norges Bank's preemptive cut means no further action next week

Norges Bank has cut rates by 50bp, a week ahead of its formal meeting on 19 March. The sharp fall in oil prices, flattening of global interest rate expectations and announcements of staff layoffs by businesses in recent days, all prompted policymakers to act more preemptively.

The new interest rate projection keeps the door open to another 25bp rate cut later in the year, but for now, the central bank looks like it will take a breather at next week's formal meeting. Don't expect too many fresh signals either, given that the majority of its new forecasts were unveiled at the same time as the unscheduled interest rate announcement.

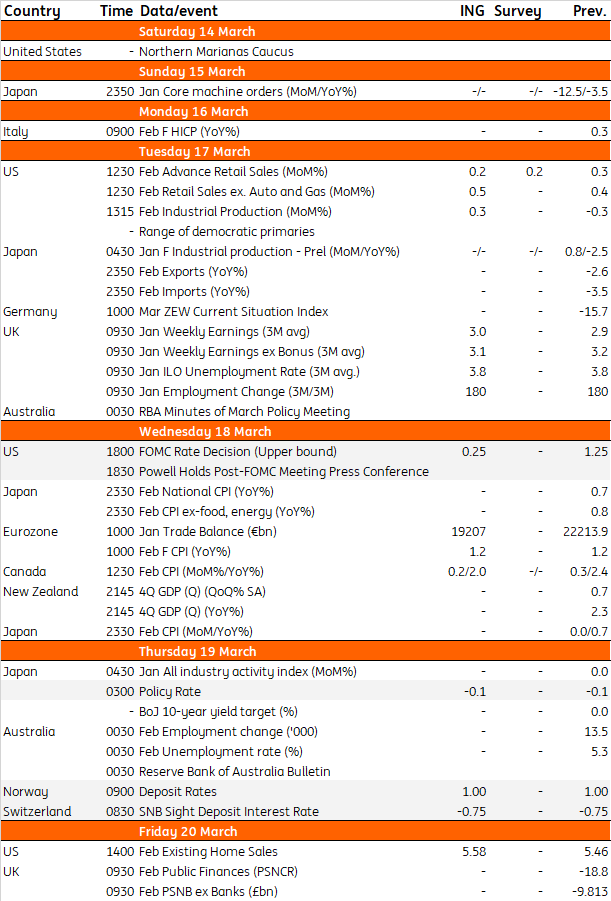

Developed Market Economic Calendar

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

13 March 2020

Our view on next week’s key events This bundle contains 3 Articles