Key events in developed markets next week

Two questions arise in developed markets next week: Will some form of a Brexit deal be proposed in time for the European Council meeting, and will Italy be softening its budget stance? We also expect US economic momentum to carry on, with upside risks to two key domestic data releases

US: Maintaining its momentum

After a disappointing August for retailers, caused by clothing discounting and a decline in restaurant sales (which make up 10% of all retail spending), sales should bounce back strongly in September. Vehicle sales jumped to an annualised 17.4 million rate from 16.6 million, while a strong jobs market and robust consumer confidence also suggest that the weak August reading was likely just a blip. Admittedly there is the potential for some disruption due to Hurricane Florence, but on balance we see upside risks to the 0.7% month-on-month consensus expectation.

Likewise, there is the risk for some data volatility within the industrial production report, but again we see some upside to the market forecast of a 0.2% MoM gain. Business surveys remain at incredibly strong levels, and with manufacturing employment having risen 18,000 on the month, we look for a very respectable 0.3% MoM increase. The post-Florence clean-up and rebuilding efforts are going to support activity in the affected region, and this should contribute to healthy activity readings for October, too.

Will there be a Brexit deal in time for the European Council meeting?

Reports suggest the UK and EU are close to reaching a deal on the Irish backstop issue, which if true would allow both sides to wrap up the overall withdrawal agreement. As ever though, the challenge is wording all of this in a way that will convince MPs to vote for it when the agreement comes to Parliament.

The political declaration – a vague statement that will set of a vision for the future trading relationship – is reportedly proving hard to get right, particularly with the Northern Irish Democratic Unionist Party (DUP) ratcheting up the pressure on the government not to push ahead with the Irish backstop.

While we might get indications that both sides agree to the Irish backstop in principle over the next week, we’re unlikely to see a final version of the political declaration until a special summit in November, at the earliest. But as ever, the odds of ‘no deal’ really hinge on UK lawmakers approving the deal – and a vote is unlikely to take place before mid-December at the earliest.

Strong UK wage data to keep BoE on tightening course, if (and it’s a big if) Brexit is smooth

Kicking off a packed week of UK data, we’re likely to see another decent wage growth figure on Tuesday, confirming that skill shortages across the economy are pushing employers to raise pay to attract/retain talent. In fact, there’s a possibility that headline (ex. bonuses) wage growth nudges up to the symbolic 3% level. Meanwhile a further 1.3% increase in petrol prices last month will see headline inflation remain elevated, keeping pressure on real incomes. That, coupled with the fact that employment growth appears to have stalled, indicates that the run-up to Christmas will be another big test for the high street.

Italian budget proposal: Softening?

The eurozone will be focused on the Italian budget proposal to the European Commission, and whether that will show any last minute changes that could indicate a softening of the stance on the Italian side. From a data perspective, it is another slow week for Europe. The trade balance will be interesting to watch given the trade turmoil, especially after a significant slide in the balance in July.

Swedish politics still far from answers

It’s a very quiet week in Scandinavia, though Swedish house prices are worth keeping an eye on as there are signs that prices may be about to take another leg down this autumn. And 14 October is the deadline for Conservative party leader Ulf Kristersson to propose a government to the Swedish parliament. If he finds himself unable to form a government, or his proposal is voted down, the government formation mandate is likely to pass to Social Democrat leader Stefan Lofven (currently serving as caretaker PM). So far there are few signs that the post-election deadlock is any closer to breaking, so discussions could easily drag on for some time yet.

Canada: Price levels to remain flat on the month

We expect Canada’s September inflation to come in at 2.6% YoY, stagnating in monthly terms. High oil prices should be the main driver in keeping headline figures aloft. Dampening effects such as slowing wage growth and typical weaknesses in household activity following the summer period, as well as the fact that the oil price rally didn’t really kick off until the back end of September, should cause price levels to remain flat from August.

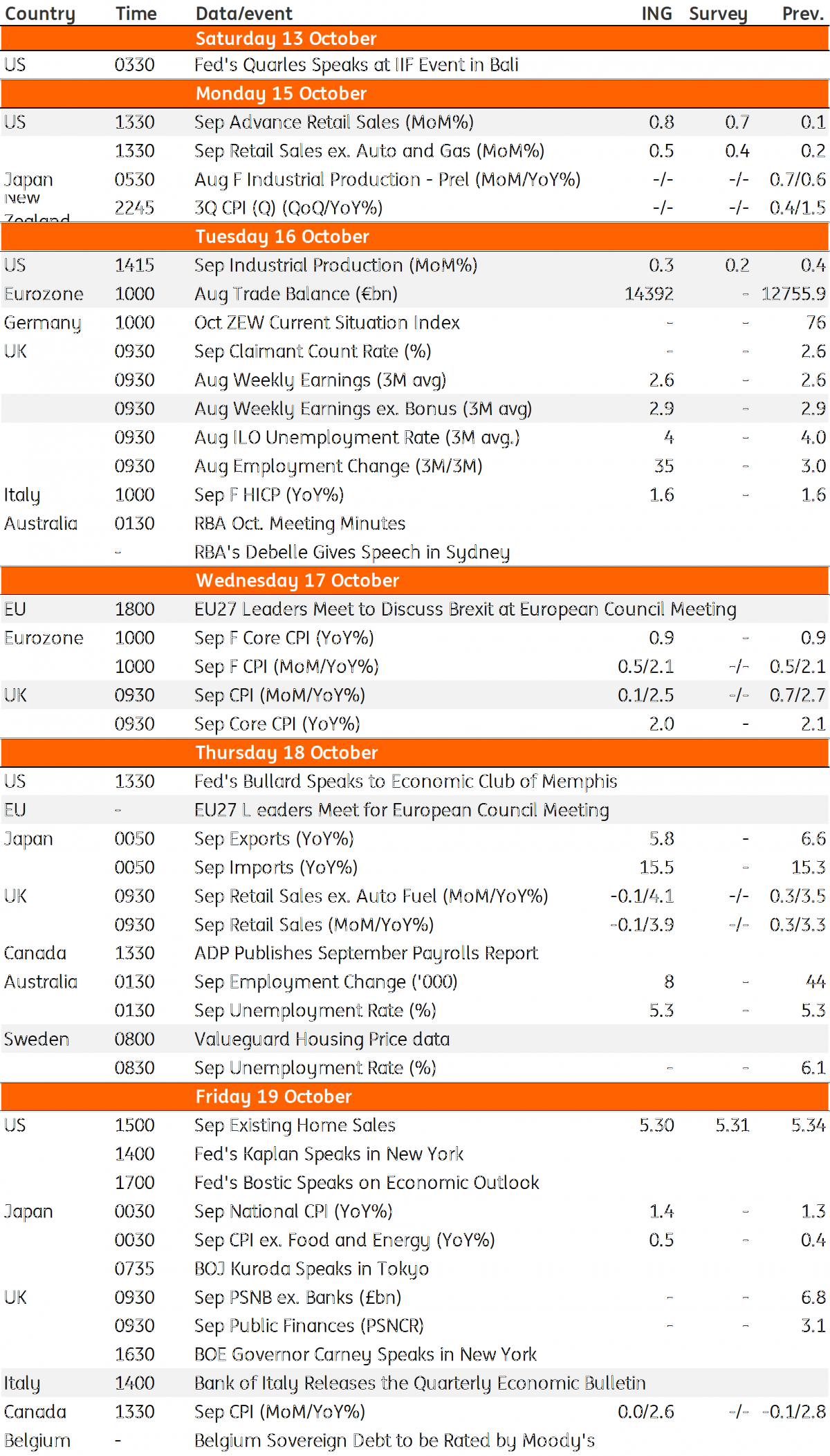

Developed Markets Economic Calendar

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

11 October 2018

Our view on next week’s key events This bundle contains 3 Articles