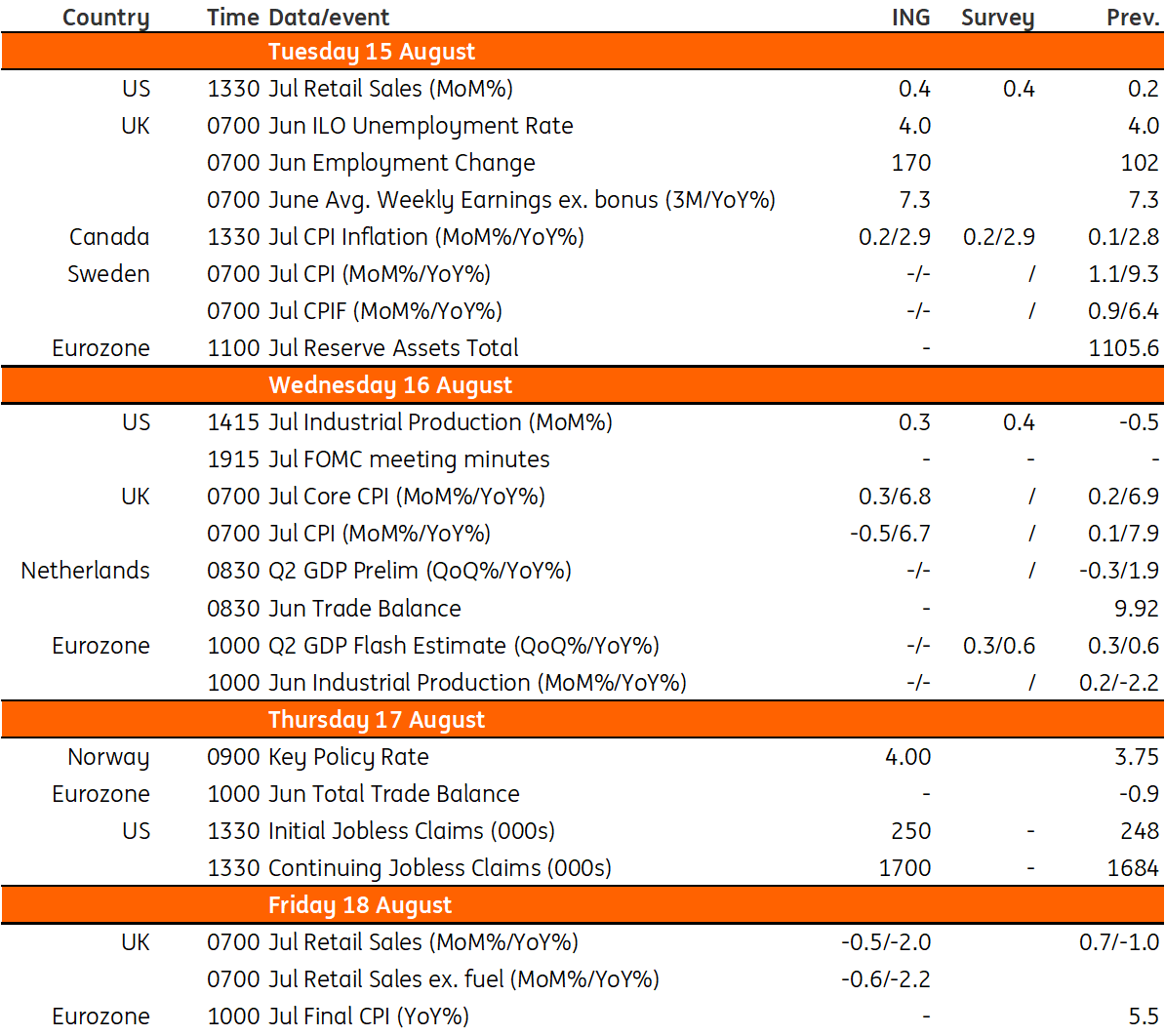

Key events in developed markets next week

We expect the minutes from the July Federal Open Market Committee (FOMC) meeting will continue to exhibit hawkish sentiments with the Fed wary about signalling an imminent peak in US interest rates, with markets fully embracing the soft landing story. Meanwhile, in the UK, inflation and wage data will be released

US markets have fully embraced the soft landing story

Markets have fully embraced the soft landing story in the United States whereby growth is respectable while inflation is slowing nicely, offering the Fed the opportunity to call time on interest rate hikes and eventually cut rates in early 2024 to cushion the economy from a hard landing, as high borrowing costs and tight lending conditions inevitably take their toll.

There is a lot that could go wrong though, most notably the abrupt hard stop in credit expansion seen since March and its impact on economic activity – but that is a medium-term story. In the near term, the upcoming data is unlikely to support market sentiment, with retail sales looking set to post a decent figure thanks in part to Amazon Prime Day lifting spending, higher gasoline prices boosting the value of gasoline station sales, and vehicle sales ticking higher. However, there will be areas of weakness with chain stores seeing poor sales in recent months, suggesting a risk that the year-on-year rate of retail sales growth will slow to a crawl in the next couple of months.

Meanwhile, the minutes of the July FOMC meeting will continue to exhibit hawkish sentiments with the Fed wary about signalling an imminent peak in US interest rates, fearing that this could intensify 2024 interest rate cut expectations and in turn trigger a sharp fall in Treasury yields that would be detrimental to the fight to get inflation back to target. Nonetheless, recent Fed comments have suggested that some members of the committee think they may have done enough with the latest inflation data likely to see more members thinking along those lines. The next big Fed event will be the Jackson Hole symposium between 24-26 August, where we expect to hear Fed Chair Jerome Powell give a bit more guidance on the potential near-term path for policy rates.

Rounding out the numbers, we will likely see manufacturing production flat-lining after nine consecutive contraction prints from the ISM index. Industrial production overall may rise thanks to higher utility usage.

Retail sales vs weekly Johnson Redbook sales

UK inflation and wage data to help shape BoE path after November

The Bank of England has made it abundantly clear that it’s watching services inflation and wage data, and not a whole lot else, to judge how many further rate hikes are needed. We discussed recently why a September pause is unlikely but not totally out of the question, and why we think a November hike can hopefully be avoided. But that latter prediction hinges on the data showing a bit of improvement, and here’s what we expect over the next week:

Jobs/wages (Tuesday): The jobs market has been cooling, and we expect to see further signs of improving worker supply in next week’s figures. Indeed there’s a risk that the unemployment rate ticks another 0.1pp higher. For now though wage pressures remain strong and we think private sector wage growth will remain at 7.7% (measured as the last three month’s average compared to the same period last year). That will slip back over the next few readings, but the downtrend is going to be slow. We tend to agree with the BoE’s forecasts that this will have only fallen to around 6% by year-end.

Inflation (Wednesday): Household energy bills fell by almost 20% in July, so it should be no surprise that the headline inflation rate should have fallen by more than one percentage point. A further improvement in food inflation should also help. But the BoE is watching services CPI and expects this to nudge up from 7.2% to 7.3% on a year-on-year basis. While the start of summer holidays leaves plenty of scope for package holidays/air fares to throw this around, we think the risk to that Bank of England forecast is to a lower reading. We expect services inflation to remain flat or in fact go slightly lower, and if so, that would support our tentatively held view that the Bank will only hike once more.

Retail sales (Friday): If June’s decent retail figures were helped by warmer weather, then the washout that was July should see a bit of weakness creep back in. July was the sixth wettest on record. Ultimately though the retail figures are of little consequence to the Bank of England right now, which is squarely focused on inflation.

Norway to pivot back to 25bp rate hike following krone stabilisation

After the krone continued to weaken throughout the second quarter, Norges Bank hiked rates by half a percentage point in June and substantially increased its interest rate projection. Back then it saw rates peaking at 4.25% (from 3.75%) now, and there’s little reason to believe that thinking has changed much since.

Inflation has come in largely as expected, while the krone has strengthened and Norges Bank’s I44 trade-weighted index is on-track to undershoot (i.e a bigger appreciation) than had been forecast in June. That suggests we will get a 25bp rate hike next week, and assuming other central banks are very close to finishing their own tightening cycles, we suspect another 25bp hike in September will mark the peak for policy rates in Norway.

Key events in developed markets next week

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

11 August 2023

Our view on next week’s key events This bundle contains 3 Articles