Key events in developed markets next week

Multiple Fed speakers next week will likely signal a pause in the tightening cycle while remaining upbeat about the economic outlook. To fire things up, we also have a heavy political week in both the UK and Sweden. Will Theresa May's Brexit deal be shot down as we expect?

US: Calmer Heads

The second week of trading in 2019 has seen less volatility following soothing words from Fed Chair Jerome Powell and a stellar US jobs report, both which helped ease fears that the US economy’s bull run will soon come to an end. Positive sentiment regarding the US-China trade talks has also been supportive for risk appetite, while policy easing from the Peoples’ Bank of China has reminded us that policymakers are alive to the risk of a downturn.

The coming week will see more Federal Reserve officials make appearances, and the message is likely to continue signalling a pause in the Fed’s policy tightening path in 1Q, though officials will probably remain upbeat on the US’s economic prospects. This should be apparent in the data too, although the ongoing partial government shutdown will reduce the number of releases.

Retail sales will be published but given the Census Bureau is effectively shut for business, this risks being delayed. If published, headline sales will be depressed by the plunge in gasoline prices, but aside from this, the story should be strong given firm car sales and rising real incomes. Industrial production, published by the Federal Reserve, is set to be released. We suspect manufacturing output held up well, but that mining output will have been impacted by reduced drilling resulting from the plunge in oil prices since October. Taking this all together, we suspect it is consistent with the economy having expanded at around a 2.5% annualised pace in the final quarter of the year.

Little signs for a eurozone growth comeback

Industrial data from France and Germany has been dismal for November and we expect the same for the eurozone as a whole. That would confirm a picture of a weak industrial sector that does not show many signs of a bounce back in economic growth.

Germany: Any hope for a fourth quarter rebound?

The most interesting release next week will be the first estimate for annual GDP growth in 2018, which will also include a first 'guestimate' for growth in the fourth quarter. Latest data releases have dented hopes for a quick rebound of the German economy after a disappointing third quarter.

UK MPs set to vote down Theresa May’s Brexit deal

On Tuesday, Theresa May's Brexit deal will finally be put to members of Parliament (MPs) to vote upon, and as things stand, it looks set to be defeated by a fairly heavy margin. If that happens, the Prime Minister will have three days to bring forward a new plan, and at this point, MPs will get a say on what direction to take. The Labour Party has also suggested it will put forward a vote of no confidence in the government, in the hope of triggering an election.

Nobody really knows exactly where the next couple of weeks will take us, but time is running out and an extension to the Article 50 process looks increasingly likely. Find out more here.

Swedish inflation data and another vote in parliament

We expect headline inflation in December to remain around the 2% target, while core inflation will remain well short at 1.4%. Over the coming months, headline inflation is likely to fall back further as the recent drop in energy prices feeds through. Core inflation meanwhile may edge up a little over the first half of the year, but looks unlikely to reach 2% anytime soon as wage growth remains anaemic.

At the same time, the political impasse in the Swedish parliament is set to end one way or another. Parliament is set to vote on a new government on Wednesday. If that vote is unsuccessful, another final vote will take place the following week, and if that also doesn’t yield a new government then new elections will take place, most likely at the end of March or early April. Over the holidays, the two main candidates (Social Democrat Stefan Lofven and Conservative Ulf Kristersson) both sought the support of the two centrist parties holding the deciding votes, but as yet, neither appear to have reached a deal. It remains unclear which, if any, side the centrists will choose, so all three outcomes (centre-left government, centre-right government, or new elections) remain on the table.

Canada: Energy prices will weigh (again) on December's headline inflation

Headline inflation in December should be pulled lower by weaker energy prices, though the drop won't be as large as that seen in November. Average prices (USD/bbl) for both Brent and Western Texas Intermediate (WTI) were lower in the last month of 2018, but the price decline wasn’t as sharp compared to what we saw in November.

With oil production cuts in Alberta – which helped double the average price (USD/bbl) of Western Canadian oil in December, we should see headline inflation down only slightly (0.1%) on the month.

We've revised down our annual CPI projection for 2018 to 2.2%, due to lower-than-expected inflation in the later months of 2018.

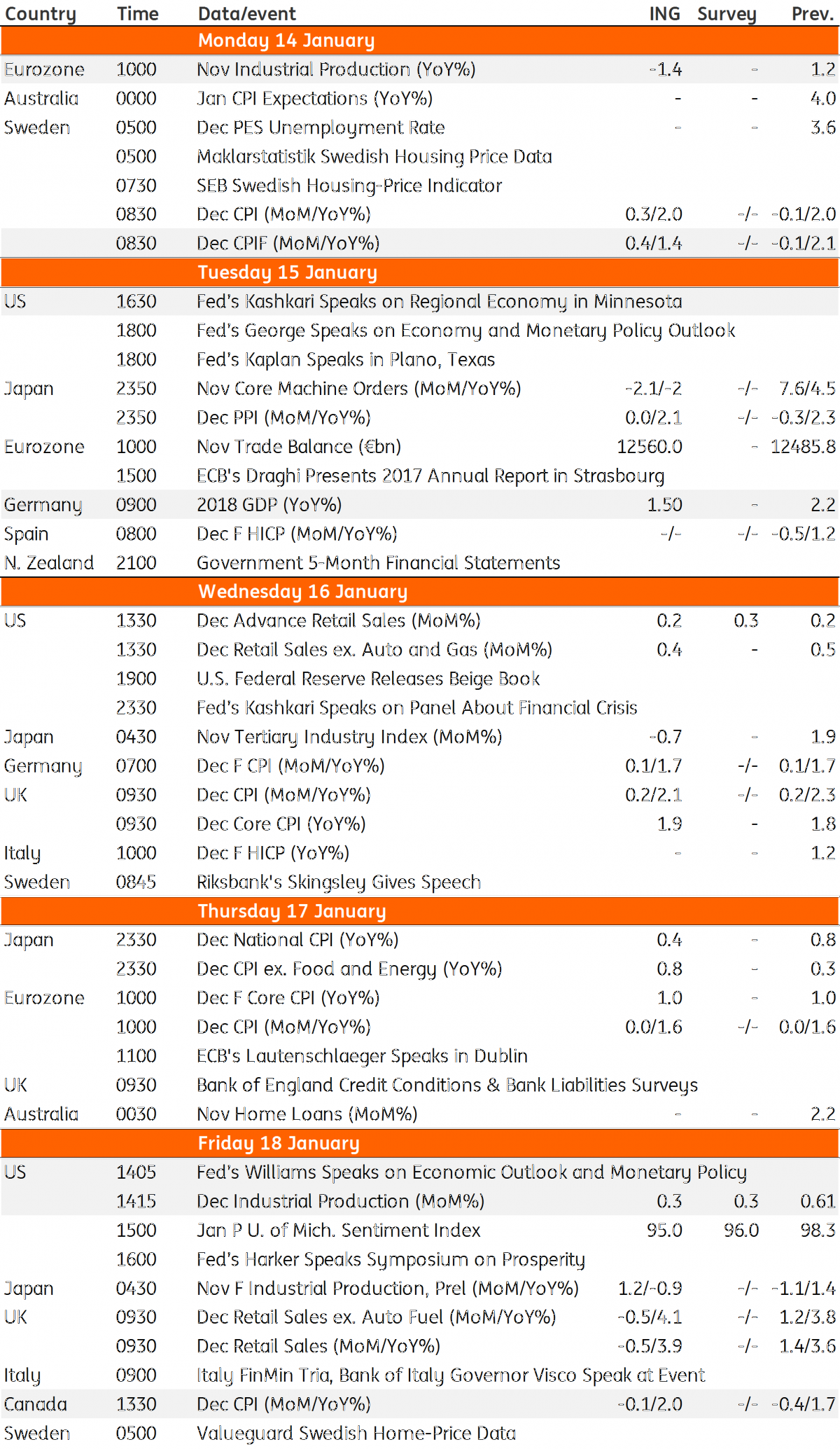

Developed Markets Economic Calendar

Download

Download article

11 January 2019

Our view on next week’s key events This bundle contains 3 ArticlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more