US: A hawkish Fed message will likely fall on deaf ears

Markets are firmly expecting the Federal Reserve to opt for a 50bp hike at the 14 December Federal Open Market Committee (FOMC) meeting after already implementing 375bp of rate hikes, including consecutive 75bp moves at the previous four meetings. The central bank has been at pains to point out that despite smaller individual steps, we are likely to end up at a higher ultimate interest rate than the central bank indicated was likely back in September. Its forecasts are likely to show the Fed funds rate rising above 5% with potential slight upward revisions to near-term GDP and inflation and a lower unemployment rate to justify this.

Officials have been suggesting they may not cut rates until 2024 and we suspect Fed Chair Jerome Powell will echo this sentiment. Nonetheless, this “hawkish” rhetoric is likely the result of concern that the recent steep falls in Treasury yields and the dollar, coupled with a narrowing of credit spreads, is loosening financial condition – the exact opposite of what the Fed wants to see as it battles to get inflation lower. In terms of our view, we continue to expect a final 50bp rate hike in February, but with recession risks mounting, which will dampen inflation pressures further, we look for rate cuts from the third quarter of next year.

Ahead of that announcement, we will have consumer price inflation data. The surprisingly soft core CPI print was the catalyst for the recent moves lower in Treasury yields and the dollar, and a second consecutive low reading would reinforce the market conviction that rate cuts are going to be on the agenda for the second half of 2023. This means Powell will have to battle hard with his commentary in the post-FOMC press conference to prevent financial conditions from loosening too much before inflation is defeated.

UK: Hectic data week proceeds key Bank of England decision

There’s probably just about enough in the latest UK data and recent Autumn Statement for the Bank of England to pivot back to a 50bp rate hike at its meeting next Thursday. Inflation looks like it has peaked, although BoE hawks will be keeping a close eye on the data due a day prior to its announcement. Headline CPI is likely to dip, however core could be more sticky, and last month’s data saw core services inflation come in slightly higher than the bank had forecast in November. Jobs data has also hinted at persistent labour shortages, which will keep the pressure on wage growth. Still, Chancellor Jeremy Hunt probably did enough last month to lower concerns that the BoE and the Treasury are working at cross-purposes, even if the fiscal tightening announced won’t have a huge bearing on the economy, relative to the Bank’s forecasts released last month. We expect a 50bp hike next week, and another 50bp hike in February, which is likely to mark the peak of this tightening cycle.

Read our full Bank of England preview here.

Eurozone: Another jumbo rate hike has become more likely in recent days

Macro data since the European Central Bank's October meeting has shown resilience in the eurozone economy in the third quarter but also confirmed a further cooling of the economy in the last few months of the year. The drop in headline inflation, as little as it says about the impact of the rate hikes so far, could at least take away some of the urgency to continue with jumbo rate hikes.

At the same time, the ECB seems to be increasingly concerned that the fiscal stimulus and support measures announced could extend the inflationary pressure. ECB Executive Board Member Isabel Schnabel has been one of the more influential voices to watch, definitely since the summer with her Jackson Hole speech. Judging from her recent comments that “incoming data so far suggest that the room for slowing down the pace of interest rate adjustments remains limited, even as we are approaching estimates of the 'neutral' rate", 75bp is clearly still on the table.

We think that the risk of a 75bp rate hike at next week’s ECB meeting has clearly increased. Next to the rate hike, the ECB is likely to set out some general principles of how it plans to reduce its bond holdings. We expect the ECB to eventually reduce its reinvestments of bond purchases but to refrain from outright selling of bonds.

Besides the ECB, industrial data for the eurozone are out on Wednesday. Don’t expect anything that will influence the governing council meeting too much. While a tick down in production is to be expected, the fact that industry has outperformed recent expectations is likely to uphold. The Friday data are just as interesting as the PMI will show how the economy is faring at the end of the fourth quarter. Expect it to continue to signal a contraction, but just how deep is the question relevant for markets and policymakers. Finally, trade-in goods data are also out on Friday and will provide a clue on how the trade deficit is faring, which is very important for euro fair value.

Read the full ECB preview here.

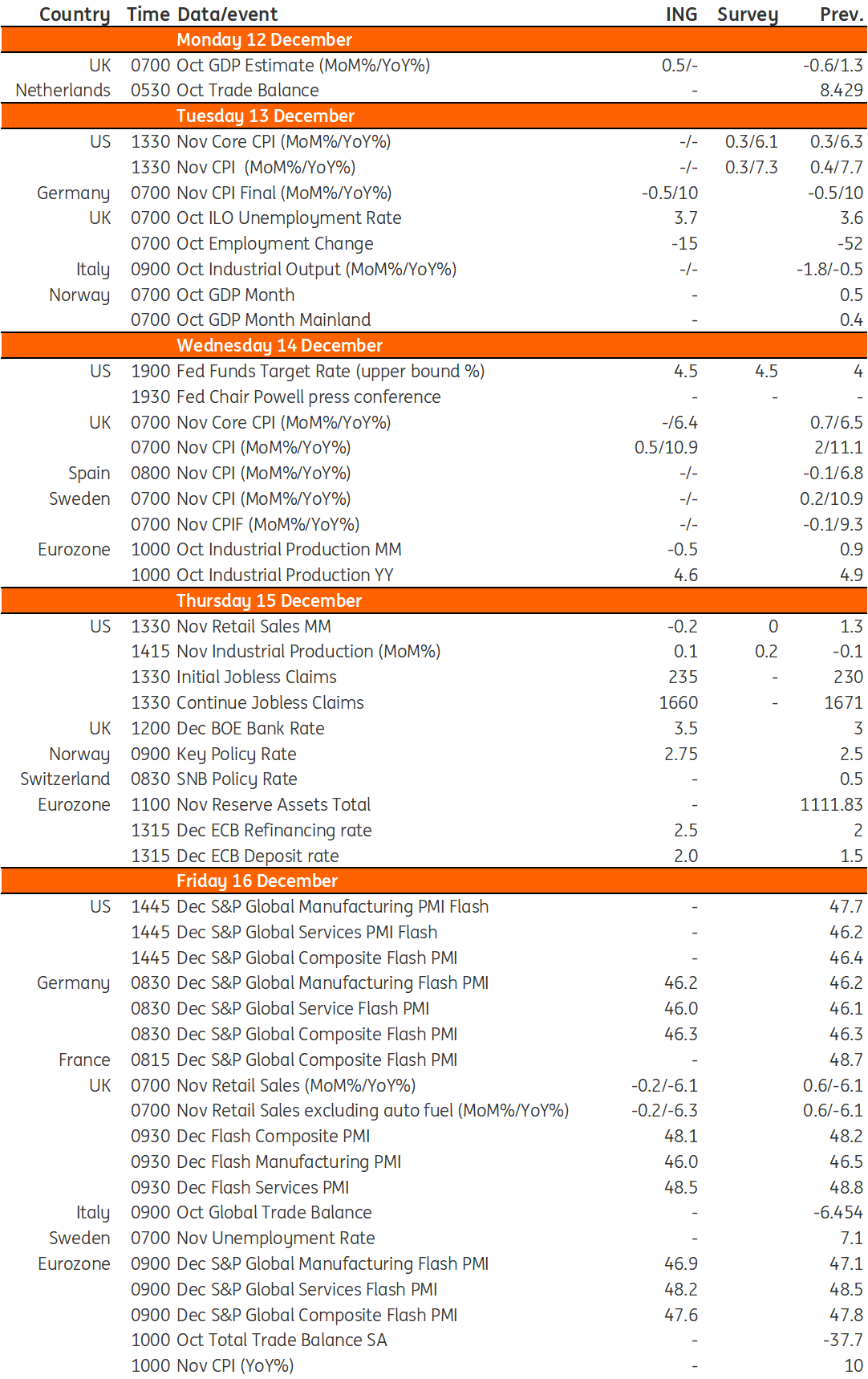

Key events in developed markets next week

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

Our view on next week’s key events This bundle contains 3 Articles