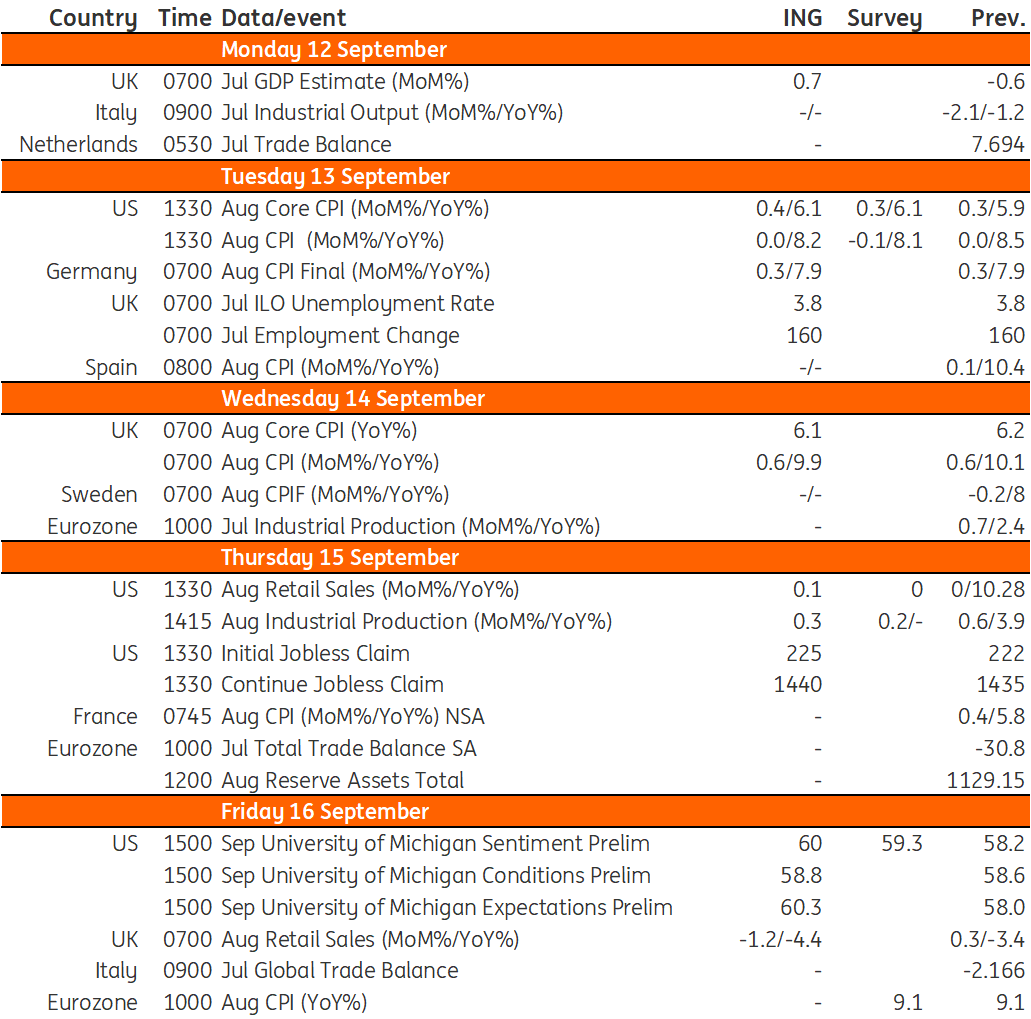

Key events in developed markets next week

Next week's US inflation numbers will need to be quite surprising for the Fed to deviate from a 75bp hike at its September meeting. The Bank of England's scheduled meeting has been postponed, and instead the focus will be on several pieces of key UK data

Article updated on 9 September to reflect the postponement of the Bank of England's scheduled meeting

US: Core inflation likely to rise to 6.1%

We have the last full week of economic data ahead of the September Federal Open Market Committee (FOMC) meeting, but it will take some surprising numbers to make the Fed deviate from a third consecutive 75bp rate hike. After all, the economy is posting decent growth, creating jobs in significant numbers, and Fed Chair Jerome Powell is arguing that “we need to act now, forthrightly, strongly as we have been doing and we have to keep at it until the job is done”. The data includes CPI, which should show headline inflation being depressed by lower gasoline prices, but core inflation is likely to rise to 6.1% from 5.9%. Retail sales should post flat growth, but remember this is a nominal figure and those falling gasoline prices will be a major drag. Real consumption is likely to be up in the third quarter. We also expect manufacturing output to grow further.

The deteriorating global outlook and weakening domestic housing market combined with the cumulative impact of policy tightening and the strong dollar means we think the Fed will moderate its hiking to 50bp in November and 25bp in December. Weaker wage pressure and more limited month-on-month increases in CPI thanks to lower import and other input costs would certainly help this argument.

UK: Bank of England to stick to 50bp rate hike despite energy package

The United Kingdom will observe a period of mourning following Queen Elizabeth II’s death on Thursday, and Parliament will be adjourned during this time. The Bank of England's scheduled meeting has also now been postponed to the following week, but the ONS has confirmed that several pieces of important data will still be released. Here's what we expect:

July GDP (Monday): Expect a large bounce-back from June, where the addition of an extra bank holiday artificially distorted the monthly GDP numbers. Depending on the arrangements during the period of mourning, the addition of an extra bank holiday in September is possible, and this would factor into the GDP numbers for the current month. We’ll therefore have to wait until the fourth quarter to get a clearer idea of how the economy is faring in GDP terms, and we suspect there’s still a risk of a negative growth figure. However, the announcement of an energy price guarantee by the government considerably reduces the risk of a deep downturn, and potentially also a technical recession.

Jobs (Tuesday): Hiring demand is falling, though recent data and surveys have suggested that the worker shortages plaguing the jobs market have only improved slightly over recent months. The announcement of an energy price cap for businesses should help limit what otherwise could have been a more immediate rise in redundancies as firms’ costs increased. We expect the unemployment rate to remain stable next week, but we’ll also be watching closely for signs of a more pronounced return of inactive workers to the jobs market.

Inflation (Wednesday): A 6% fall in petrol/diesel prices through August will drag headline inflation slightly lower. That doesn’t mean we’re past the peak, though the introduction of the energy price cap means inflation is less likely to materially surpass 11% in the autumn. Without the cap, we’d forecast inflation would go to 16% or above in January. This is a double-edged sword for the BoE. On one hand, the reduced the peak in headline inflation should ease concerns about consumer inflation expectations becoming even less anchored. That points to another 50bp rate hike when the BoE meets later in September, despite the Fed and ECB going more aggressively.

The BoE has shown in past meetings that it isn’t pressured to follow those other central banks, albeit the hawks will be worried about the recent slide in sterling. They will also argue that the government’s action increases the risk of inflation staying elevated in the medium-term, given the reduced risk of recession, Some members are therefore likely to vote for a 75bp hike at the next meeting. But ultimately with a lot already priced into markets for the BoE, policymakers will be wary about adding fuel to the fire. As we saw with the ECB on Thursday, the decision to go with a 75bp hike saw markets price that as the default move at the next meeting.

Key events in developed markets next week

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

9 September 2022

Our view on next week’s key events This bundle contains 3 Articles