Key events in developed markets next week

The economic rebound will be reflected in positive data releases next week. However, what happens next will depend on policymakers as government support in the labour market begins to unwind and EU recovery fund discussions continue

US: Data will reflect further reopening, but oil and gas prices continue to hold industry back

The US data should again reflect the reopening story with manufacturing activity and retail sales posting another decent increase. With in-store shopping now broadly permitted in all states we should see a subtle shift away from online to physical retail within the details. We already know car sales were healthy while gasoline prices should boost the value of spending. Incomes, of course, continue to be boosted by the extended unemployment benefits including the extra $600 per week provided by the Federal government with 68% of recipients actually now having higher incomes than when they were working, according to a recent paper by the University of Chicago. This fact should also be supportive of a decent retail sales figure for June. Meanwhile, manufacturing activity continues to recover with the ISM report pointing to a robust number, but broader industrial activity will be held back somewhat due to lower oil and gas output caused by the plunge in prices earlier in the year and the credit strains in the sector making drilling less viable. Housing starts should also be healthy given the rise in mortgage applications and home builder sentiment while inflation is likely to remain muted.

UK: Three data releases to watch next week

- GDP figures for May are likely to show a rebound from April's low, although the size of the economy was (and still is today) significantly lower than pre-virus levels. Google's mobility data points to only around a 4% rebound after March and April's combined 25% GDP decline. However both construction and manufacturing contributed a fair chunk to that fall, and as both were allowed to reopen in May, the overall recovery that month might have been slightly faster.

- Headline inflation should stay at around half a percent, and is likely to stay around that level over the summer. This is obviously down to the slump in oil prices, but the wider economic downturn means inflation is unlikely to be a major medium-term by-product of the pandemic.

- The unemployment rate may tick marginally higher, but the impact of the crisis on these figures has thus far been very limited. That's because furloughed employees, as well as affected self-employed workers, are still classified as employed in these official figures (instead the impact is registered by fewer hours worked). Still, this masks some fairly depressing announcements in the jobs market over the past couple of weeks, as firms prepare to make adjustments to their workforces ahead of a phased unwinding of the Job Retention Scheme. Unemployment will undoubtedly tick higher over the next few months - the question is whether Chancellor Rishi Sunak's latest pledges can help reduce the scale.

Eurozone: Recovery fund discussions looking optimistic

Next week’s focus for the eurozone will be mainly on the EU Recovery Fund again. After weeks of tête-à-têtes, European leaders will once again sit around the virtual table to discuss a possible fund. It is now down to the discussion on whether grants or loans should be disbursed and whether there should be a conditionality on the disbursement. What is perhaps more relevant is what is not on the table anymore. The details are fiercely debated, but the fact that the EU will borrow from the market for funding seems to be getting very little pushback anymore. This means that large hurdles have already been overcome and adds to optimism about a fund seeing the light of day. Whether that will be next week already remains to be seen of course, it usually takes a good few summits for something large to be decided in Brussels.

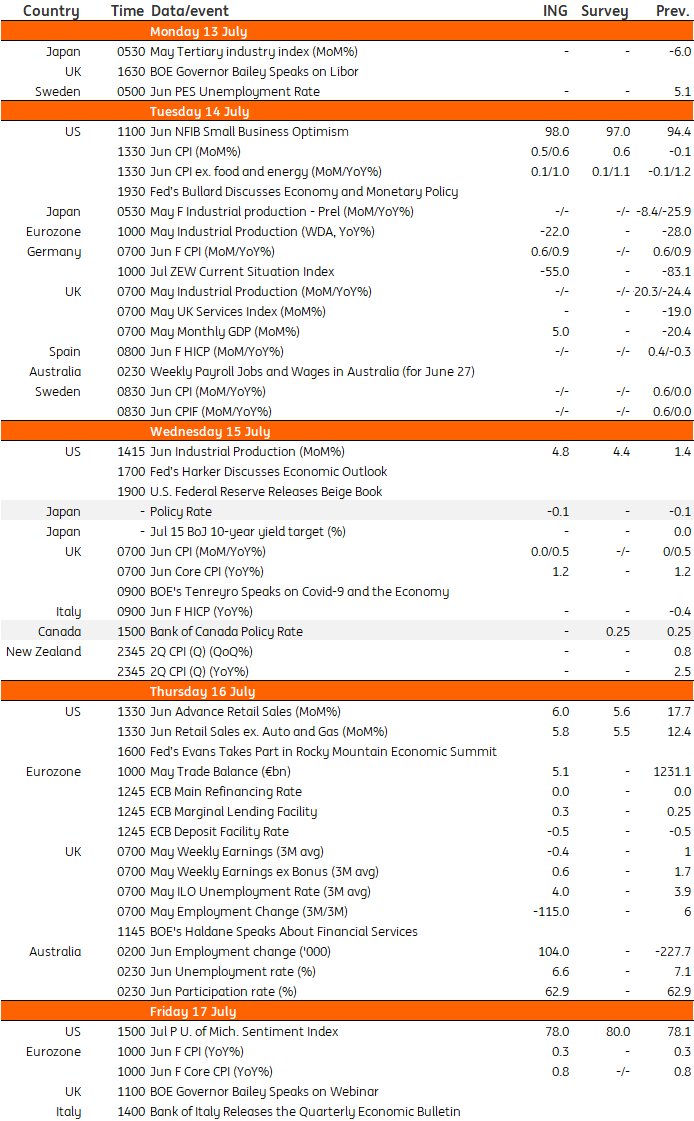

Developed Markets Economic Calendar

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

10 July 2020

Our view on next week’s events This bundle contains 3 Articles