Key events in developed markets next week

Weekly initial jobless claims has been the indicator to watch in the US over the past few weeks. But a broader range of figures will help quantify the impact of Covid-19 from next week onwards

Gauging the depth

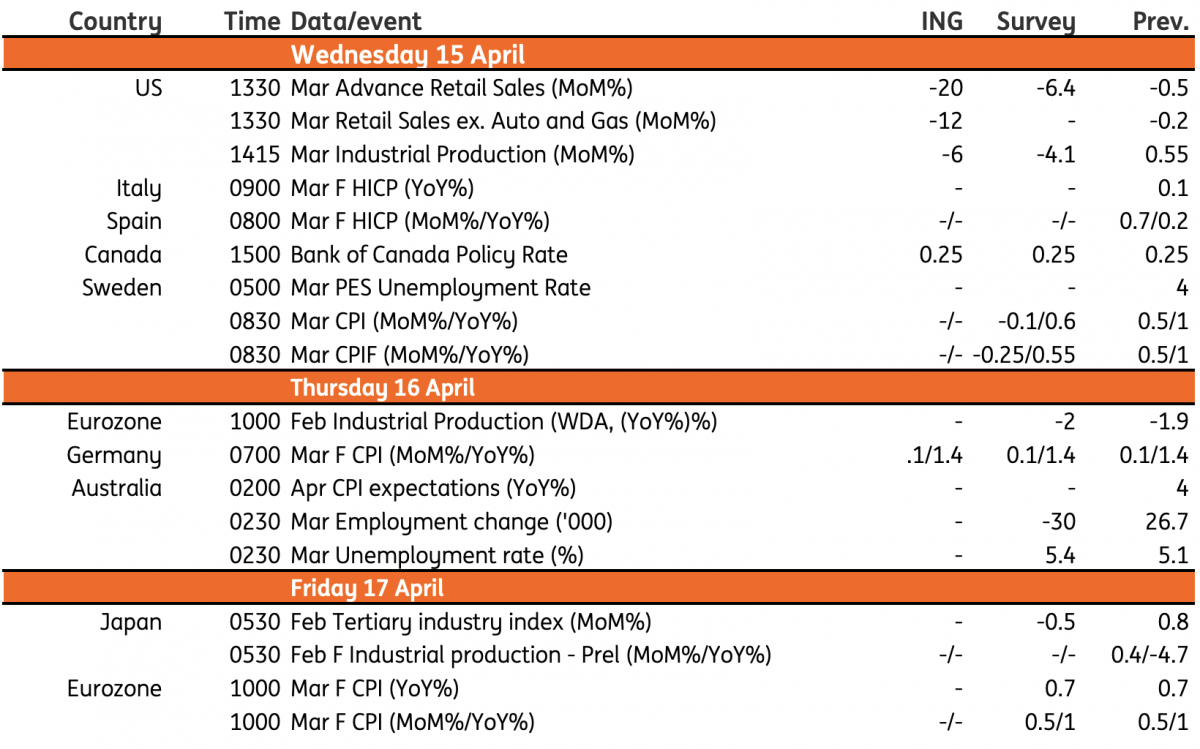

Weekly initial jobless claims has been the key indicator to watch as we measure the economic effects resulting from Covid-19 containment measures. They will again be closely followed, but from this week we will get a broader range of figures to quantify the impact with the release of March retail sales, industrial production and housing starts numbers.

We know the retail sales figures will be unprecedented. The city and state shutdowns have spread across the country over recent weeks with traditional bricks and mortar stores, aside from grocery and pharmacies, largely now closed. Millions of Americans have lost their jobs with rapidly rising unemployment compounding the weakness in consumer spending.

Data on credit and debit card usage released by Bank of America show that spending has fallen by around 15%YoY on average through the month with it deteriorating to more than 30%YoY down in the final week of March. However, even this probably underplays the downturn. While some physical cash spending that would have been done in-store has been switched to online electronic payments - here we would focus on clothing, furniture - lots of that physical cash spending also wouldn’t have been moved online – restaurants and bars for example. Furthermore, we know that auto volume sales fell 32% in the month. As such we are conservatively estimating a 20%MoM drop in retail sales for March. The core “control” group that excludes the volatile food, auto, building material and gasoline station sales, maybe marginally weaker given it excludes grocery, which has experienced booming sales as panic buying kicked in during mid-month.

Industrial production is likely to post a less sizeable fall. The ISM manufacturing production index dropped to 47.7 from 50.3, which is historically consistent with a fall in manufacturing production of “only” 3%YoY. We are a little sceptical of this relationship right now. Many factories have remained open, but reduced orders and supply constraints will have led to a cut in output and there were job losses in the sector. We are forecasting a 5%MoM fall for manufacturing with industrial production dragged even lower by mining and drilling given price developments.

Housing activity is also likely to have slowed dramatically, in part due to rising unemployment and economic worries, but also because of a spike in mortgage rates that was caused by distress in financial markets towards the beginning of the month. None of this should come as a shock to financial markets who instead appear to be focusing on more positive news about the path of the virus and the potential for a gradual re-opening of the economy from May.

Nonetheless, it is important to remember that the scale of the downturn – which we estimate will be around three times greater than the global financial crisis – will mean many businesses will not survive with unemployment likely to be much slower to come down versus its rapid spike higher. A return to “normality” is not likely soon with the output lost in the downturn unlikely to be recouped before mid-2022 at the earliest.

Bank of Canada meeting likely to be a non-event

The Bank of Canada meeting is likely to be something of a non-event given rates have already been cut to the lower bound of 0.25% and the Bank has initiated quantitative easing for the first time.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

USDownload

Download article

9 April 2020

Our view on this week’s key events This bundle contains 3 Articles