Key events in developed markets next week

An exciting week ahead in developed markets. We hope to better understand the Eurozone's recent poor performance, and see a political stalemate in Sweden come to a showdown. And if your feeling particularly blue after the midterms, we expect a healthy run of US domestic data

Another set of decent US data to keep Fed firmly on track

With the mid-term elections now behind us, focus switches back to what looks set to be another solid week for US data. Core inflation should remain above the Fed’s 2% target, and we expect it to stay like that as firms look to pass on the higher wage costs they are increasingly faced with. These positive fundamentals, combined to some extent with the additional tailwind of earlier tax cuts, should make for another decent set of retail sales figures next week. Taken together, this should all keep the Fed firmly on track to hike rates in December and three further times in 2019.

The Eurozone's poor performance: Completing the picture

Next week will give more of an idea on how poor the third quarter for the Eurozone economy has actually been. The 0.2% QoQ GDP growth from the first estimate was a bit of a shocker and raised doubts about possible revisions, but this week’s German data is already showing that the Eurozone’s largest economy has had a very poor summer - German GDP data next week could show the worst performance since 2015.

The second estimate of Eurozone GDP, including most of the country estimates, will be released on Wednesday. And with September industrial production data out as well, this should provide a rather complete picture of how poor the performance has actually been.

Another week, another game of “is a Brexit deal imminent”

Not for the first time, hopes are building that the UK government is on the verge of agreeing a Brexit deal. Press reports suggest the Prime Minister may gather her Cabinet to sign it a compromise on the contentious Irish backstop early next week, potentially unlocking an ad-hoc EU summit to sign it off later in November.

But even if ministers are prepared to accept the mooted fudge on the Irish border, the fundamental question of whether MPs will vote for it in Parliament appears just as uncertain as ever. And while Brussels appears keen to get a deal all wrapped up, the multitude of practical challenges associated with the UK-wide customs arrangement being proposed as part of the Irish backstop, may yet see talks drag on beyond November.

While nobody really knows when a deal might be agreed & approved, we still think there is risk that it might not be until much closer to the UK’s exit date in March, that we find out whether ‘no deal’ has been truly avoided.

UK data to keep on theoretical tightening path

Without all the noise of Brexit, we suspect the Bank of England would like to carry on with its tightening cycle. That certainly seemed to be the main message from its latest meeting, and next week’s data should largely support it. Crucially, wage growth should remain above 3%, indicating that skill shortages are continuing to put pressure on firms to offer faster pay rises to attract talent – although admittedly, the more recent employment numbers indicate that hiring has ground to a halt.

Core CPI may nudge back up to 2%, although importantly we think the days of persistently above-target underlying inflation are largely behind us. That means household incomes are no longer being squeezed to quite the same degree as they were 6-12 months ago. At face value, a rebound in retail sales would indicate that is showing up in the spending numbers – although in reality the monthly numbers have been very noisy recently. Either way, consumers still remain fairly cautious and we think this will make for another testing Christmas period for retailers.

Scandi domestic data in focus: Growth picks up and price pressure is sustained

Key Scandi data next week will be Norwegian GDP on Tuesday, where we expect a further pick up in growth to 0.7% QoQ from the rather weak 0.45% seen in 2Q18. And along with this is Swedish inflation, where we see the headline figure to remain elevated at 2.5% and core more subdued at 1.6%.

In addition, the Swedish political stalemate is finally heading for a showdown, with parliament set to vote on a new government on Wednesday and 2019 budget proposals due on Thursday. Because of the unprecedented situation, the two processes are happening in parallel and in some confusion. By the end of the week it should however be clear whether the conservative leader Ulf Kristersson will succeed in forming a government. At the moment that looks unlikely, as he is struggling to secure the support of the two liberal parties.

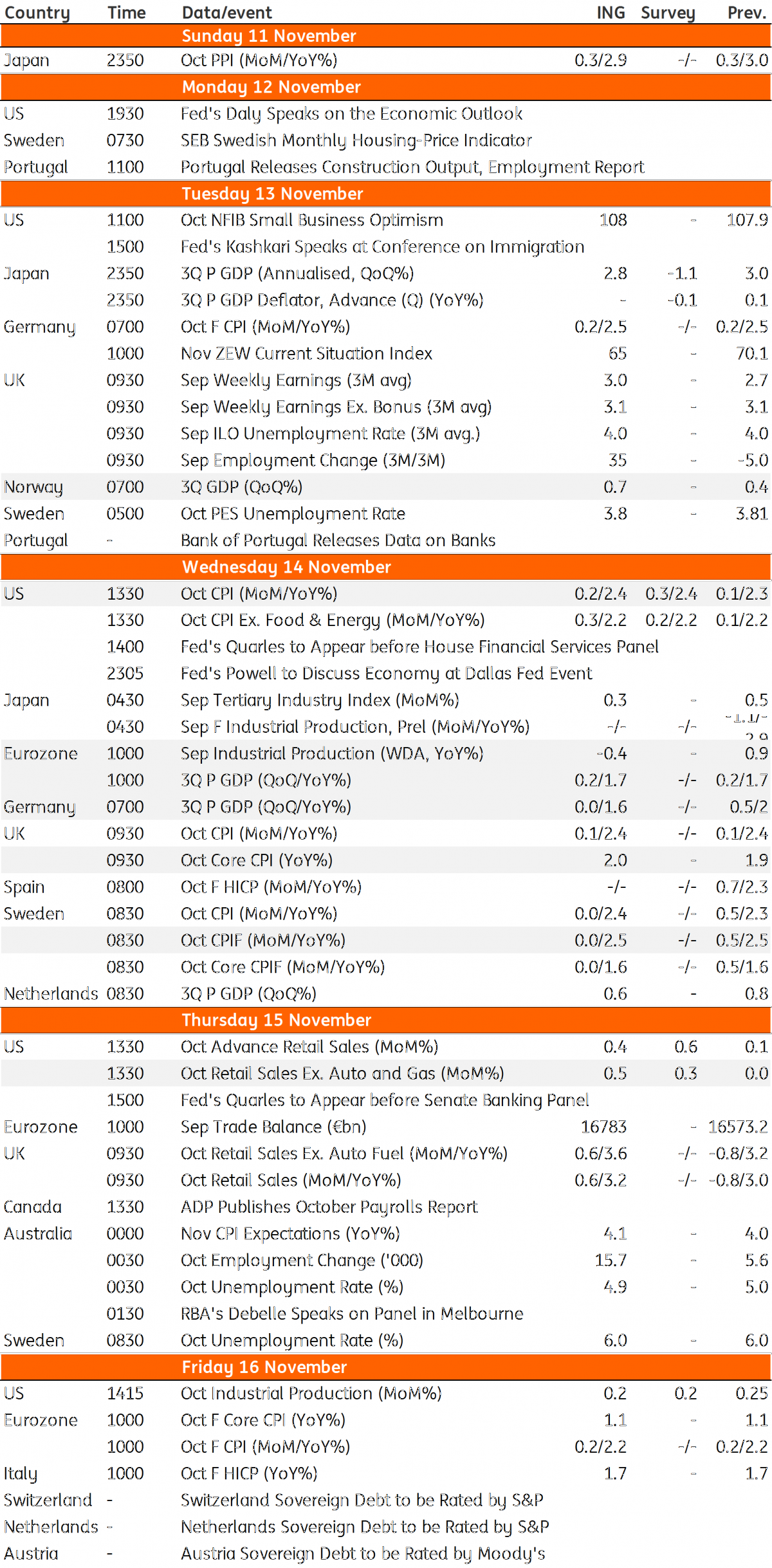

Developed Markets Economic Calendar

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

9 November 2018

Our view on next week’s key events This bundle contains 3 Articles