Key events in developed markets next week

Key releases to watch next week are inflation data from the US which is expected to jump close to 4% and UK GDP numbers which should be 'less bad' than initially feared as vaccination programmes steam ahead

US: Inflations to jump substantially, possibly signalling earlier than expected rate hikes

There are three key data releases from the US next week.

Consumer price inflation is likely to jump to close to 4% as prices in a vibrant re-opening economy contrast starkly with those from 12 months ago when the economy was in lockdown and companies were slashing prices to generate cash flow. These “base” effects should ease as we move through the third quarter, but we continue to believe that inflation could be more persistent than we have seen in previous economic cycles. Commodity prices, freight charges, supply chain disruptions, surging house prices and rising employment costs all factor into our thinking. At the same time, the positive growth and jobs story we are seeing will mean any spare capacity will be swiftly eaten up. This leads us to conclude that the Federal Reserve is more likely to raise interest rates in early 2023 rather than leave it until 2024 as they are currently signalling.

Regarding activity, retail sales are expected to post a decent gain again after jumping 9.8% month-on-month in March on the back of the $1400 stimulus payments. The cash deposits were made in the second half of the month, and this should mean there is some carry through on spending into April. The re-opening economy also means there are more options to spend money, and with household savings having risen $3tn during the pandemic, there is plenty of cash ammunition to use.

Industrial production should also post another strong rise, although manufacturing could be somewhat mixed given that semi-conductor chip shortages have been impacting many sectors, especially the auto sector. Oil and gas rig counts are up strongly, though, and that should mitigate any softness there. We will also see consumer confidence reading, and given the re-opening, rising asset prices and improved job prospects, we expect to see more gains.

UK GDP ‘less bad’ than feared in the first quarter

The combination of schools returning and healthy month for retail should help lift UK March GDP by over 2%, limiting the overall scale of the first quarter fall in activity to around 1.5% - considerably ‘less bad’ than feared given the Brexit disruption and the strict lockdown.

We expect substantial gains in the second quarter as the economy continues to reopen. GDP is likely to grow in the region of 5% and could be close to pre-Covid levels by the end of the year.

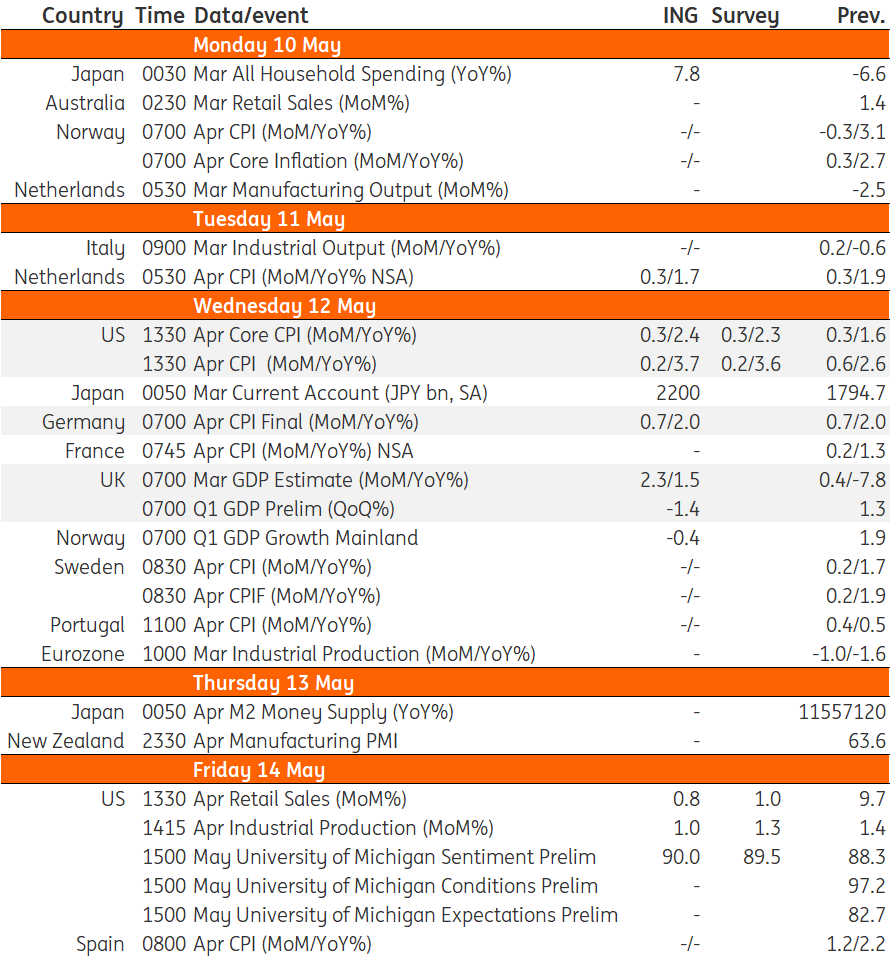

Developed Markets Economic Calendar

Download

Download article

7 May 2021

Our view on next week’s key events This bundle contains 3 ArticlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more