Key events in developed markets next week

We'll be watching Eurozone industrial figures with caution next week hoping to gain some insight into the length and depth of the economic slowdown. Otherwise, it'll all be about the British PM's update to UK parliament on Brexit progress next Thursday and the backlog of delayed US data releases

US: Back in the groove

The US economy clearly felt a little broader impact from the government shutdown, but the data calendar remains in a state of flux as statisticians work to clear the backlog of their number crunching. We will finally get the December retail sales and durable goods order numbers, but 4Q GDP won't still be released for another couple of weeks.

The numbers should in general be supportive of the Federal Reserve’s decision to indicate a prolonged pause for monetary policy. Lower gasoline prices will drag headline inflation down to just 1.5% YoY, while core inflation should remain in line with the target at 2% YoY. Lower fuel costs will also weight down on the value of retail sales, but excluding this, the story looks good with a strong jobs market and rising pay giving consumers the cash and the confidence to spend. Decent manufacturing surveys suggest industrial production should remain firm, so the Goldilocks scenario of healthy activity with a benign inflation backdrop continues.

We will also be looking for news on trade-related issues, especially the build-up to whether the US determines the car industry is a national security issue. If this is decreed by February 17, this could see tariffs eventually applied to imports, which would heighten fears of escalating protectionism.

Eurozone: Slowdown - how deep and how long?

Eurozone industrial figures will be watched anxiously as German data has already been poorer-than-expected. The slowdown in Eurozone industry has been at the top of everybody's mind, but the question remains how deep it is and how long it will last.

That said, although German data has been weaker than expected, domestic demand should have prevented the economy from falling into a technical recession.

Another week, another Brexit vote

British Prime Minister Theresa May has said she would update parliament on Brexit progress, which will be done in the form of another amendable motion next Thursday. Like a couple of weeks ago, this means lawmakers can put forward their proposals, and one focus for markets will be whether we get a re-run of the so-called 'Cooper amendment'.

This proposal would have given MPs a vote on applying for an extension to the Article 50 negotiating period if the government fails to get a deal approved by the end of this month. Given that MPs rejected this last month, it’s hard to see any such proposal gaining enough support this time. We think it’s also unlikely that we’ll get indicative votes on a second referendum to an alternative Brexit stance on Thursday.

All the while, the economy continues to struggle. UK fourth-quarter GDP is likely to be pretty disappointing in light of increased uncertainty surrounding Brexit and renewed consumer caution.

Scandi's: Riksbank meeting and Norwegian inflation

Expect next week's Riksbank meeting to be largely a non-event. Having delivered a very dovish rate hike in December, the Riksbank is unlikely to change much at the February meeting. The data so far this year shows the Swedish economy is now clearly slowing down, and the global outlook continues to worsen as well. But the Swedish central bank is likely to balance this against the positives – decent inflation reading for December and a solid labour market – and leave the policy stance largely unchanged. We expect the policy statement to continue to indicate the next rate hike is likely to come in the second half of 2019.

In Norway, January inflation is likely to show a continued pick up in core inflation, while headline inflation is likely to fall back as the drop in oil prices since last autumn weigh on the energy component. But the core figures is what matters for the central bank, and a strong reading would strengthen the case for Norges Bank (NB) to stick to its plan to raise rates in March despite the increasingly dovish tilt among developed market central banks – the NB could well be the only G10 central bank raising rates in the first quarter.

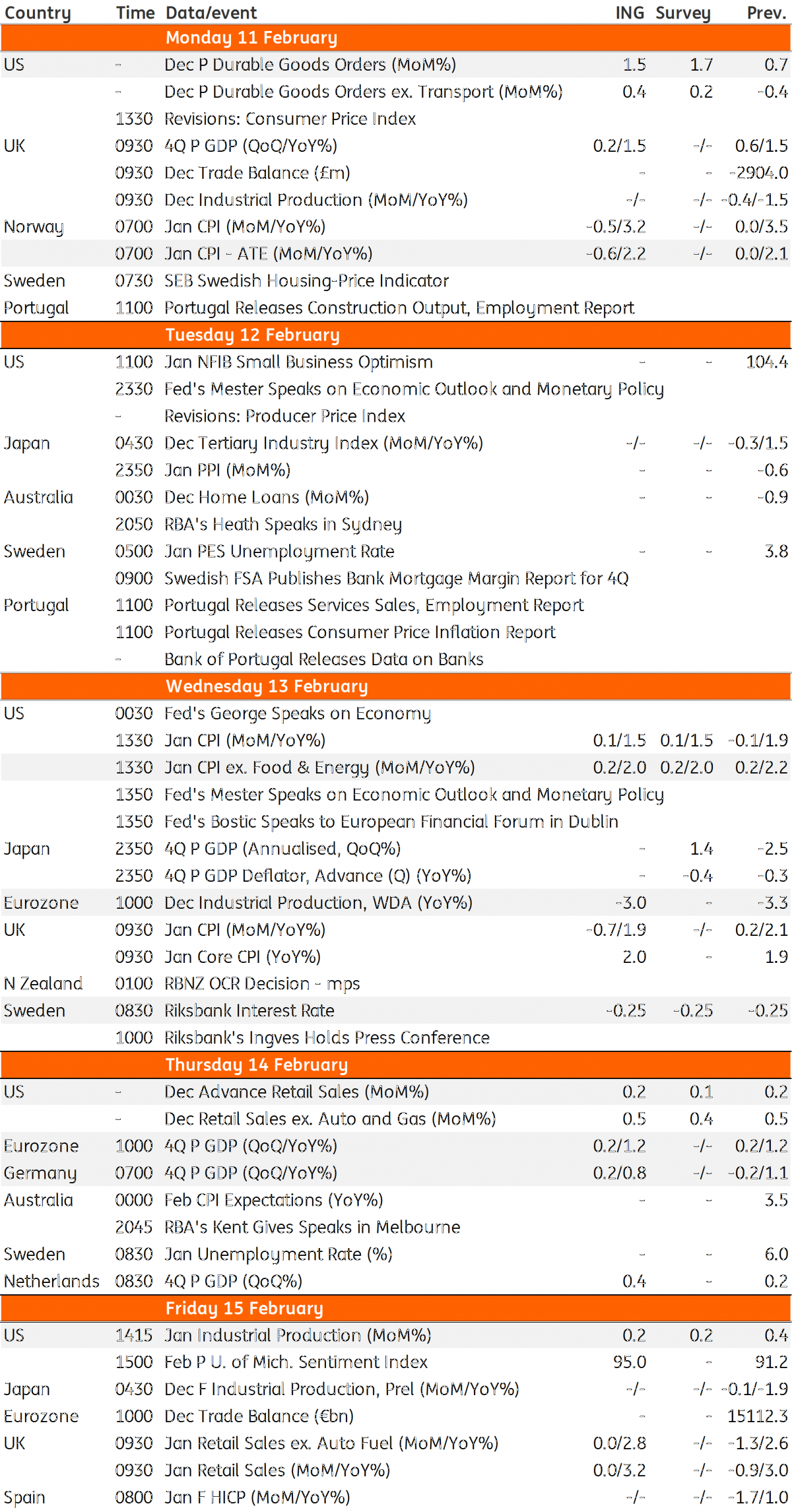

Developed Markets Economic Calendar

Download

Download article

8 February 2019

Our view on next week’s key events This bundle contains 3 ArticlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more