Key events in developed markets next week

Key CPI and PPI readings in the US should reflect continued labour supply issues and higher costs. In the UK, activity growth is likely to stagnate over the summer

US: Supply constraints and rising costs to give higher inflation readings

The main economic data points of interest in the US over the coming week will be the various inflation readings.

Federal Reserve doves suggest that inflation shouldn't get as much focus as it has been doing, given that price pressures have been focused in relatively few sectors such as used car prices and areas that have been feeling particular reopening frictions. We are less sanguine and expect to see price pressures broaden out across more areas of the US economy given ongoing supply constraints, including a lack of suitable workers, and robust, stimulus-fuelled demand.

Numerous surveys, including the ISM and NFIB reports, suggest companies are experiencing rising pricing power and are prepared to use it to pass higher costs on to customers and preserve profit margins. Given the lags between these inflation components and actual house price growth, we also expect to see housing costs increasingly be a major source of inflation pressures.

With CPI and PPI set to hit new highs and import price inflation running in double digits, next week's data is likely to give more ammunition to the relative hawks within the Federal Reserve's FOMC membership and support the case for an earlier tapering of asset purchases and interest rate hikes starting in 2022. Also, watch for rising inflation expectations amongst consumers as measured by the University of Michigan consumer sentiment report.

UK: Buoyant second quarter growth to give way to lacklustre summer of activity

Next week’s UK GDP will likely show a huge 5% growth rate for the second quarter.

Of course, that’s largely a function of the reopenings, but it also represents the rapid rebound in confidence and appetite to socialise again among consumers. Ultimately this is a bit out of date now, and the reality is that the growth rate is likely to slow markedly over the summer. We’re pencilling in 1.5% third-quarter growth due to the disruption from higher Covid-19 cases and perhaps some renewed reluctance to visit hospitality and other venues given the risk of getting ‘pinged’. That said, this is likely to pause rather than stamp out the recovery, and we still think the size of the UK economy will be at, or close to, pre-virus levels around the end of this year.

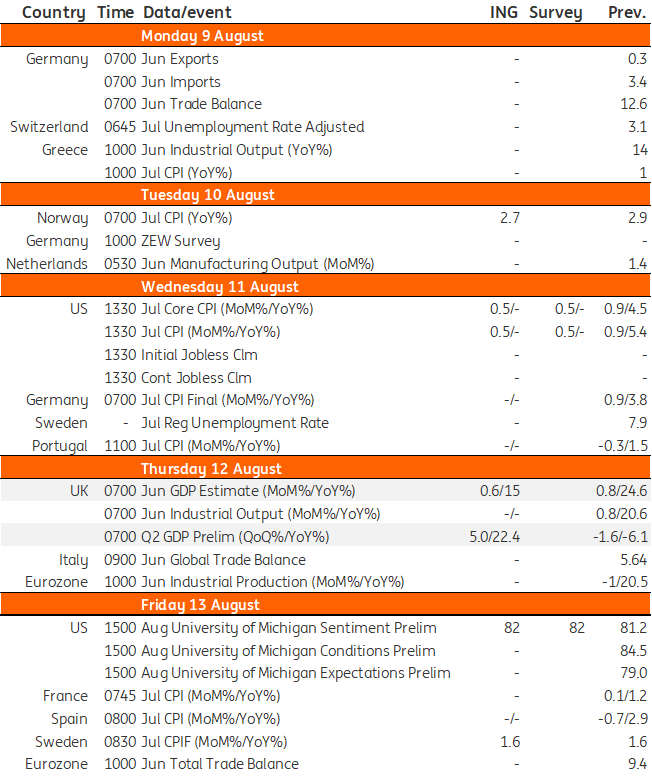

Developed Markets Economic Calendar

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

6 August 2021

Our view on next week’s key events This bundle contains 3 Articles