Key events in developed markets next week

Industry, confidence, labour market and retail sales data in developed markets next week suggest a slow recovery ahead for both the US and the Eurozone

US: Growing impatient

This coming week’s data is for July and the story should remain fairly positive with industrial production and retail sales continuing to recover from the lockdown measures.

The ISM survey posted decent gains while strong auto sales and higher gasoline prices are providing solid bedrock for the retail sales number. Inflation should also pick-up a little further given rising gasoline and food prices in particular. However, high-frequency data suggests that the US recovery story is showing signs of stalling as a rising number of Covid-19 led to reintroduced containment measures.

Confidence has taken a massive hit while the employment situation is looking more challenging as many businesses that had re-opened are forced to close due to restrictions. This is leading to job losses in many areas while the deadlock in Washington over another fiscal support package means that 30 million-plus people that had been receiving the $600 per week additional Federal unemployment benefit will no longer do so.

The combination of weaker confidence, a tougher jobs market and a squeeze on household income means that the outlook for August and September activity data isn't great.

Eurozone: Industry slow to recover

After this week’s encouraging retail sales figures, the Eurozone focus will be on how industrial production and exports recovery is shaping up. Hopes for a 'V' outside retail are smaller, so expect a slower recovery in production and exports.

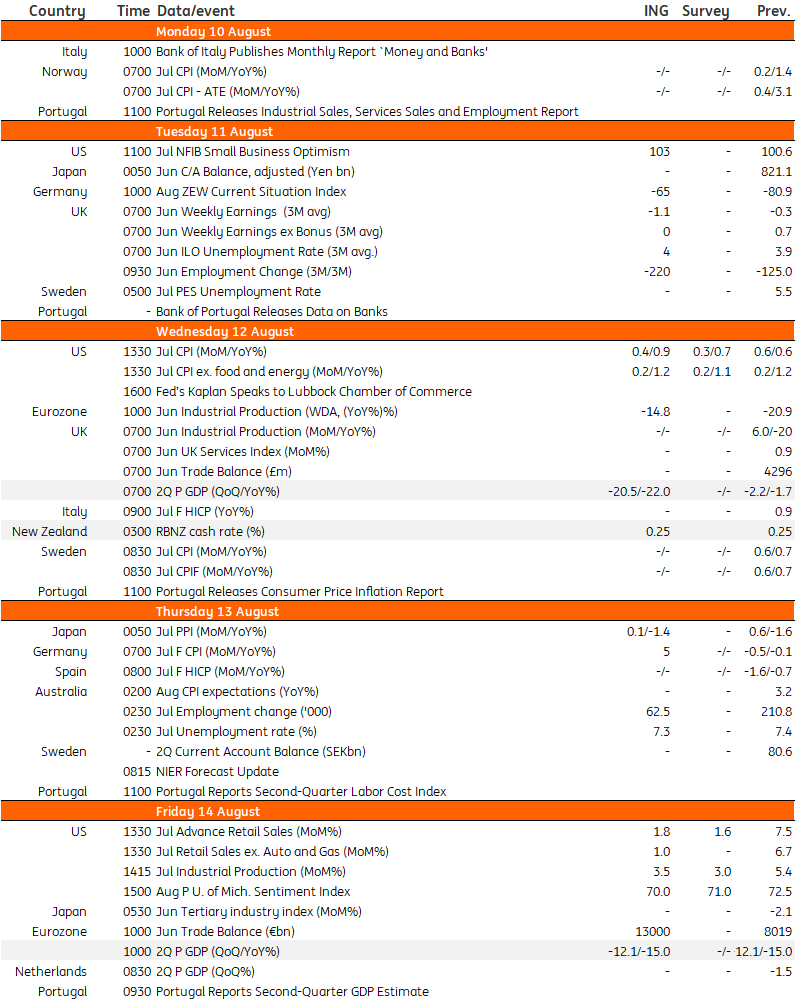

Developed Markets Economic Calendar

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

7 August 2020

Our view on next week’s events This bundle contains 3 Articles