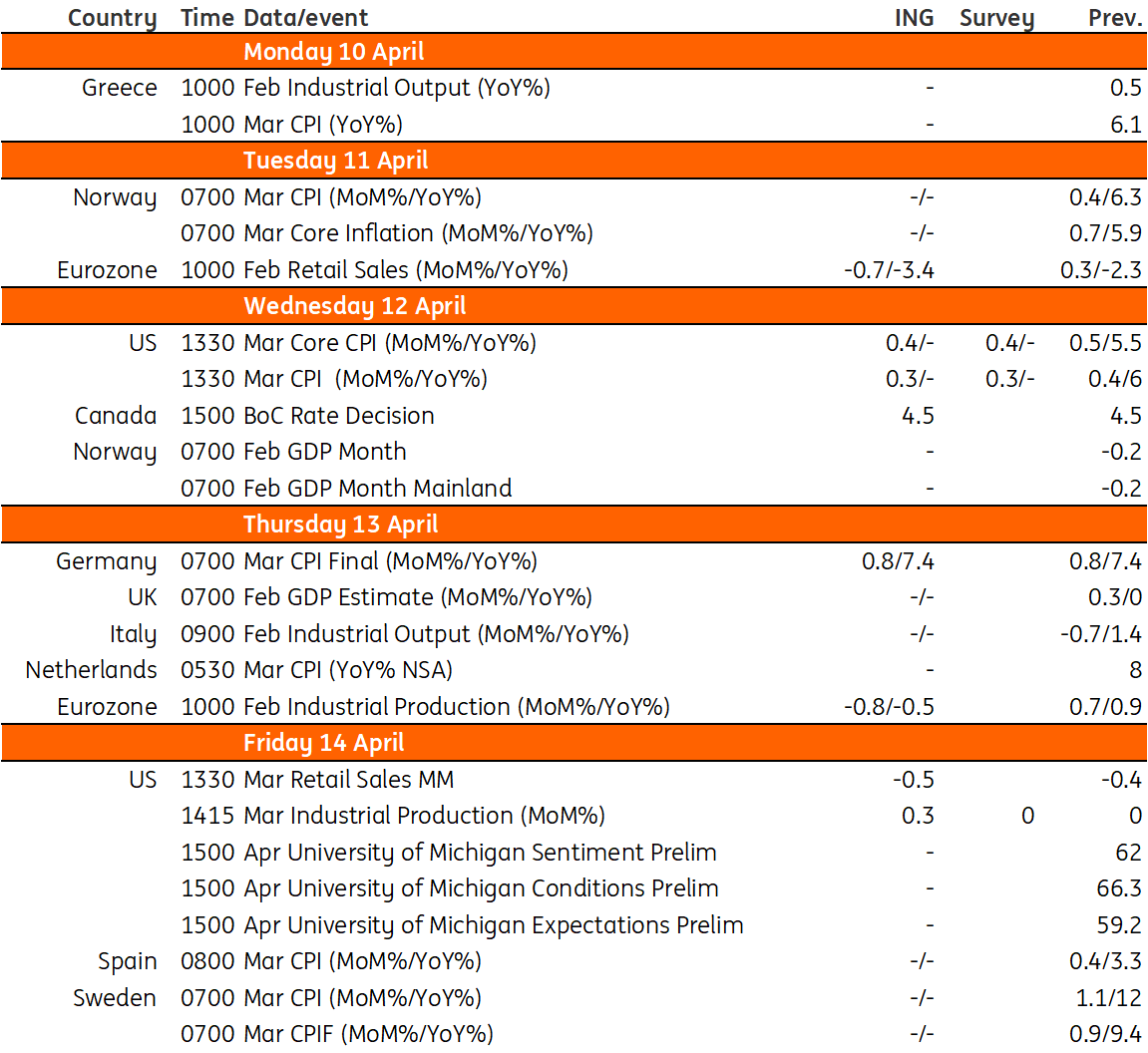

Key events in developed markets next week

Next week's CPI report will play a big part in whether the Fed will hike rates much further. We expect it will prefer to raise rates at least one more time, however, we also see a strong probability of rates being cut later in the year given the circumstances. For the Bank of Canada, expect rates to remain unchanged as we are likely to be at the peak

US: Strong probability of the Fed reversing course

Markets are increasingly doubtful that the Fed will be able to hike rates much further, but that could yet change after the upcoming CPI report. Another 0.4% month-on-month figure on core CPI, more than double the rate required over time to take the US back to the 2% year-on-year inflation rate target, could nudge expectations for the upcoming FOMC meeting higher.

We still think the Fed would prefer to raise rates at least once more should financial conditions allow, but we see a strong probability that it reverses course and cuts rates by 100bp later in the year as ever-tighter lending conditions, high borrowing costs, weak business sentiment and a deteriorating housing market all weigh on growth and rapidly dampen price pressures.

Canada: Rates to remain at 4.5%

The Bank of Canada is widely expected to leave rates unchanged next week having signalled that rates are already likely at the peak. The downside risks for global growth in the wake of recent banking turmoil only make it more likely that the next move from the central bank will be an interest rate cut.

Eurozone: February data will be key

For the eurozone, it’s an important week to get a sense of how GDP has developed over the first quarter. Industrial production and retail sales figures are both up for February, following a rise in January. They were up only moderately though and given how volatile these numbers are, February data will be key to determining whether we will see quarterly growth for the most timely consumption and production figures.

Key events in developed markets next week

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

6 April 2023

Our view on next week’s key events This bundle contains 3 Articles