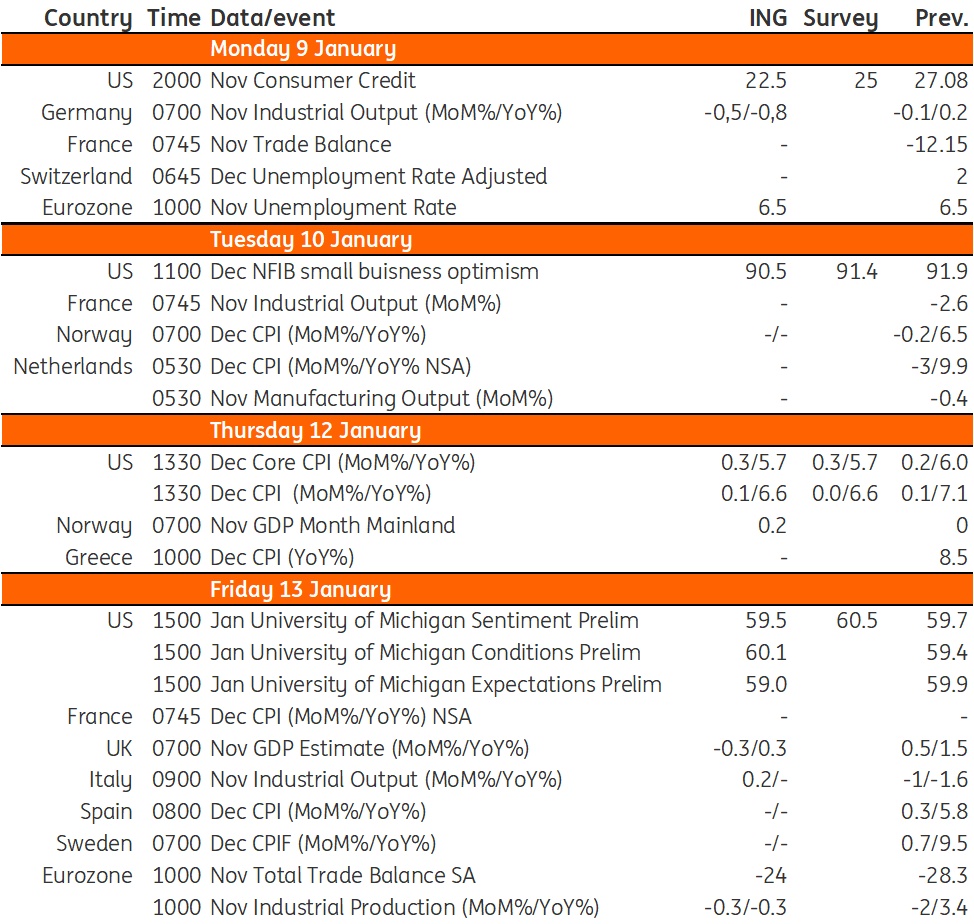

Key events in developed markets next week

In the US, we see a further moderation in the annual rate of inflation, from 7.1% to 6.6%, and expect much sharper falls from early second quarter onwards. For the UK, we expect a negative monthly GDP figure for November, and for now are pencilling in a 0.1% fall in fourth quarter GDP. In the eurozone, we see a further improvement in the trade balance

US: Core inflation pressure elevated for now

It is clear that economic headwinds are intensifying and business surveys are softening as a result. With business leaders becoming more pessimistic, we expect this to translate into weaker hiring and eventual job shedding as companies look to cut costs. Competitive pressures amid a weakening demand environment also suggest that inflation should slow too. However, Federal Reserve officials continue to indicate they think they have more work to do in the battle to get inflation back to the Bank's 2% target. They remain concerned that policy needs to be more restrictive and to stay restrictive for a long period of time to ensure that demand moves into balance with the economy’s supply capacity and price pressures subside.

In that regard, the key data point next week is the US CPI report. We expect to see a further moderation in the annual rate of inflation from 7.1% down to 6.6%, but this is still more than three times faster than the Federal Reserve’s 2% target. Fed officials have made it clear they expect goods price inflation to continue softening - expect another big drop in used car prices given the steep decline in new vehicle sales as consumers pull away from major purchases and lending criteria becomes stricter. But officials are seemingly focused on services ex housing. The consumer spending story looks OK right now and that is likely to keep core inflation pressures somewhat elevated while. It is too soon for the weakening in the housing market to show up in a clear moderation in the cost of shelter since it typically lags by 12-14 months so that is more of a story for the second quarter into the third. Meanwhile, medical care costs, having fallen for two consecutive months, are unlikely to be quite so helpful in depressing overall inflation. Still, a 0.3% month-on-month print would lead to the annual rate of core inflation hitting 5.7% versus 6% in November. We expect to see much sharper falls in the annual rate of inflation from the early second quarter onwards.

Other things to look out for include consumer confidence and small business confidence. Both are likely to remain weak given the impact of falling asset prices, high inflation and more headlines regarding job losses from some big corporate names. Also, look out for comments from officials, including Fed Chair Jerome Powell.

UK: Monthly GDP to point towards second consecutive quarter of negative growth

The UK’s monthly GDP figures have been a bit all over the place recently, in part because of the Queen’s funeral last September. But strip out the volatility and the economy is clearly weakening, and the constant downtrend in retail sales through last year is one such example. We expect a negative monthly figure for November, after October’s artificial bounce back following September’s extra bank holiday. That, and another such decline in December, would probably be just enough to lock in the second consecutive quarter of negative growth and mark the start of a UK recession that’s likely to last until at least the summer. For now, we’re pencilling in a 0.1% fall for overall fourth quarter GDP when the figures are released next month, and just over a 1.5% peak-to-trough fall in output over several months.

Eurozone: Further improvements in trade balance expected

The eurozone kicks off the year with new labour market data. October saw unemployment drop once more despite deteriorating economic conditions. The question is how long the labour market can continue its run of improving unemployment rates. If indeed we see unemployment decreasing further, this could unleash more hawkishness from the European Central Bank.

Besides unemployment, we also get trade and industry data. Industrial production has been resilient despite the energy shock, but survey data points to weaker activity regardless. The trade balance is important to watch as expensive energy imports have completely flipped the eurozone trade balance from surplus to deficit. October saw an encouraging improvement in the trade balance and the question is whether softening natural gas prices have caused further improvements. This is important for the fair value of the euro/dollar.

Key events in developed markets next week

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

6 January 2023

Our view on next week’s key events This bundle contains 3 Articles