Key events in developed markets next week

A busy week ahead with US core CPI set to return to the 2% target, a raft of Fed speakers including Powell and Eurozone trade and industrial production data

US core inflation set to hit target as cell phone quirk drops out

After a prolonged period of weakness, US core CPI looks set to return to the 2% target (or even slightly above) next week as a distortion related to cell phone data pricing drops out of the annual comparison. While this may sound slightly bizarre, a quality adjustment to the CPI basket made in March last year resulted in a sharp one-off drop in communication costs and this has been knocking 0.2-0.3ppt off most core inflation measures ever since.

We'll also be keeping an eye on clothing costs, which have been extremely volatile over the past few months. Aside from the fact, the US economy is strong; the fact that apparel prices have increased so much over the past couple of months is hard to square at a time when competition in this sector is intensifying. A sizable correction could put a temporary drag on the overall price picture - although if this does happen, we suspect it is largely noise.

Watch Fed comments for tariff thoughts

As the US and China increasingly exchange tit-for-tat tariffs, markets will be scrutinising Fed commentary over the next week to see how policymakers are viewing the latest developments. We hear from a range of Fed speakers, including Chair Powell, some of whom have struck a note of caution on trade. The Fed minutes will also be in focus, although admittedly, much of the recent trade escalation has come since the last meeting in mid-March.

With most of the tariffs yet to be officially implemented, we suspect the Fed will be more focused on the impact they are having on confidence, as well as financial conditions. On the latter, so far the impact has been relatively contained outside of the equity markets.

Will Governor Carney drop stronger hints at a May hike?

As far as markets are concerned, a May rate hike in the UK is more-or-less a done deal. Investors are pricing in roughly an 80% chance of a rise at the next meeting, and we tend to agree. Aside from the severe dip in the PMIs (which was thanks to several bouts of snow), data on wage growth has been moving further in the right direction. And the agreement of a transition period will bolster the Bank's view that the road to Brexit will be smooth (at least for now).

The begs the question of whether Governor Carney will look to signal a May rate hike more explicitly when he speaks in Canada next week. We wouldn't rule this out, but policymakers tend to avoid tieing their hands unnecessarily and markets are in a very different place to last September, when the Bank felt it necessary to offer a near-unconditional commitment to a rate hike at the next meeting.

What will be the impact of the strengthening euro?

In the Eurozone, the focus will be on the impact of the strengthening of the euro as Bundesbank president Weidmann gives a speech on the topic on Thursday and trade data will come out on Friday, giving an indication of whether export growth is being dampened by the appreciated currency.

Eurozone industrial production on Thursday should bounce back as energy production is set to improve given the colder February. As sentiment figures have been slipping in the Eurozone, some hard data on production should provide insight into how strong Q1 has been.

Scandinavia focuses on inflation

In Scandinavia, this week’s inflation figures will be key for currency and rates markets. We think Swedish headline inflation will bounce back to 2% for March, though core inflation remains well below at 0.6%. This will provide little comfort for the Riksbank, which is likely to have to revise down its inflation forecast again when it meets later in April. That means it will probably have to postpone its first interest rate hike (currently scheduled for Q3) to the end of the year.

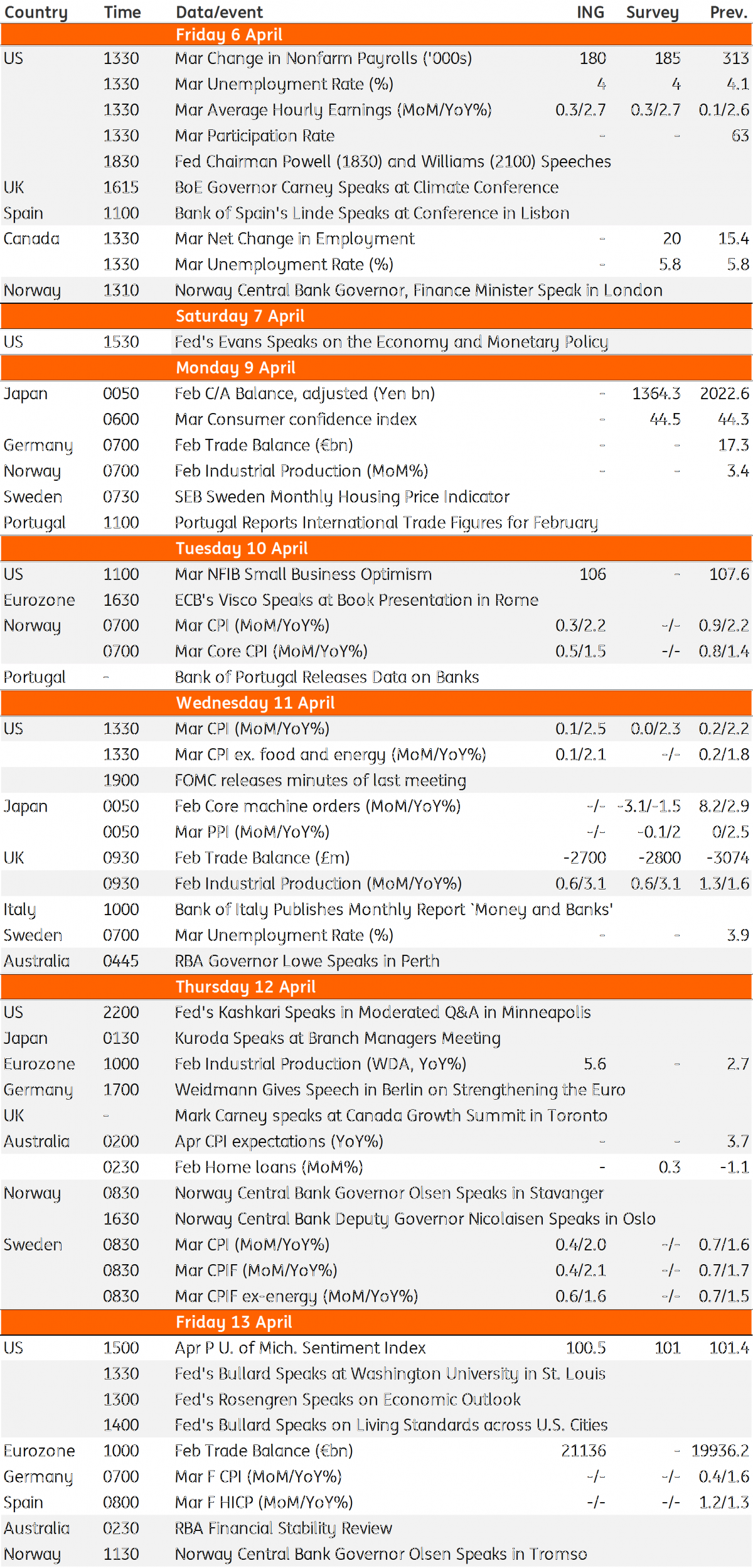

Developed Markets Economic Calendar

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

6 April 2018

Our view on next week’s key events This bundle contains 3 Articles