Key events in developed markets next week

The key focus of developed markets will be the ECB meeting next week where we expect rates to remain unchanged, and the same goes for the Bank of Canada. In the US, the inflation discussion will continue to be in the spotlight while the UK reports GDP numbers for January

Eurozone: ECB meeting in focus, and upbeat industry data expected

Besides the ECB meeting, which is clearly the main event for the eurozone next week, industrial production is out on Friday.

However, it is pretty important given that industry has been key in limiting 4Q GDP losses. With extended lockdowns in the first-quarter and bleak retail sales figures for January, it is equally important this quarter.

Surveys have painted a pretty strong picture for the start of the year in manufacturing with improving order books and increasing optimism among businesses. Friday’s data will show whether that is reflected in January output.

US: Inflation to edge higher, but don’t expect FED changes yet

Once again the focus will be on inflation ahead of the Federal Reserve’s FOMC meeting on 17 March. The Fed remains relaxed about the situation, arguing that there is significant spare capacity in the economy that will continue to dampen price pressures while there continue to be uncertainties over the resilience of the recovery. As such they still feel it could be “some time” before they start slowing the rate of QE asset purchases – currently $120bn per month – and that the first interest rate hike is unlikely to come before 2024, based on their forecasts.

However, with President Biden having announced that the US will have enough vaccines for all American adults by the end of May, paving the way for a second-quarter re-opening, and the US macro data having started on a strong footing, we think the growth prospects are very good and this could see more price pressures emerge.

This week headline inflation is likely to move a little higher primarily due to rising gasoline prices with the annual rate of headline inflation set to head to 1.6% from 1.4% while core (ex-food and energy) stays at 1.4%. Annual rates will start to rise quickly though in March-July as price pressures in a depressed, locked down economy 12 months ago are compared with price levels in a vibrant re-opening economy in 2021. We expect to see headline inflation move above 3.5% in 2Q which could lead to a change in language from the Fed at the June FOMC meeting surrounding the prospects for a tapering of asset purchases. We also think inflation could be stickier due to improved corporate pricing power in a supply-constrained economy.

Other newsflow includes the University of Michigan sentiment index, which could get a lift on the prospects of the fiscal stimulus and positive news on the vaccine and a diminished drag from the February winter storms that hit parts of the US very hard.

Meanwhile, the Bank of Canada will leave monetary policy unchanged with recent lockdowns constraining activity and a slower vaccine distribution performance limiting the chances of a swift economic re-opening.

UK GDP set to plunge on lockdowns and Brexit

It won’t come as much surprise that January’s growth figures are set to plunge, reflecting the return to full national lockdown.

We expect a 5% fall in GDP, driven predominantly by the closure of several consumer service sectors. But there will also be a hit from manufacturing as the change in EU trade terms kicked in. The jury is very much out on how big the impact could be. Car production fell 30% in year-on-year terms, albeit perhaps not as much as you might think given the widespread reports of fewer lorries and ships crossing the Channel. Some of the hit was cushioned by firms stockpiling in Q4, opting to take a ‘wait and see’ approach through January. We have been pencilling in as much as a 3-4% fall in manufacturing production in January, though in reality the damage could prove smaller.

Nevertheless, the change in trade terms is clearly causing considerable issues for firms and could get more challenging in the near-term as the UK prepares to phase in customs checks between April and July. We think this higher cost burden will hold back investment and hiring in the recovery phase.

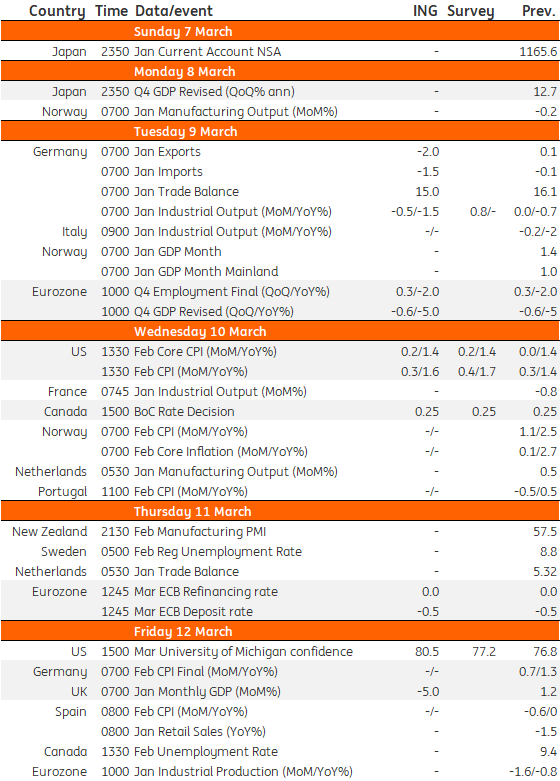

Developed Markets Economic Calendar

Download

Download article

5 March 2021

Our view on next week’s key events This bundle contains 3 ArticlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more