Key events in developed markets next week

Inflation data is at the forefront of developed markets next week, as US core measures could show signs of rising at the fastest rate in over ten years. We'll also be keep an eye on German macro data as well as Scandi inflation

US: Balancing the risks

The US economy continues to grow strongly, and there is evidence of rising inflationary pressures. Wages are ticking higher, while higher oil prices and tariffs also suggest inflation is likely to persist above the Federal Reserve’s 2% target for longer than what we thought just a few months ago. This week we expect to see core consumer price inflation rise to 2.3%, and then break above 2.5% in the next couple of months – the fastest rate of inflation for over ten years.

Unsurprisingly, the Fed is forecasting three interest rate rises next year after one final move for 2018 in December. There are a number of Fed officials scheduled to speak this coming week, and we will be looking to see whether the risks appear skewed to the upside or the downside in terms of Fed policy. For now, we think the risks are balanced, given some uncertainty is likely following the mid-term elections.

Germany: Moment of truth

It will be the first moment of truth for the German economy, with hard macro data for July showing whether the rebound, which was suggested by confidence indicators, actually materialised. Elsewhere, the minutes of the European Central Bank's September meeting should shed some light on the ECB’s current thoughts on their path.

Sweden and Norway's inflation data

Inflation data will be key in Sweden and Norway this week. We expect headline measures to remain elevated, and also see somewhat higher core inflation in Sweden.

The new monthly GDP indicator in Norway will also be published (for August) – it’s hard to tell with such a new data series, especially over the summer months, but we think the data will show continued solid expansion.

And of course, the slow-motion political drama in Sweden continues as the leader of the Conservative Party, Ulf Kristersson, has now received the mandate to propose a new government, but cobbling together a workable governing coalition still looks like a daunting task.

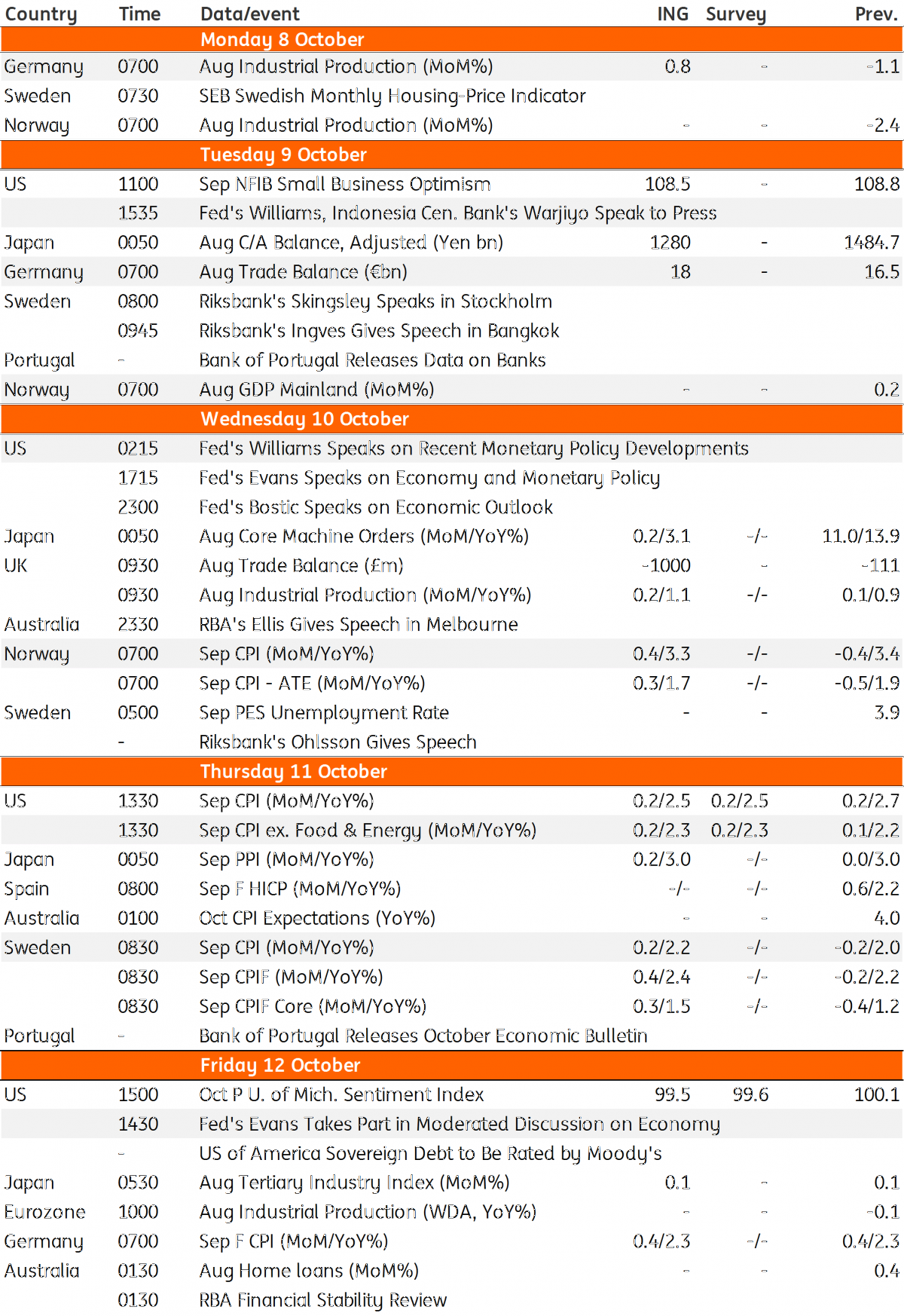

Developed markets calendar

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article