Key events in developed markets next week

US inflation will take the spotlight next week alongside UK-EU negotiations and 2Q GDP numbers. And a dovish Canadian central bank is likely to keep rates on hold

US: Inflationary rebound won’t last long

US inflation numbers will be in focus given the Federal Reserve’s recent framework review that included a formal adoption of average inflation targeting.

As the Fed’s Lael Brainard said in her recent speech, this means they are willing to “accommodate rather than offset inflationary pressures moderately above 2 percent” thereby allowing the economy to run a little hotter than they would have otherwise.

We expect inflation to continue rebounding in August to reflect the lagged effects of supply constraints relating to Covid-19 containment measures amidst the re-opening of the economy, but this will not last long given the US economy is still 10% smaller than it was at the end of last year and there are around 12 million fewer people in work.

In general, we expect inflation to remain subdued with core rates likely to remain well below 2% for a prolonged period with a Fed rate hike unlikely until the second half of 2023.

Canada: Rates to stay on hold

The Bank of Canada meets next week and will keep interest rates unchanged at 25 basis points.

The Canadian economy has performed midway between the US and Europe with output falling a little over 13% through the first half of the year. Growth has now returned, but the spare capacity in the economy means the prospect of a rate hike is very distant, especially given added uncertainties relating to Canada’s higher weighting of foreign trade and commodities relative to the US.

Like everywhere else, high-frequency indicators have pointed to a recent levelling off in activity suggesting the dovish tone from the central bank will persist, especially with inflation remaining benign given the large output gap.

UK: Don’t expect much from trade talks; GDP to show further sign of rebound

UK and EU negotiators will meet again next week, but an imminent breakthrough seems unlikely.

We expect roughly 17% growth in the third quarter, although importantly this still leaves the size of the economy around 8% smaller than pre-crisis levels

We’re reaching the point where political intervention is needed, and the UK will soon need to table a proposal on state aid if talks are to start moving in the right direction. There are growing signs that the de-facto October deadline for a deal to be wrapped up maybe breached (although some time will be needed before year-end for ratification). But, we still think a basic free-trade agreement is narrowly the most likely scenario this autumn. Read our latest monthly update for more info on what all of this means for the outlook in 2021.

Separately, data is likely to show that the economy rebounded by another 6-7% during July, given that many lockdown measures were eased during the month (notably in the accommodation and food sectors). We think the rate of growth is likely to slow in August, but pick up marginally again in September on the back of the return of schools and universities in September (which bizarrely feed into GDP numbers).

Overall, we expect roughly 17% growth in the third quarter, although importantly this still leaves the size of the economy around 8% smaller than pre-crisis levels, and the pace of the recovery is likely to stall as we head into the winter as unemployment starts rising.

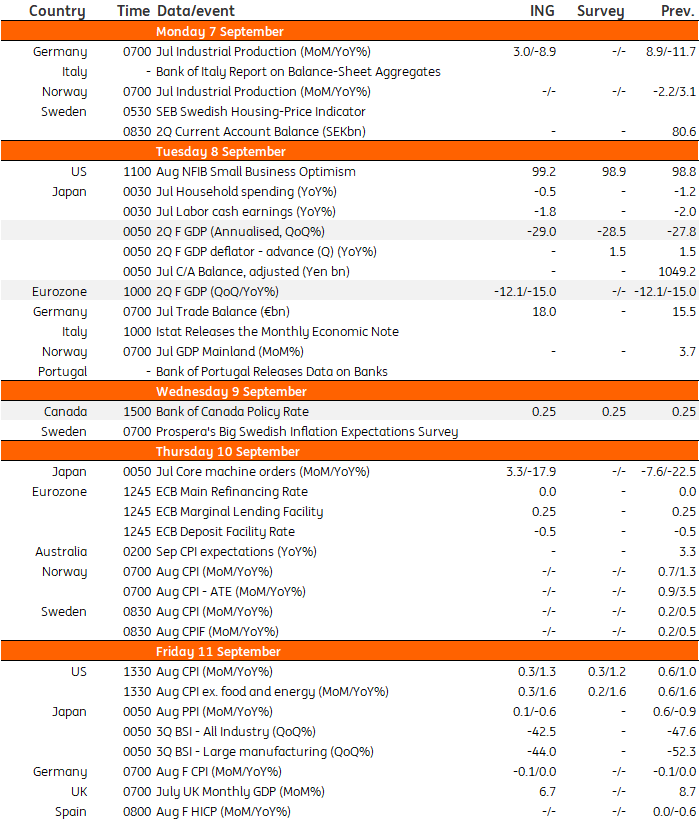

Developed Markets Economic Calendar

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

4 September 2020

Our view on next week’s events This bundle contains 3 Articles