Key events in developed markets next week

Expect Fed Chair Powell to reiterate his comment 'an ounce of prevention is worth more than a pound of cure' as he testifies before Congress next week. Elsewhere, UK monthly GDP report is set to be a noisy one

US: Pulling the trigger

The main focus in the US will be Federal Reserve Chair Jerome Powell testifying to Congress on monetary policy. At the June FOMC meeting officials clearly signalled they were preparing the groundwork for an interest rate cut to mitigate against “uncertainties” that could weigh on the economic outlook.

Activity data is showing signs of softening, inflation pressures are benign and markets are keen for action (as is President Trump). We expect the Fed Chair to signal a 25bp rate cut at the July FOMC meeting and he is likely to repeat his comment that “an ounce of prevention is worth more than a pound of cure”. Financial markets are currently pricing in three rate cuts for 2019 with a fourth coming in early 2020, but we think this is overdone given solid US economic fundamentals and the likelihood that a US-China trade deal will eventually be signed later this year. A long-term trade deal would be a huge fillip for global growth and financial market risk appetite, hence why we only expect two 25bp rate cuts this year – one in July and one in September.

Canada: Cautious optimism

The Bank of Canada is widely expected to keep monetary policy unchanged given recent improvements in sentiment and activity data and a surprise pick-up in inflation. We also have to remember that the BoC raised interest rates far less aggressively than the Federal Reserve so while rate cuts look likely in the US, monetary policy is still described as “accommodative” in Canada.

UK: Lacklustre GDP points to stable BoE rate outlook

Next week’s UK monthly GDP report is set to be a fairly noisy one. Back in April, the fact that several car manufacturers brought forward their annual shutdown saw output plummet. Now that those closures have finished, car production moved back to more normal levels in May should translate into a partial rebound in overall industrial output.

But away from vehicles, the manufacturing sector is being plagued by a slowdown in new orders as firms grapple with what to do with elevated stock levels, having built up so much inventory in anticipation of a possible ‘no deal’ scenario earlier in the year. Much of this is noise, but even once that is stripped out, the underlying trend doesn’t look much prettier. For that reason, we struggle to see the Bank of England increasing interest rates this year, although equally, we think markets are getting a bit ahead of themselves when beginning to price in a 2019 rate cut.

Sweden: Inflation to back-up Riksbank rate hike guidance

While Swedish inflation will dip back below the Riksbank’s 2% target, importantly it is still likely to come in roughly in line with the Riksbank’s latest forecast. In other words, it would support policymakers’ recent guidance that the next rate hike could come as soon as late-2019. In reality though, we think this is unlikely. Global risks are mounting, and there was a subtle nod to this in the Riksbank’s July statement. Similarly, we think there’s a risk that next year’s wage negotiations produce a more lacklustre outcome than the central bank's recent set of forecasts suggest. We expect the repo rate to remain on hold for the foreseeable future.

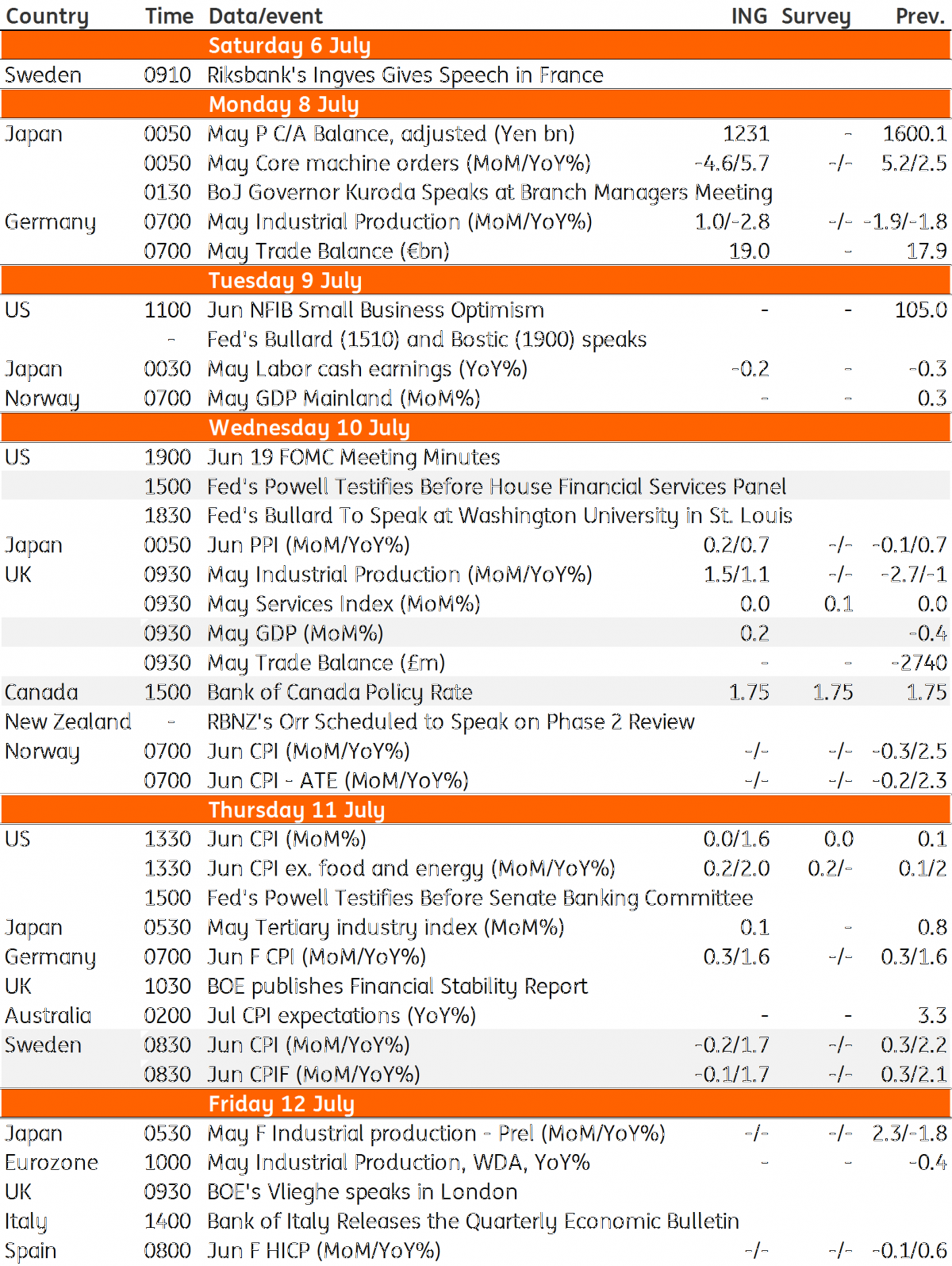

Developed Markets Economic Calendar

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

5 July 2019

Our view on next week’s key events This bundle contains 3 Articles