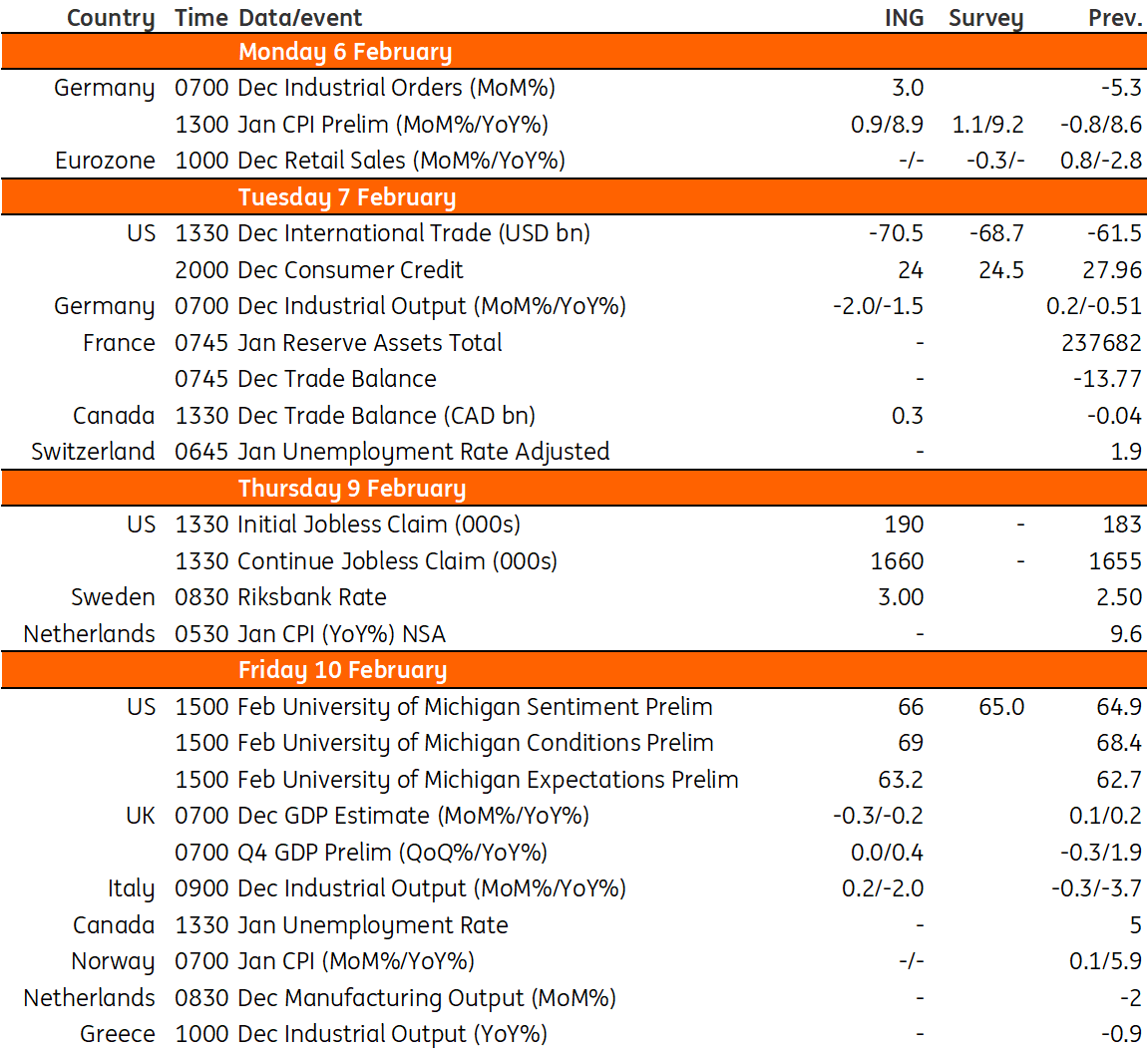

Key events in developed markets next week

Due to the artificial bounce in activity in September, we believe the UK will narrowly avoid entering a technical recession in the fourth quarter of 2022. For Sweden, we expect the Riksbank to hike by 50 basis points next Thursday, due to persistent core inflation and uplifts in wage growth

US: Eyes on Jerome Powell's appearance at the Economic Club

After last week’s excitement, it is a much quieter week for US data and events. With activity data softening and inflation cooling, the market remains unconvinced about the Federal Reserve’s desire to raise interest rates a “couple more times” as outlined by Fed Chair Jerome Powell this week. A recession appears to be the base case with expectations of policy easing in the second half of the year, which is putting downward pressure on the dollar and US Treasury yields. This is going someway to undermining the effectiveness of the Federal Reserve’s rate hikes at the short end of the curve as it battles to ensure inflation is eradicated from the system.

Consequently, the highlight for the week could be Powell’s appearance at the Economic Club of Washington. If he fails to push back meaningfully against the market reaction, the implication would be that the Fed itself is relaxed with what the market is doing, which risks it pushing further in the direction of pricing future interest rate cuts. Several other Fed officials are scheduled to speak during the week.

In terms of data, it is largely second-tier releases although the trade balance could be interesting. It has narrowed sharply through 2022, contributing positively to GDP growth in the second half of the year, but this appears to be unsustainable. It was driven by falling imports rather than rising exports and we see a strong chance that this partially unwinds in December. Meanwhile, the Conference Board measure of consumer confidence is expected to improve given the rally in equity markets and the fall in gasoline prices with a strong jobs market continuing to provide a firm underpinning for now.

UK: narrowly escapes late 2022 recession

An artificial bounce in activity after the Queen’s funeral last September suggests the economy will narrowly avoid entering a technical recession in the fourth quarter. Nevertheless, we expect a modest contraction in the first quarter of this year and probably the second, meaning recession is still the base case. It is however likely to be very mild by historical standards, not least because the recent fall in gas prices now means the government can probably cancel April’s planned increase in household energy bills – and indeed they’ll probably have fallen from the current £2,500 annual average to £2,000 by the summer.

Sweden: Riksbank to hike by 50bp, but the peak isn’t far off

The Swedish economy is not looking great. GDP fell by half a percent in the fourth quarter, while house prices are down 15% on last February’s peak. For now though, the Riksbank is more worried about core inflation which has continued to climb. Important pay negotiations are due to conclude in a matter of weeks, and all signs point to an uplift in wage growth across wide areas of the economy. With new Governor Erik Thedeen warning against recent SEK weakness, and the Riksbank saying in the past that it wants to stay ahead of the ECB in its tightening cycle, we expect a 50bp rate hike next week. Nevertheless, with the housing market under pressure, we think we’re nearing the top for Swedish rates. We expect one further 25bp hike in April, marking the top of the cycle.

Key events in developed markets next week

Download

Download article

3 February 2023

Our view on next week’s key events This bundle contains 3 ArticlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more