Key events in developed markets next week

A potential US-China trade deal could well be within touching distance and US data should remain decent, both of which don't point towards a Fed rate cut this year. The first-quarter GDP report is out for the UK too and here we anticipate a solid figure, though 'no deal' stockpiling preparations are likely to be the main driver

US: Even more reasons to suspect the Fed won't cut interest rates this year

Following the Federal Reserve’s decision to leave monetary policy unchanged and maintain the 'patient' mantra, we will be mainly waiting for any news on the potential US-China trade deal, given the scheduled Fed speakers will almost certainly stick to the party line. There are suggestions concessions are being made by both sides and markets are becoming increasingly optimistic on the potential for a trade deal that would lift a lot of uncertainty hanging over the global economy. It may also give businesses the clarity required to invest in the US economy knowing that supply chains are secured.

Datawise, the March trade balance numbers are likely to deteriorate, but from good levels. The will he/won’t he uncertainty over another round of President Trump tariffs on Chinese imports has led to significant volatility in trade numbers over the past six months. Given the tariffs weren’t enacted in January, we expect things to settle down. We will also have consumer price inflation data; headline CPI will be boosted by the surge in gasoline prices, but look out for a rise in core inflation too, given rising transportation fares and stronger housing component readings. Rising wages will continue to nudge core inflation higher and argue against the current market pricing of Federal Reserve interest rate cuts late this year.

UK: GDP - it’s all about stockpiling

First-quarter UK growth will be lifted pretty substantially by preparations firms made for a possible ‘no deal’ Brexit. There’s little doubt that companies ramped up stockbuilding activity – the levels of the PMI inventory component seen in the first-quarter were unprecedented, not just for the UK, but for all of G7. But while we know many firms were building up inventory, it’s harder to know by how much. Don’t forget that warehousing space in the UK was already fairly limited, making it trickier for some firms to ramp up stock dramatically. Like the Bank of England, we expect a 0.5% quarterly growth figure, helped along by some better retail spending figures, although the warehousing issue suggests the risks (if anything) lie to the downside.

Eurozone: PMI's in focus

This week’s eurozone growth figures were quite a positive surprise, but next week brings little news to go on for the second-quarter yet. Retail sales for March will come out and may shed some light on how much of a role consumption has played in strong growth performance. The final PMIs for April will also be closely watched after a poor first estimate.

Norway: Rising inflation set to keep Norges Bank a hawkish outlier

In contrast to its Scandinavian neighbours, the Norwegian central bank has seen ample – and perhaps even excessive – inflation pressure this year. Core inflation in Norway has jumped above 2.5% and could well stay around that level this year as momentum in the domestic economy remains solid and wage growth is likely to increase further.

In addition to higher inflation, oil prices have risen further, boosting the energy-dependent Norwegian economy. The Norwegian krone has also remained weaker than the NB’s forecast. If this combination continues, that strengthens the case for higher rates in Norway. We think the NB will hike at least once more this year and again early next year (at the September and March meetings).

Canada: Will the labour market fall to the feet of weaker growth?

The Canadian economy is slowly coming off its peak and transitioning into a more muted growth spell, and – despite showing some resilience up until now – it could be dragging the labour market along with it. Overall employment in both the goods and services producing sectors looks relatively decent, but when you boil it down to annual performances in specific sub-sectors, it’s not a positive picture.

Softer employment growth could be attributed to labour shortages. However, the BoC didn’t take a more dovish turn for nothing. Global trade uncertainties, concerns surrounding household activity and a struggling energy sector all pose downside risks to growth in the near-term and are simultaneously dampening business sentiment. The business survey implied that the optimism, coming from firms, about the year ahead had diminished. It wouldn’t be a surprise if employment growth took a milder tone over the coming months, but not necessarily now due to supply-side issues, but because solid demand prospects have lessened.

On the back of this, we suspect that the unemployment rate will nudge up slightly, from its recent 5.8% plateau, by year-end.

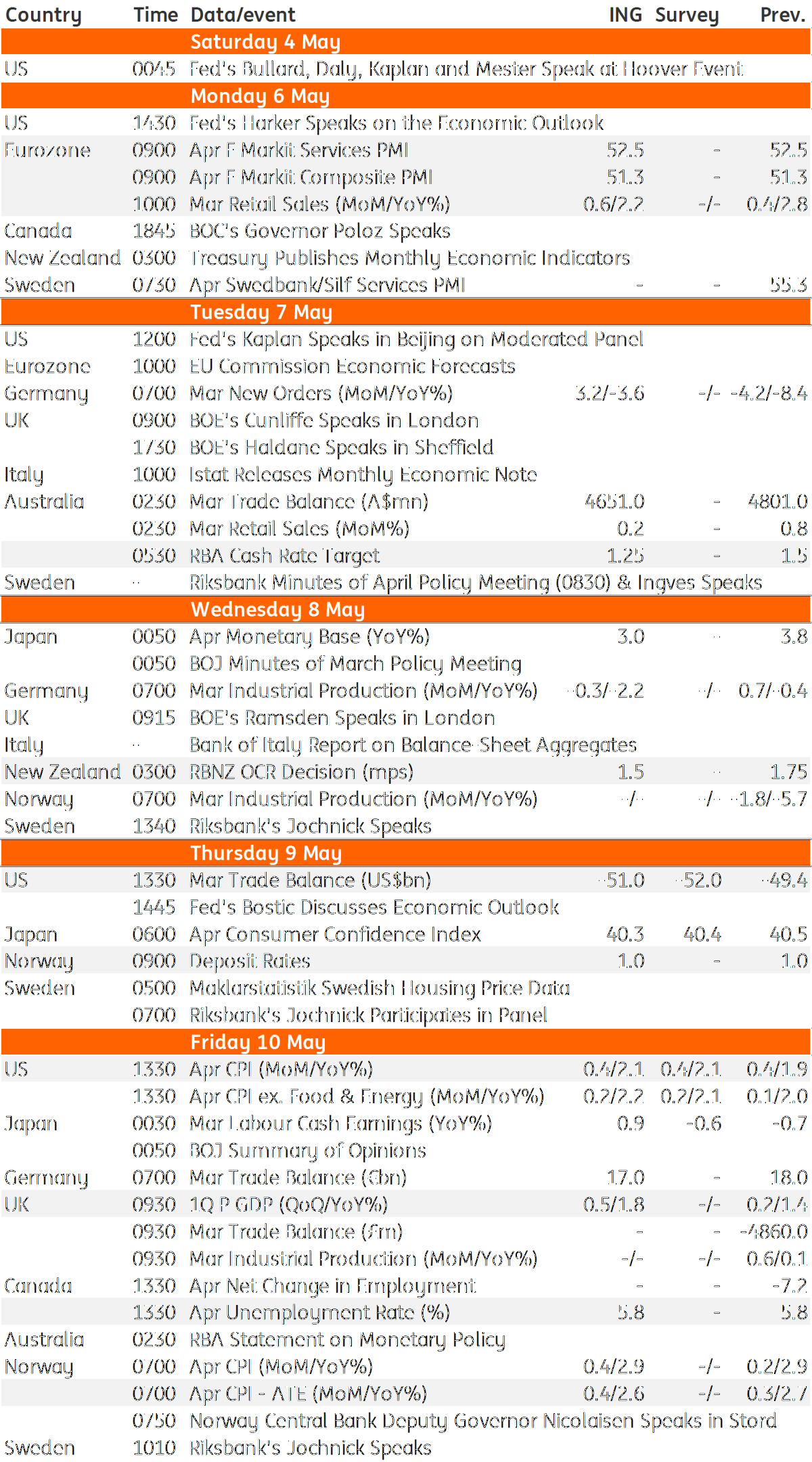

Developed Markets Economic Calendar

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

3 May 2019

Our view on next week’s key events This bundle contains 3 Articles