Key events in developed markets next week

US jobs figures are released next Friday. For us to seriously consider changing our July Fed call we would need to see payrolls growth fall with the unemployment rate moving a couple of tenths higher and wage growth showing signs of stagnating

Expectation of a 75bp rate hike from the Fed is unlikely to change

Between now and the 27 July Federal Open Market Committee (FOMC) meeting there are only two US data releases that could potentially prompt us to switch our forecast from a 75bp rate hike to a more cautious 50bp hike. After all, the Fed has made it clear that it is resolutely focused on getting inflation under control so we will either need to see a very weak jobs report, published on 8 July, or, but quite possibly together with, a surprise drop in inflation, out 13 July, that reflects declines in a broad range of categories. Currently, we are expecting inflation to dip only very modestly from its 8.6% rate in May, but given that is two weeks away, the market will be focused on next Friday’s jobs figures.

We know that there were around 11 million job vacancies at the last count, equivalent to nearly two vacancies for every unemployed American. This itself should point to a very strong figure for job creation, but the issue is the lack of suitable workers available to fill these positions, hence why wages have been rising so rapidly as firms compete for labour. However, we sense that the plunge in equity markets and the increasing recession talk as the Fed ramps up interest rates, may lead some employers to slow down the rate of hiring. Consequently, we think payrolls may grow somewhere in the 250-300,000 range, down from 390,000 in May, which should still be enough to keep the unemployment rate at 3.6% and wages continuing to tick higher. For us to seriously consider changing our July Fed call we would need to see payrolls growth fall with the unemployment rate moving a couple of tenths higher and wage growth showing signs of stagnating. Even then we would still probably need to see a surprisingly large decline in inflation the following week.

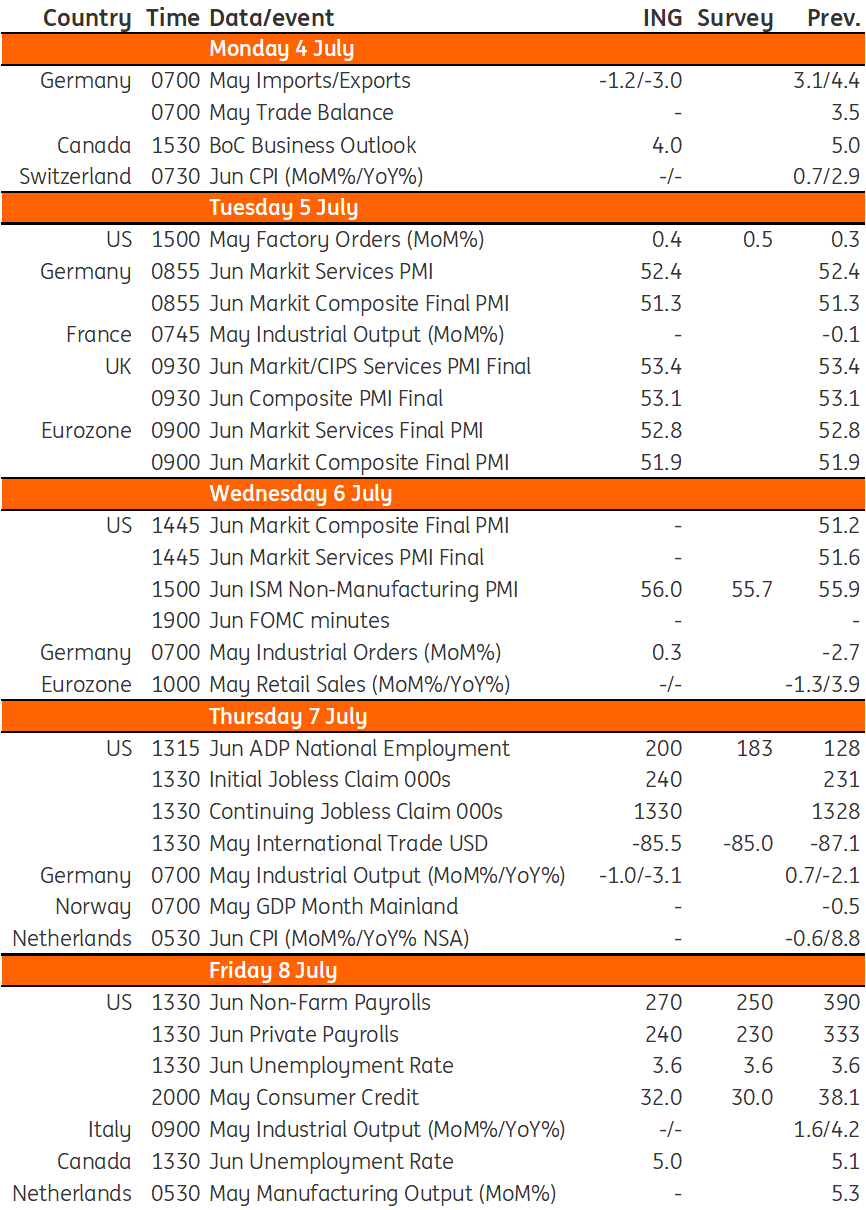

Developed Markets Economic Calendar

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

1 July 2022

Our view on next week’s key events This bundle contains 3 Articles