Key events in developed markets next week

Will the ECB change its communication and forward guidance to comfort the hawks? Is the UK making progress on a post-Brexit transition period?

US: why are we forecasting four Fed interest rate hikes?

Following an upbeat US economic assessment from new Federal Reserve Chair, Jay Powell, markets are now fully pricing in three rate hikes this year with around a 30% chance that the Fed will end up hiking on four occasions. Given we think that the economy will expand 3% in 2018 and that inflation could hit 3% this summer, we are forecasting four interest rate increases. We will have more Fed officials speaking this week and the general tone will help us gauge the likelihood that the Fed will also pencil in four moves when they update their own forecasts accompanying the 21 March FOMC meeting.

This week’s data is likely to be supportive of such a change with wage growth looking more robust and employment gains remaining firm. Business surveys are also set to remain at historically strong levels, supporting an increasingly positive assessment on the economic outlook. Nonetheless, the topic of “twin deficits” is becoming more of a focus with the prospect of a $1trillion fiscal deficit next year following President Trump’s tax cuts and looser budget. We will get the January trade data this week and this may provide a little comfort with stronger external demand, a weaker dollar and rising domestic oil output all helpful.

Eurozone: will the ECB change its communication and forward guidance to comfort the hawks?

In the Eurozone, the big topic at the ECB meeting will be whether the ECB will change its communication and forward guidance to comfort the hawks and to cautiously prepare markets for an end to QE. The only way to do this would be to drop the easing bias on QE from the ECB’s introductory statement.

As regards Germany, obviously Sunday’s result of the SPD vote could have a bigger impact on markets than next week’s macro data.

UK: is progress being made on a post-Brexit transition period?

With the countdown to the 22/23 March European Leaders summit fully underway, the focus in the UK will be on whether progress is being made towards an agreement on a post-Brexit transition period. A deal looks feasible, particularly given both sides accept urgent action is needed to prevent firms from executing worst–case contingency plans. The UK has reportedly backed down on the issue of citizens’ rights during the transition, but there are still differences in opinion on how long the period should last, as well as whether the UK will be able to benefit from existing trade deals with non-EU countries during the transition.

Norway: weak inflation could mar the sunny outlook of Norge's Bank

In Norway February inflation figures will be published on Friday. After a very weak January print, we expect inflation to have remained fairly low in February. That will make things a bit tricky for Norges Bank when it meets to set policy on March 15th. Other data indicate the Norwegian economy is picking up, but weak inflation would mar the central bank’s sunny outlook.

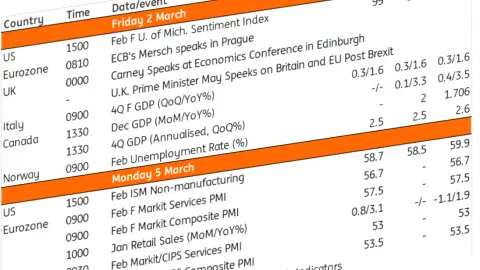

Developed Markets Economic Calendar

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

1 March 2018

Our view on next week’s key events This bundle contains 3 Articles