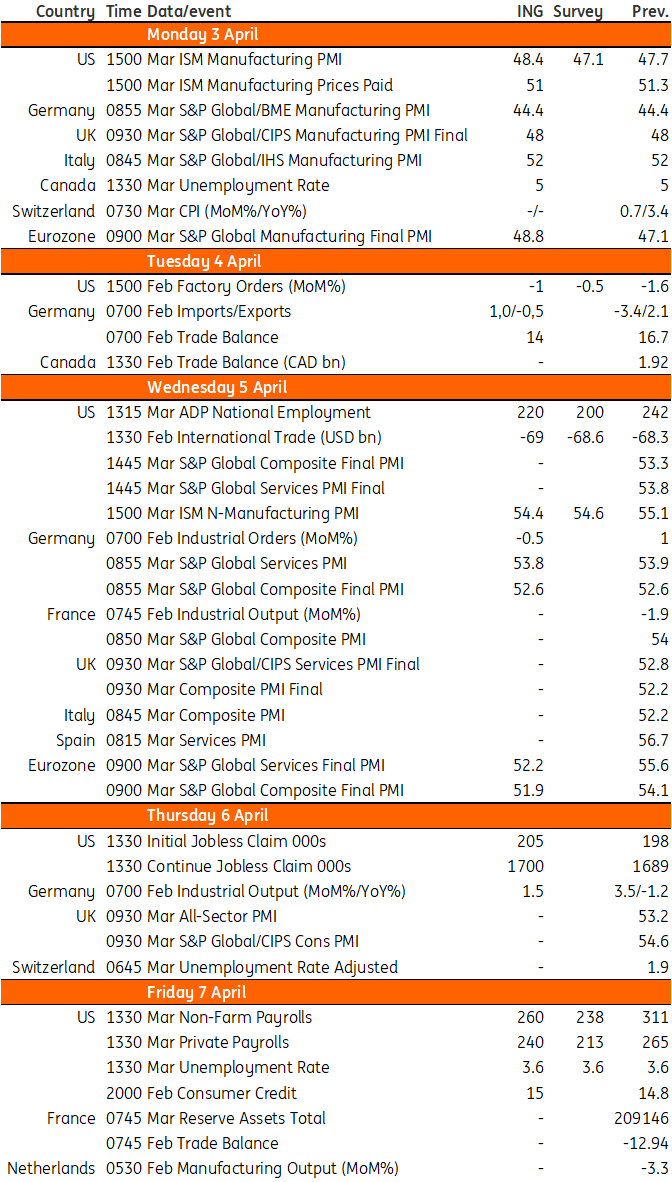

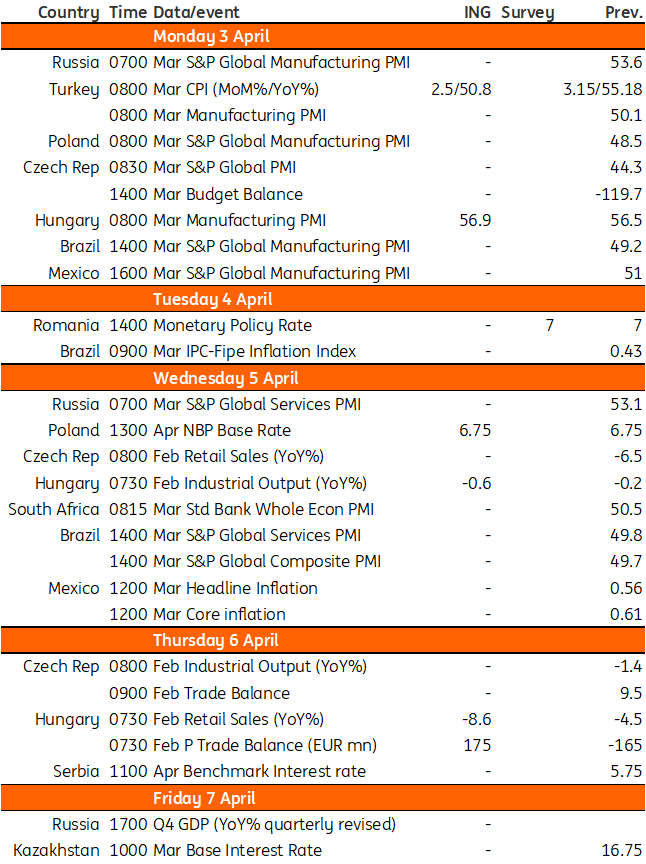

Key events in developed markets and EMEA next week

Next week we will get US jobs figures. We remain nervous about the outlook for jobs, but this will take time to be reflected in payroll numbers. In Hungary, we expect the fall in energy prices to affect the trade balance positively

US: If there's a May hike, it will be the last

Financial markets remain split on whether the Federal Reserve will hike interest rates one last time at the 3 May Federal Open Market Committee meeting. Officials have been non-committal so far, preferring to wait for the data and evidence on how the threat to financial stability from recent banking sector turmoil unfolds.

The key numbers coming up are next Friday’s US jobs figures and the 12 April CPI report. While we remain nervous about the outlook for jobs given the rise in job lay-off announcements and the inevitable tightening of lending conditions resulting from banking stresses that will be a major headwind for struggling businesses, this will take time to be reflected in payroll numbers. Anything over 200,000 in terms of March payroll growth will likely boost expectations for a 25bp rate hike. We will also be watching car sales numbers and the ISM business surveys on the activity side, while comments from individual Fed officials will also be worthy of attention.

We are currently expecting a 25bp rate hike on 3 May, but think this will mark the top for the policy rate. Tighter lending conditions, a deteriorating housing market and pessimism amongst American business leaders were already a concern for us. Banking troubles will only intensify the downside risk for all three of these. With the risk of a hard landing for the economy on the rise, this increases the chances that inflation will fall more quickly and allow the Fed to respond with interest rate cuts before the end of this year.

Poland: No room for monetary easing this year

The Polish Monetary Policy Council is broadly expected to keep rates unchanged on Wednesday (the main policy rate is still at 6.75%). Even though the flash estimate pointed to the decline in annual CPI inflation in March, the momentum remained solid (1.1% month-on-month) and core inflation most likely increased further (12.3% year-on-year vs. 12.0% in February).

On Thursday, National Bank of Poland governor Adam Glapinski will deliver the monthly speech on economic developments in Poland. In the wake of the March CPI figure, the NBP governor's narrative of inflation rapidly falling from the plateau and declining to around 6% at the end of 2023 will be more difficult to defend. The market is pricing-in rate cuts before the end of 2023, but given prospects of sticky core inflation we see no room for monetary easing this year.

Turkey: Risk outlook still on the upside

Cumulative inflation in the first two months of the year reached 10%, showing a continuation of the broad-based deterioration in price dynamics despite currency stability in recent months. Given this backdrop, we expect March inflation to be 2.5% month-on-month, leading to a further decline in the annual figure down to 50.8% from 55.2% a month ago due to the supportive base. Given deeply negative real interest rates, disinflation would be quite challenging, while risks to the outlook are on the upside given the significant deterioration in pricing behaviour, higher trend inflation and still elevated levels of cost-push pressures.

Hungary: February puts an end to a 19-month series of monthly deficits

Next week brings a lot of economic activity data in Hungary. We don’t want to waste too much time on PMI figures, as recently these have been extremely unreliable in forecasting industrial production. This puts us in a difficult position when estimating the February performance of industry. We think that the trend-like slide will continue in production, while seasonality will help somewhat. As a result, we see only a moderate decline on a yearly basis in the Hungarian industry. Despite this weak-ish performance, we believe in the positive effect of falling energy prices affecting the trade balance. Thus we expect a monthly surplus in February, ending a 19-month series of monthly deficits.

The volume of turnover in the retail sector will continue to shrink, in our view, reflecting the major reduction in purchasing power of households due to high-flying inflation. A positive surprise can’t be ruled out based on dropping fuel prices, which might boost fuel consumption yet again.

Romania: on hold at 7.00%

The Romanian National Bank (NBR) will announce its latest policy rate decision on 4 April. We believe the NBR will stay on course and keep the key rate unchanged at 7.00% both on 4 April and for the rest of 2023. However, with the 3-month Robor below the policy rate and apparent upside pressures for the EUR/RON, a mildly hawkish tone could be employed. Given the recent developments in the FX market, we believe that there is a preference for tighter liquidity management. This could lead to a mild reversal in the current downside trend in market rates and a repositioning of the curve up to 1-year closer to the policy rate.

Key events in the developed markets next week

Key events in EMEA next week

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

31 March 2023

Our view on next week’s key events This bundle contains 2 Articles