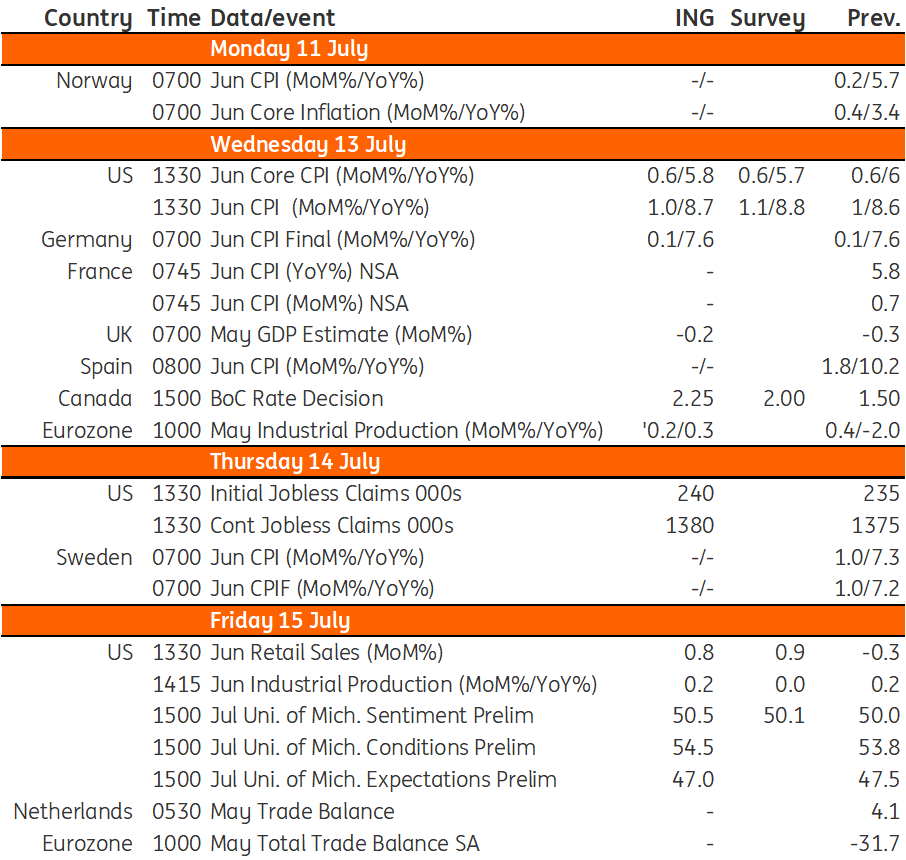

Key events in developed markets and EMEA next week

The resilience of the US economy makes a July rate hike look certain, with the market sensing a strong chance that we get another before the year's end. In the UK, the size of the August rate hike seems to be dependent on wage inflation data

US: July rate hikes looks certain

The resilience of the US economy has seen market interest rate expectations push higher with the yield on the 10Y Treasury bond breaking above 4%. A July rate hike looks certain with the market sensing a strong chance that we get another hike, as suggested by the Federal Reserve, before year-end. The upcoming data flow centres on inflation and here we expect to see some good news with lower energy costs, softening food prices, a topping out in housing rents and falling vehicle prices set to partially offset strength in the core services ex-housing component that the Fed is so fearful of.

A 0.3%MoM reading for headline and core inflation would see the annual rate of headline inflation slowing to 3.1% from 4% and core (ex-food and energy slowing to 5% from 5.3%). While this will do little to alter the likelihood of a July hike, it could at the margin provide a little relief and see longer-dated interest rate expectations tick a little lower.

Pipeline price pressures are set to offer more encouragement that inflation can continue slowing with the PPI report set to show annual increases in producer prices slowing to just 0.4%YoY with the core PPI rate slowing to 2.5%. We will also be closely following the National Federation of Independent Businesses’ pricing intentions survey. A further decline here in company appetite to hike prices would offer encouragement that we will also start to see more of an easing in service sector inflation.

UK: wage data hold the key to size of August rate hike

With a month to go until the Bank of England’s August meeting, next week’s jobs data is one of only two datasets that is likely to have any bearing on its decision – the other being CPI on 19 July.

Policymakers will be watching regular pay growth (average earnings excluding bonuses), which has picked up again lately. The question is whether that’s solely down to firms implementing the 10% increase in the National Living Wage, or a genuine increase in pay pressures. Assuming it’s at least partly the former, then we think we could get a fractional fall in the annual rate of pay growth next week. Assuming we don’t get any unpleasant surprises from the CPI data in a couple of weeks' time, that would probably allow the Bank of England to pivot back to a 25bp rate hike in August. We expect a further hike in September, but come November, we are hopeful there should be sufficient improvement in the inflation story to merit a pause.

We’ll also get monthly GDP figures next week, but these will be heavily distorted by the extra bank holiday surrounding the King’s Coronation in May, so are unlikely to be of much relevance for the BoE. And even without the distortions, it's clear the Bank is firmly focused on inflation rather than growth right now.

Canada: central bank policy meeting

In Canada, the highlight will be the Bank of Canada (BoC) policy meeting. It hiked interest rates 25bp last month having left them untouched since the last hike in January. We don’t see last month’s move as a one-off. To restart the hiking process means that the BoC feels it has unfinished business, and with the jobs market looking tight and inflation running above target we expect the BoC to hike by a further 25bp.

Czech Republic: Inflation to fall below 10% for the first time since January last year

We expect prices to have risen at a similar pace in June as in May by 0.2% MoM. This should translate into a drop from 11.1% to 9.6% YoY, returning to single-digit territory for the first time since last January. We expect stable food prices and modest growth in fuel prices after the massive drop in the previous month. We should also see small increases in housing (0.2%) and the rest of the consumer basket with no significant driver this time around.

Hungary: June monthly budget to accumulate a wider deficit

Next week will be rather quiet in Hungary except for Monday. We are going to see the preliminary trade balance data in May. Though export activity has shown some volatility recently, the continued contraction of domestic demand and the demand destruction in energy will help in scaling back import activity. As a result, we see yet another widening of the trade surplus. After a strong May, we see the June monthly budget balance accumulating a wider deficit mainly on the weaker stream of indirect revenues.

Key events in developed markets next week

Key events in EMEA next week

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

EMEADownload

Download article

7 July 2023

Our view on next week’s key events This bundle contains 2 Articles