Key events in developed markets

A much busier week for developed markets. We look for signs of recovery in the US jobs report, hard German data to evaluate true signs of economic recovery and whether Riksbank will maintain its typically dovish stance

US jobs report to recover from a July slump

With the summer vacation period at an end, markets will be gearing up for a big week of data and news releases.

In the US, the highlight will be the August jobs report. Both payrolls and wages disappointed in July so we’ll be looking to see if we get a decent recovery, given tthe pace of economic expansion stays strong. We suspect that we will since other labour data releases have suggested the jobs market remains robust - something around the 200,000 mark is our call for the net change in payrolls. Given the tightness in the jobs market, we expect wages to rise 0.3% MoM, which should nudge the annual rate of wage growth up to 2.8%.

We will also get the ISM manufacturing index, which should hold at strong levels, while the non-manufacturing equivalent should rebound after a big fall in July that didn’t tally with evidence from other economic surveys. The report that is most likely to disappoint is the trade balance number. We have already had the advanced estimate for goods, and this deteriorated markedly. However, this is in the context of a very decent run this year, which is at least in part due to producers who have been trying to accelerate exports to avoid the imposition of scheduled tariff increases - soybeans have attracted a lot of headlines in this regard.

‘No deal’ risks likely to test UK growth momentum over coming months

Talk of a ‘no deal’ Brexit has been ratcheting up as the UK government begins releasing details of its contingency plans. While we still think it’s more likely a deal will be agreed, this may not come until much closer to Christmas, which means the critical Parliamentary vote on the agreement is unlikely to happen until January. Until then, uncertainty is only likely to increase, and sentiment could begin to take a hit.

Admittedly it may be too early to see much evidence of this in the PMIs next week – we may even see a slight recovery in the service-sector index. But as we approach the end of the year, momentum could begin to slow. For this reason, we don’t expect the Bank of England to hike again before May 2019 at the earliest.

Hard economic data is to be the true test of Germany's recovery

After strong confidence indicators this week, hard economic data next week will be the first test case for the robustness of the German recovery. We expect some improvements in July, providing a good start for the economy going into the third quarter.

Another delay in rate hikes expected from Riksbank

Two major events in Sweden will set the tone next week.

With the krona selling off heavily, the Riksbank’s policy announcement on Thursday looks increasingly pivotal. With core inflation still weak, we expect the dovish majority on the Riksbank monetary Policy committee will remain cautious and will likely signal (yet another) delay to interest rate hikes.

At the same time, the Swedish election campaign enters the final stretch ahead of the Sunday vote. The outlook is as unclear as ever: strong support for the far-right Sweden Democrats mean a hung parliament and potentially lengthy negotiations lie ahead.

Expectations on Eurozone retail trade at a fork in the road

A quiet week in the Eurozone, but watch the retail trade data. A first hard data point for July that will give insight into spending over the summer months. While confidence has been wading, wage growth has been encouraging recently.

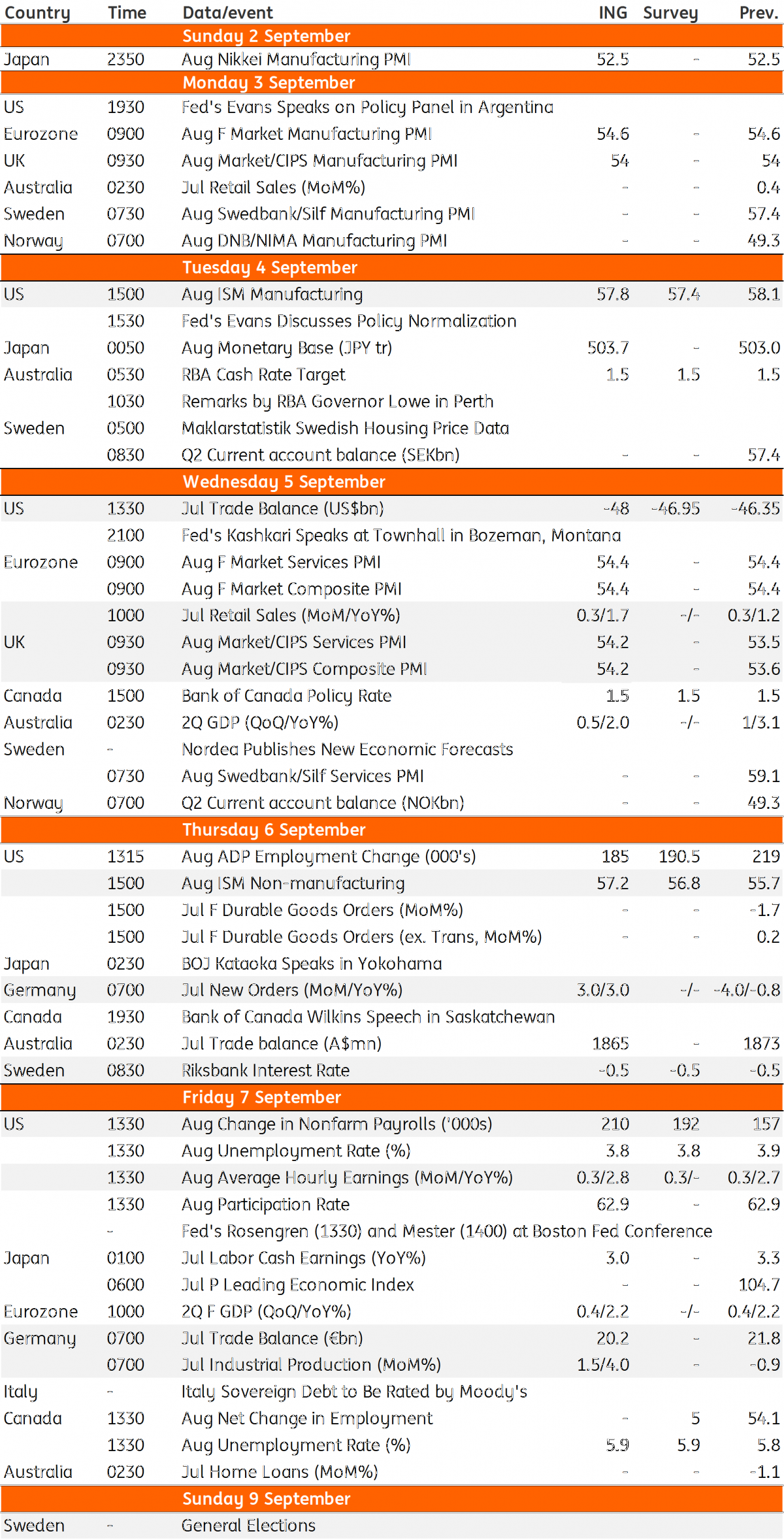

Developed Markets Economic Calendar

Download

Download article

31 August 2018

Our view on next week’s key events This bundle contains 3 ArticlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more