Key events in developed markets

Prepare to have your hands full next week with yet more Brexit stories, plenty of eurozone data, the US jobs report on top of both Canadian and US central bank meetings - we expect the Fed to keep on cutting

US: Keep on cutting

After last week’s momentous Brexit vote and the ECB’s farewell to Mario Draghi attention switches to the US with a slew of key data releases that will likely culminate in the Federal Reserve cutting interest rates for a third consecutive FOMC meeting. The Federal Reserve has been keen to characterise the two rate cuts in July and September as “insurance” against external threats posed to the US economy (trade & weak global growth) rather than the start of a significant easing cycle. However, the deceleration in domestic demand, weaker wage pressures and declining inflation expectations suggests that economic weakness is spreading and that more action may be needed in the coming months.

The data flow is likely to show 3Q GDP coming in sub-2% with payrolls growth continuing to slow given economic uncertainty with the manufacturing sector still in recession. However, on the all-important payrolls number, it's worth noting that this may be artificially depressed by a General Motors strike that reportedly involved roughly 50,000 workers. Once that's stripped out, the true jobs growth figure would be a little better.

For now, economists are mixed on next Wednesday’s FOMC meeting outcome, but with the market currently pricing in 23bp of a 25bp rate cut, we believe the Fed will take action. Assuming the economy continues to soften in line with our view, then the Fed will likely follow up with additional rate cuts in December and January.

UK lawmakers set to decide on December election

Faced with the reality that October 31 is no longer an achievable Brexit deadline, the UK government will table a motion on Monday asking Parliament to authorise an election on December 12th. But as things stand, MPs are likely to reject it.

This gives the EU a tricky decision when it comes to an Article 50 extension. Brussels will almost certainly grant a further delay, but Parliament’s indecision adds complexity over the length.

What the government will do next is also very unpredictable. But with an election still inevitable (it’s a question of when), we suspect the government may be minded to press ahead with its withdrawal agreement bill to try and ensure the UK leaves the EU before voters go to the polls – perhaps in an early 2020 election.

Eurozone: Data packed week for Lagarde's debut

Christine Lagarde’s first week in the corner office at the ECB will give plenty of insight into the current state of the Eurozone economy straight away. GDP data for Q3 will be released and the question is whether growth continued at its Q2 pace of 0.2% or whether it has slowed even further to 0.1%. Furthermore, October inflation data will show whether inflation has bounced back from a low level of 0.8%. Sentiment for October and unemployment for August will conclude a big data week that will be nervously studied in Frankfurt as recession concerns grow louder.

Bank of Canada meeting: Don't expect any big moves

The Bank of Canada will also be setting interest rates, but the recent election outcome is unlikely to be a trigger for a move. The economic data is softening here too, but not by as much as in the US. Moreover, the Bank of Canada did not hike interest rates as aggressively as the Federal Reserve, and there is general consensus that policy remains somewhat accommodative. Nonetheless, we don’t think the BoC will be able to hold out forever and still feel the next move from them will be a 25bp rate cut.

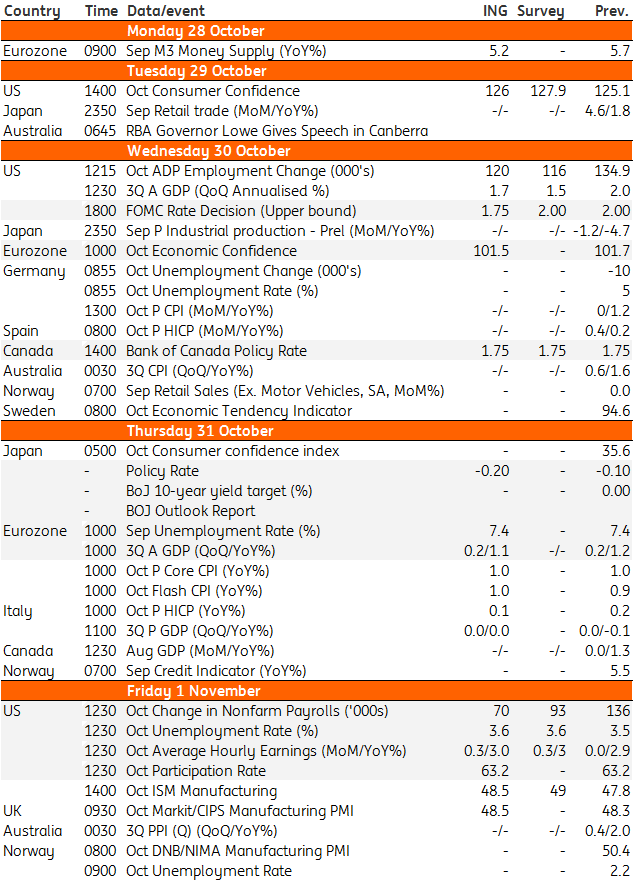

Developed Markets Economic Calendar

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more