Japan: Tankan survey - not bad!

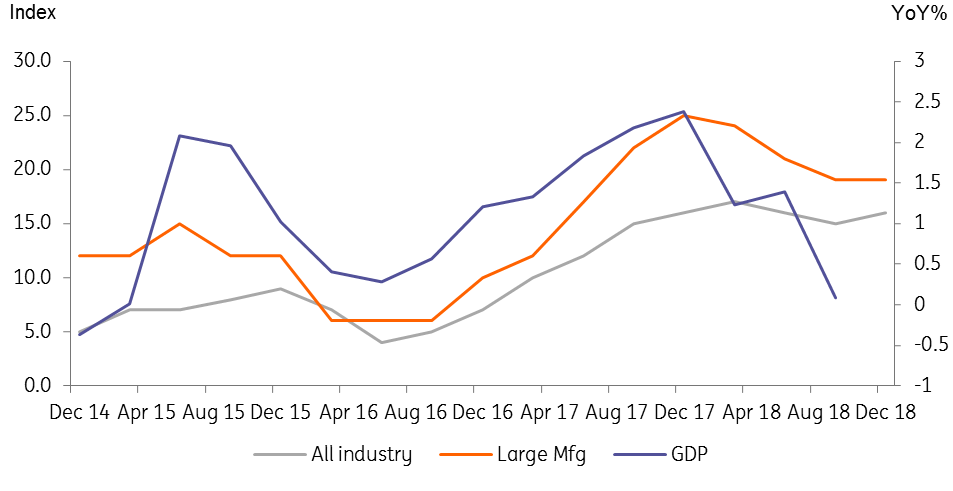

Floods and Typhoons hit 3QGDP hard, but the latest Tankan survey shows that Japan's underlying economy remains in decent shape.

Headline large manufacturing index steady at 19

Most of the knee-jerk response to any Tankan release is the large manufacturing firm index. Although manufacturing accounts for only 21% of total Japanese GDP, and large firms probably only about 50% of that, the link between the manufacturing cycle and overall economic business cycle in Japan is tighter than in many more service driven economies (the US, or the UK for example).

The 4Q18 Tankan shows the rate of activity remaining strong, in contrast to the very weak 3Q GDP results, with the index steady at 19. This, in our view, is a better indication of the underlying strength of the Japanese economy than the prior GDP figures.

The same message played out in other parts of the survey, where overall index levels remain consistent with ongoing, and in some cases, slightly improved growth from 3Q18. As such, we feel that there is a good chance that the 4Q18 GDP figures, when released next year, will show a strong bounceback from the apparent weakness of the preceding quarter, leaving overall GDP growth only a little shy of 2.0% - a very creditable performance for Japan.

| 19 |

Headline Tankan indexLarge Manufacturing firms |

| Better than expected | |

There's more to a Tankan survey than manufacturing

Many people don't get past the Tankan's headline large manufacturing index, but the beauty of this survey is the depth of other material buried in its guts.

Profits data is a good place to start. The profits figures for 2017 were very strong as Japan and the rest of Asia picked up from 2016 weakness. Profits and net income figures for 2018 look far less impressive, which gives us some concern looking ahead to 2019.

Notwithstanding that, figures for fixed investment, R&D and software investment look robust, though land purchases not so much. Survey data on the financial conditions of firms remains solid, and firms continue to report insufficient employment (tight labour markets) which will hopefully keep wages growth supported into 2019, underpinning consumer spending growth.

Tankan survey and Japanese GDP growth

Outlook for the BoJ - nothing imminent

We continue to expect the Bank of Japan (BoJ) to reduce its purchases of government bonds and other assets. Though their attempts to pursue a taper by stealth have been somewhat undermined by the very boring nature of the ECB's own taper, which provides less cover for any overt move in Japanese monetary policy. Japanese Government Bond yields are currently only 0.05-0.06%, so show little sign the BoJ is changing its JGB yield target . Governor Kuroda has hinted that this will be the clue that policy is changing. So until and unless JGB yields push above 0.1%, it will remain a case of "Nothing to see here" for forthcoming BoJ meetings.

Download

Download article

13 December 2018

Good MornING Asia - 14 December, 2018 This bundle contains 2 Articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).