Japan: Talking down the economy

Japan’s economy was severely hit by the weather, with a partial recovery now being seen. However, inflation continues to undershoot expectations, while Bank of Japan rhetoric is keeping a lid on bond yields, although the real target may be to moderate yen appreciation

Last month, we entertained the view that Japan’s economic weakness in 3Q18 GDP was largely weather-related, owing to the impact of September’s Typhoon Jebi, and that the fourth quarter of 2018 would see a strong bounce back that could carry over into 2019.

Directionally at least, the run of news seems to be validating this idea, and the 4Q18 Tankan survey released by the Bank of Japan at the end of 2018 shows manufacturing and non-manufacturing activity diverging positively from the earlier GDP figures. This data suggest that the phase of restoration, recovery, and replacement is already well underway and that should provide a couple of quarters of strongly supported growth – absent further natural disasters.

Japan: GDP and Tankan survey

An Orwellian version of forward-guidance

However, this has not provided much comfort to the Bank of Japan. At their last policy meeting of 2018, they put more emphasis on the downside risks to growth and the economy and seemed to be backing further away from the hints at a policy taper they had made earlier in the year.

The central bank is still clinging on to the claim that their 2% inflation target is achievable

In what seems to be a sort of Orwellian version of forward-guidance, where thoughts of any taper are being dispelled, the central bank is still clinging on to the claim that their 2% inflation target is achievable, and not too far off – claims that are unsupported by reality. They perhaps believe that admitting a 2% inflation rate is no longer a viable objective could set in train a much weaker set of inflation expectations that could deliver a self-fulfilling downward spiral towards deflation.

Breakeven inflation rates in Japan are already at barely 0.2% on a 5–10-year basis and have been falling since January last year, though their descent has picked up pace recently. That probably has more to do with the sharp decline in conventional bond yields than any genuine worry about the outlook for inflation, though there are no reliable survey-based inflation expectation measures to compare this with.

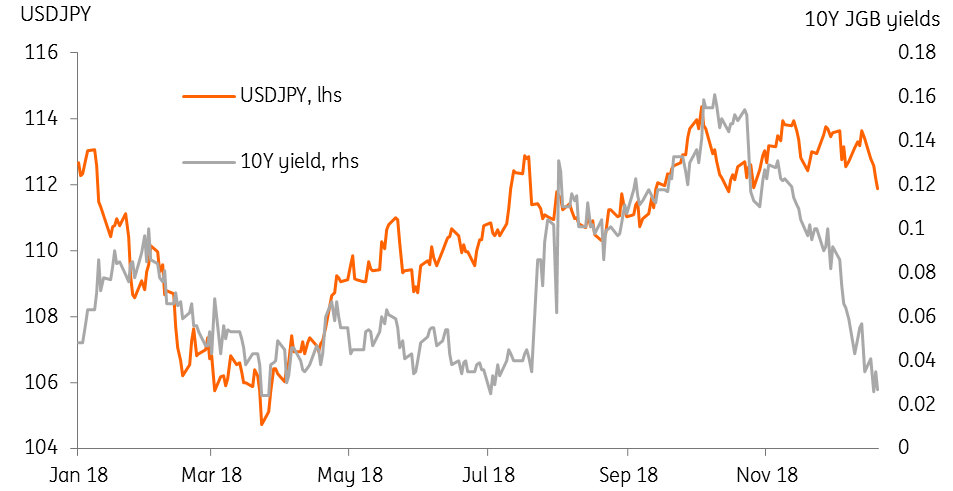

USD/JPY and 10-year Japanese bond yields

We think, the decline in bond yields is a response to BoJ rhetoric and actively managed by them, although the principal target, we suspect, is not bond yields themselves, which at their recent peak, were only about 0.2% for the 10-year government bond (10Y JGB).

Instead, we suspect that yen strength is the bigger motivator. With scepticism rising about the continued resilience of the USD, the EUR story looking less supported by fundamentals, CNY under downward pressure and GBP at the mercy of Brexit fears, the JPY stands out in this “flower show” as the only display not covered in aphids.

Ultimately, this is not a game the BoJ can win, but we suspect they will be content if their actions manage to limit and control the scale and speed of any further appreciation of the currency.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

4 January 2019

January Economic Update: Overdoing the gloom This bundle contains 8 Articles