Japan: Smoothly does it

So far, Japan’s consumption tax hike seems to have gone down far more smoothly than its previous equivalents in terms of both GDP growth and inflation. Though the coming months could still see some fallout even if the front-loading was smothered by inventory fluctuations

3Q19 GDP rises only 0.1% QoQ

Japan is now in the midst of an adjustment phase following on from its consumption tax hike from 8% to 10% in October. So far, this has gone far more smoothly than the previous episodes of this tax hike. The 3Q19 GDP result was only 0.1% QoQ, or 0.2% annualised, down from the previous quarter despite front-loading of consumer spending in September on some items affected by the hike.

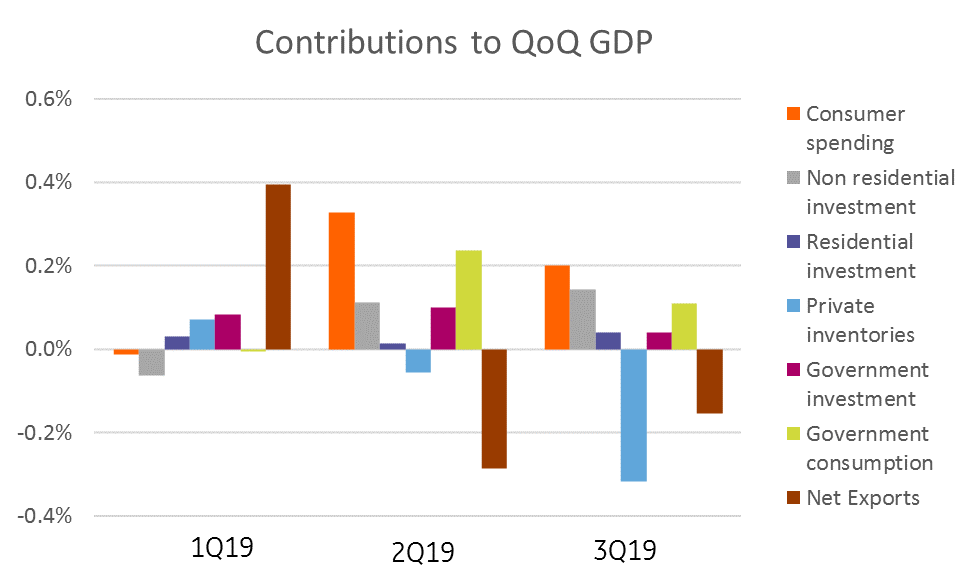

The GDP figures were also negatively affected by a big drawdown in inventories. The QoQ contribution of private inventories was -0.3%. That was enough to totally offset the growth in private consumption. Net exports stripped a further 0.2pp from the total, with the result that the front loading of residential and non-residential investment, which in any case was fairly subdued, was totally offset.

| 0.1% QoQ |

3Q19 GDP0.3% saar |

| Lower than expected | |

Contributions to QoQ GDP growth

Front-loading buried, but a big drop still probable

But if the front-loading was denatured, does that mean that 4Q19 figures will escape the big drop that usually follows the front loading? In our view, probably not.

For one thing, it seems a stretch to rebuild inventories against a known background of likely weak 4Q19 demand. Sure, if it were involuntary, then it could happen, but it is not as if a weak quarter of demand in 4Q19 is likely to be a surprise. More probable, inventories will be roughly unchanged rather than fall sharply as they did in 3Q19. Their contribution might rise to something closer to zero, so it gives 4Q19 GDP a better starting point. But that is likely to be offset by falling household consumption and falling investment.

Retail sales for October fell by 17.4%YoY, having risen by 11.0%YoY in September. Compared to 2014, this means that sales rose slightly less just ahead of the tax hike, and have also fallen slightly less too immediately afterwards. So perhaps the 4Q19 collapse will not be as abrupt.

The other hope is for a bigger decline in imports and recovery in exports. That is not impossible. Though exports are still likely to struggle against a weak global demand backdrop, some softer imports may at least soften the blow of weak domestic demand.

The JPY 13 trillion support package arrives

Looking beyond the immediate period of economic disruption, prime minister Shinzo Abe launched a fiscal package of JPY13.2tr ($121bn). That is about two to three per cent of GDP, though we expect the effective element of this will be far smaller in terms of 2020 GDP as it is to be spent over 15 months, and will likely contain some spending already accounted for, or include soft loans, not real spending.

The spending could help Japan get over another hump – namely the end of construction investment following the conclusion of next year’s Olympic Games. Exactly what the package will entail is not yet public knowledge, but it will likely contain a number of natural disaster protection elements, (flood defences etc) as well as infrastructure.

Typically, it is not a good idea to bump up GDP forecasts in response to stimulus packages such as this, though they also tend to provide very lumpy support and it may well be that 2020 is every bit as bumpy as we thought 2019 would be.

Japanese inflation dampened by education

Inflation unchanged - or is it?

The other big change to our forecasts for 2020 is in terms of inflation.

Our previous forecast treated the consumption tax in the same was as previous hikes, which led to a 12-month price spike and raised inflation that then dissipated. This time, there has been no such price spike – well there has – but it has been almost totally offset by the impact of pre-school childcare, which has been made free. So in October, alongside a rise in clothing and footwear costs of 1.6% (on top of 4.1% the previous month), a 0.9%MoM medical care spike, 2.2%MoM entertainment increase and 1.1% increase in transport and communication costs, education prices fell 8.4%.

The other big change to our forecasts for 2020 is in terms of inflation

From the previous month, national CPI inflation remained unchanged in October. And we have had to drop our inflation profile for next year substantially to reflect this offsetting price reduction. Saying that there was no change in Japan's price level in October is a bit of a simplification though. Considering how few people in Japan have children of pre-school age, for most households, prices have risen quite a lot without any offsetting declines.

In other words, the lack of movement in Japan’s price level is a statistical simplification for the majority of households.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

5 December 2019

Good MornING Asia - 6 December 2019 This bundle contains 6 Articles