Japan: Policy confusion

Japan’s Central Bank (BoJ) dropped any reference to meeting its inflation targets in 2019 in its April statement. Since then, pundits have been trying to figure out what is coming next. The next monthly policy meeting on July 31, for so long a complete non-event, is now moving markets. Read further to see what we think.

Is there more than meets the eye to the BoJ’s inflation target tweak?

That earlier statement change has prompted some to suggest that the BoJ was going to downgrade its inflation forecast and adopt a lower target – perhaps at the forthcoming 31 July meeting.

We strongly doubt it. But there are good arguments for doing so.

- The likelihood of Japan ever reaching its 2.0% inflation target without either a massive devaluation of the yen, surge in consumption tax, or ballooning of oil or other energy or food prices is vanishingly small.

- Who said 2% was a sensible number anyway? For an economy with a potential real GDP growth rate of only about 1.0%, inflation is likely to be similarly muted – perhaps 1% would be a better target to aim for, and one that the BoJ might actually hit from time to time?

- There appears to be very little room for expanding the policy to make up the inflation shortfall - more leeway could be engineered by reducing the target to, or even below the current rate.

Probably not – it just was not a very flexible policy stance in the first place.

For all that it may tinker with other aspects of its policy, the BoJ, in our view, does not, seem to have any intention of changing its inflation target, and any changes may amount to no more than tweaking their ETF buying. Indeed, in a supplementary paper last July, examining reasons for failing to achieve their inflation target, the authors put most of the blame for failure to hit 2% on external factors, such as the decline in oil prices. Not their fault then!

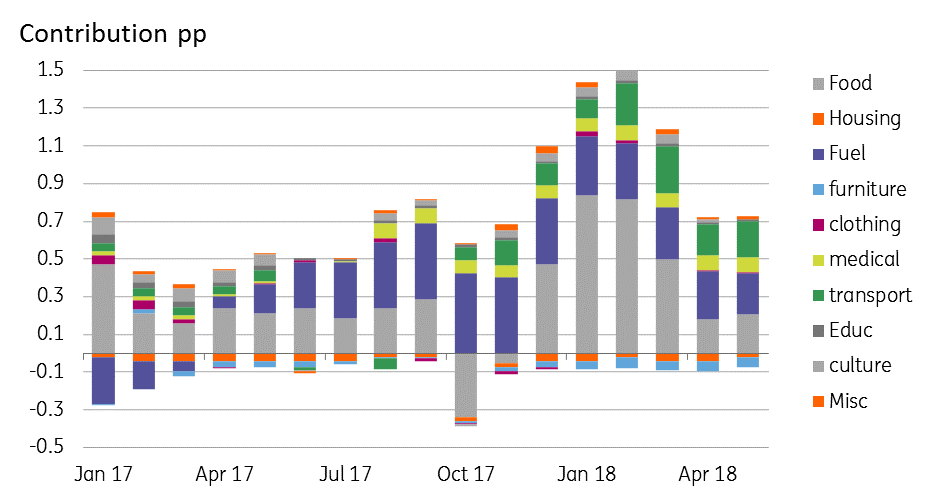

Since then, oil prices have risen by not far short of 100%, and Japanese inflation is only about 0.3pp higher than it was then.

Contributions to Japan's CPI inflation (pp)

The 2% target will probably not be consistently achieved - ever

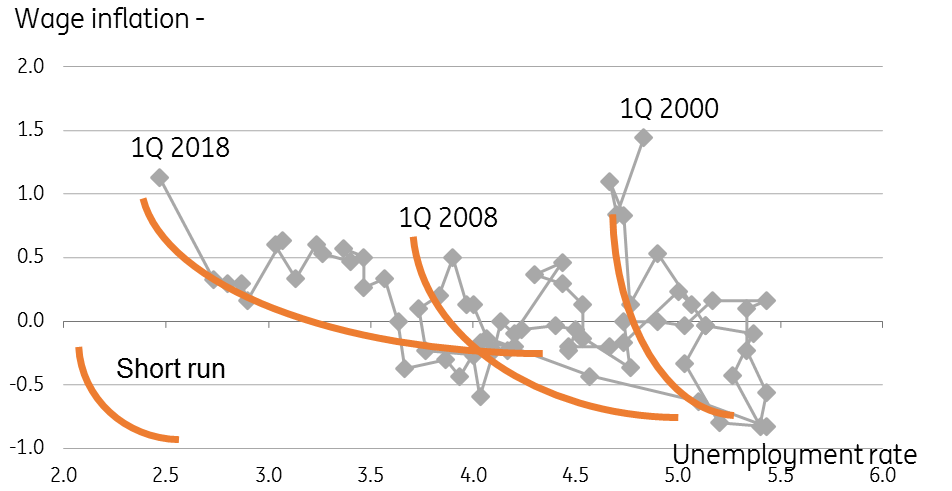

Why will the BoJ never reach its target? This author believes that across the world, the relationship between economic activity and price changes has altered, perhaps for good. There are many underlying reasons for this. Some of them local (changes in labour market structure) some global (globalisation and the increasing consumption of virtual goods). Whatever the causes, a shift in relationships also implies a shift in the inflation rate trade-off with unemployment – in this case, to much lower rates for both.

A better explanation for the BoJ’s abandonment of the mid-2019 calendar date for reaching its inflation target, is that date dependent policies are fine when the date is a long way away. But when it gets closer, if it does not look as if the target will be hit, your options are

- to shift the target further out (and keep doing that as long as it takes with the ensuing loss of credibility, or

- to get rid of the date entirely but keep the target (this is what the BoJ is doing now), or

- scrap both date and target, and do something else (this could, in our view, deliver a more consistent policy mix for Japan, but seems off the agenda for now).

But that is not a failure by the BoJ, just a poor choice of target

By losing the date element of the target, markets should not anticipate additional easing each time the BoJ has to push the date of normalization back, as might previously have been the case. This is probably the best excuse for cutting the date out of the target (something the ECB might want to consider given its recent hints at an end to QE after Summer 2019.

Does tweaking the BoJ’s target have any other implications, for example, next year’s touted consumption tax hike? In our view no. The tax hike can still go ahead. Japan’s labour market is still really tight. And the downside miss on inflation does not mean that the economy is not robust enough to tolerate some fiscal tightening. However, depending on how the unfurling trade war is affecting Asian regional growth, there could be other reasons for abandoning this policy by then

Japan's Philip's curve

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

26 July 2018

Good MornING Asia - 27 July 2018 This bundle contains 3 Articles