Japan GDP slowdown

This is just noise. The underlying drivers of growth are good.

| 0.1% QoQ |

4Q17 GDP growth - Japan0.2% expected |

| Worse than expected | |

4Q17 GDP slows - breaking run of good data

Japanese GDP grew 0.1%QoQ in the last quarter of the year, which translates into a 0.5% annualized growth rate. Bang goes Japan's streak of 8 consecutive quarters of growth of 1.0% or more (allowing for one near miss in 3Q16). And along with breaking the uninterrupted growth spell, it turns out that history was not quite so good as the data had led us to believe, with some of Japan's outsize growth quarters being trimmed back quite heavily.

Japan finishes 2017 with growth of 1.6%. By Japan's standards, this is really very good. And we think 2018 could be even better. But before looking at this year, let's briefly consider why 2017 ended with a whimper, rather than a bang.

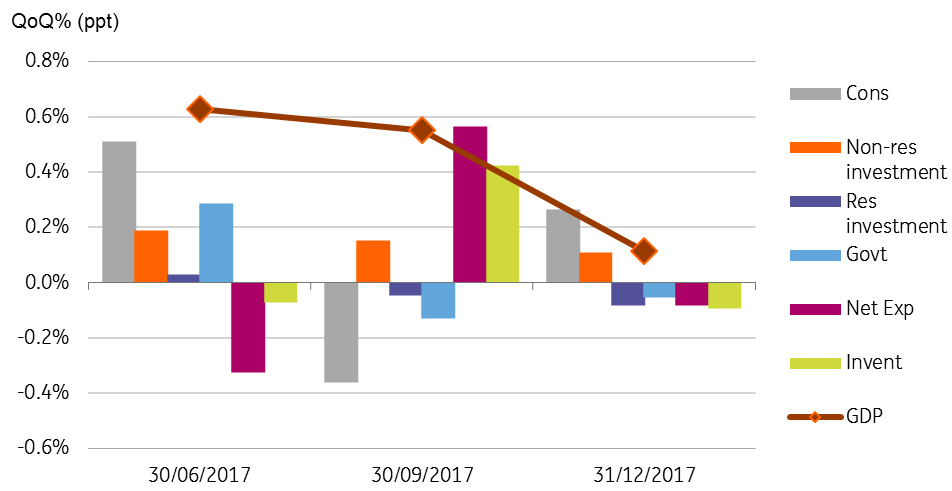

Contribution to QoQ GDP growth (%)

A lot of small things, few of which are likely to be repeated

There was no one big culprit for the 4Q17 weakness. Rather, a number of volatile factors conspired to dip at about the same time, offsetting some of the more promising trend developments. Drags to growth individually were small, but include residential investment (-0.1%QoQ), government spending (-0.1%), net exports (-0.1%) and inventories (-0.1%). Non-residential investment could have been stronger than the 0.1% recorded (but is usually end-of-year loaded) and there was an encouraging upturn in consumer spending, even before the spring wage round has had time to kick in.

2018 looks good

Our main source of optimism for growth stems from strong and sustainable corporate profit growth. Although concentrated in the manufacturing sector, we believe this will trickle through to the rest of the economy, supporting investment, employment, wages growth and consumer spending. This profit growth owes little if anything to low interest rates or the QQE policy. Instead, sales growth and operating profits are the principal drivers.

This is no excuse for the BoJ to keep on with the same policies

Although the latest growth numbers suggest that the BoJ will maintain its current policies of negative interest rates, zero bond yields and asset purchases, the practicalities of keeping on buying assets that are becoming less available, as well as the realities of the underlying growth story, means that in all likelihood, they will look for ways to extricate themselves from this tricky policy dilemma. We suspect a policy of covert tapering, followed sometime later by officializing such moves, and done under the cover of ECB tapering later this year, will be the likely outcome. Even so, the JPY is likely to appreciate sharply in that environment.

"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).