Japan: Slow start

It is becoming quite “the thing” to start the year weakly… but with Japan there is genuine room for optimism

It is becoming quite “the thing” to start the year weakly. The US does it almost every year. Europe also seems to have recorded a soft patch in 2018. Japan, too, seems to have started the year in a less than convincing fashion. Consensus opinion has Japan growing at only 0.5% quarter-on-quarter in 1Q18. It is easy to blame bad weather for economic weakness, only for it to turn out that the economy was genuinely weak all along. But in Japan’s case, we think there is genuine room for optimism.

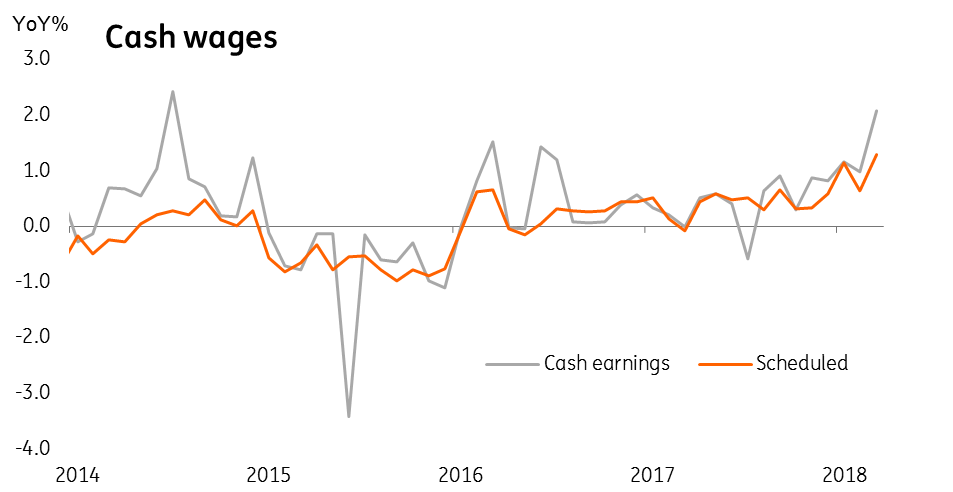

Wages are rising at the fastest rate since 2014

A recurring theme in these monthly notes has been Prime Minister Shinzo Abe’s attempts to get Japanese firms to pay higher wages, especially regular wages (not bonuses) to spur consumer spending. March cash wages rose 2.1% year-on-year. This might not sound like a lot, but wages haven’t risen this fast since 2014. Real wage earnings in March were also 0.8% higher than a year ago.

Corporate profitability is picking up too

Now, these income numbers may look like a single month’s aberration, and indeed, it is far too early to get excited. But the wage figures also tally with one of the other fundamental indicators we have been tracking – namely corporate profitability. This, especially in the manufacturing sector, has been growing strongly for some time, and it now tentatively looks as if some of this gain is being passed on to Japan’s workforce.

If this wage growth begins to show up in stronger consumer spending growth (not yet all that evident), then there really will be a convincing story of a profit-led, earnings supported, consumer spending upturn taking root.

Inflation still unlikely to reach the BoJ's target, but no need to worry

All that would be missing then as far as the Bank of Japan (BoJ) is concerned would be some inflation. Unfortunately, we don’t believe that this is likely to ensue to the degree needed to reach the BoJ’s 2.0% target. That doesn’t mean the economy remains too weak, rather than the 2% target was always unrealistic and unachievable.

As for the BoJ, we continue to believe that they are ready and willing to consider ratcheting down their asset purchase programme. But we think that they would prefer to do so under the cover of some tapering by the ECB. The recent softness of Eurozone data suggests that this is not going to happen as early as we previously thought, though this is more of a delay than a change of forecast.

Domestic politics means the Japanese economy is not in the clear, yet

But what might alter our outlook for Japan and the BoJ is the political backdrop. PM Abe’s hold on the top political job in Japan has been heavily challenged by cronyism scandals around preferential treatment for new schools. Were Abe to be forced to step down, the strongest of the three prongs of Abenomics would likely fade, and that would likely need the BoJ to pick up the slack – with the JPY a likely victim of such additional monetary policy easing.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

11 May 2018

Good MornING Asia - 14 May 2018 This bundle contains 5 Articles