Japan: The third arrow

The Japanese economy is experiencing a strong period, with the most convincing reason being the reduced efforts from the Bank of Japan to maintain low bond yields. That said, risks regarding a US-Japan tariff war still prevail

Perhaps the most convincing confirmation that the Japanese economy is enjoying a strong spell is the continued reduction of effort put into maintaining low bond yields by the Bank of Japan.

Asset purchases to be lowered and bond yields are rising

In September, a shortage of working days reduced the numbers of days per month during which the central bank conducted outright asset purchases from ten to nine. The latest schedule for October (with more working days) shows still only nine monthly operations. Moreover, purchases of 25-year and Japanese government bonds are reduced from JPY 50-JPY 150 billion per operation, to only JPY 10-JPY 100 billion.

Yields on 30-year JGBs have risen from about 0.65% back in July to over 0.91% now, and may well drift higher. 10-year JGBs over the same period have seen yields rise too, though less than half as much from 0.02% to 0.12%.

But the progression of the central bank taper is just one part of the bond yield story; there is more.

Inflation is higher than usual and should move higher still

Inflation in Japan is now running at 1.3% year on year – the last time it was this strong, Japanese prices were being lifted by a consumption tax hike (2014-2015). That isn’t the case this time around. Instead, Japan’s prices are buoyed by food and energy – factors that have little to do with domestic economic strength – and core inflation remains pitifully low otherwise.

Given that these external factors and base effects may become even more intense over the coming months, so a 1.5%YoY headline inflation rate is definitely on the cards and that is even before the government implements the next increase in the consumption tax in October next year.

Political news supports the consumption tax

While the fate of the October 2019 consumption tax increasingly lies in the hands of data developments over the coming year, to some extent, the political news is nonetheless supportive. Prime Minister Shinzo Abe managed to secure a third term as leader of the Liberal Democratic Party, which has ruled Japan with only two brief interruptions since 1955.

If prime minister Shinzo Abe serves for another three years, he will become Japan’s longest-serving leader

Although constitutional reform is one of the key elements of Abe’s policy manifesto, raising the consumption tax is also a key element. Here, things are also looking up, as Japan’s real economy is humming along nicely. We have written before about the positive effect of higher wage growth and the bulk of this still represents overtime, and not scheduled cash earnings. Nevertheless, back in June, hourly earnings growth for full-time Japanese employees exceeded that for US workers (but have since been overtaken).

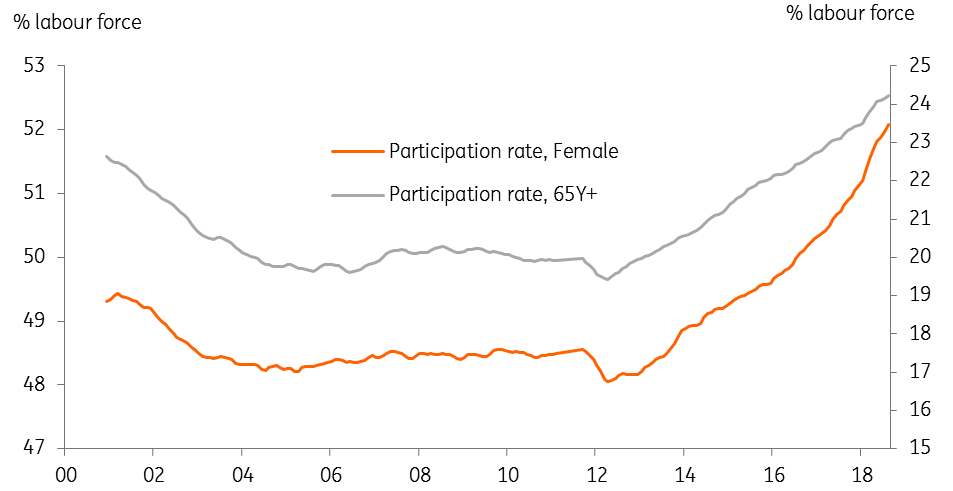

Japan's participation rate rising

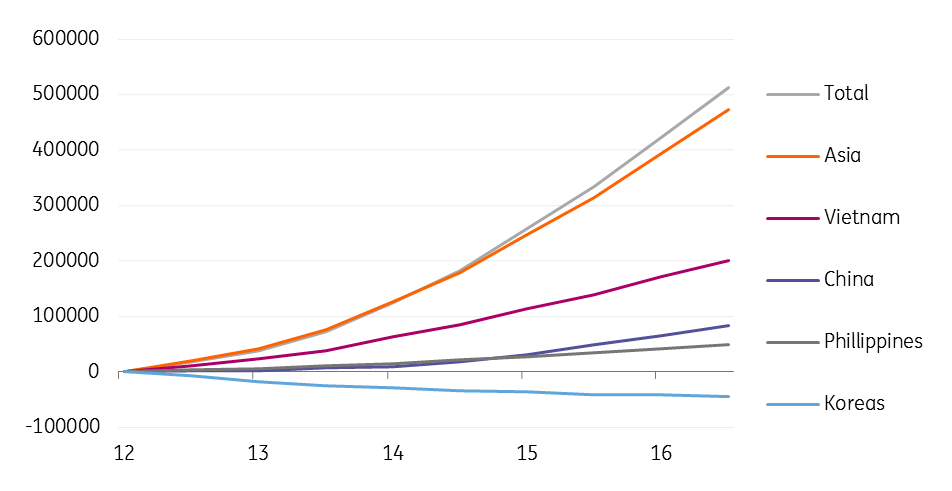

Low unemployment is an important factor too, Sure, the unemployment rate in Japan has been very low for years. But it is falling now against the backdrop of a rising participation rate – a combination of the already elderly and greater female participation, together with a little bit of immigration. This is an encouraging development and the product of what has until now been the elusive element of Abe’s three-arrow policy – structural reforms.

Cumulative immigration, 2012 = 0 (Abe becomes PM in 2012)

The main risk is trade, and a US - Japan tariff war

Will it last? It’s hard to say. Recent Tankan survey evidence already points to an impact on the manufacturing sector from the overspill of the trade war, and that is before the US has really put Japan in its sights for tariffs. We suspect this is only a matter of time. Japan’s bilateral surplus with the US was USD 60bn in the twelve months ending August 2018. The only thing that makes this less of an issue is that it has barely grown since 2012, and indeed, is lower than some years pre-global financial crisis.

But in due course, that may not be sufficient defence against the threat of tariffs from the US.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

5 October 2018

Global Economic Update: Looking for a silver lining This bundle contains 8 Articles