It’s all about capacity in the truck market

Supply frictions, including new disruptions from the war in Ukraine, have turned the European truck market upside down. Lead times are exceptionally long, and truck registrations are expected to slide again in 2022. With orderbooks reaching far into next year, we expect a delayed recovery in 2023 despite mounting headwinds

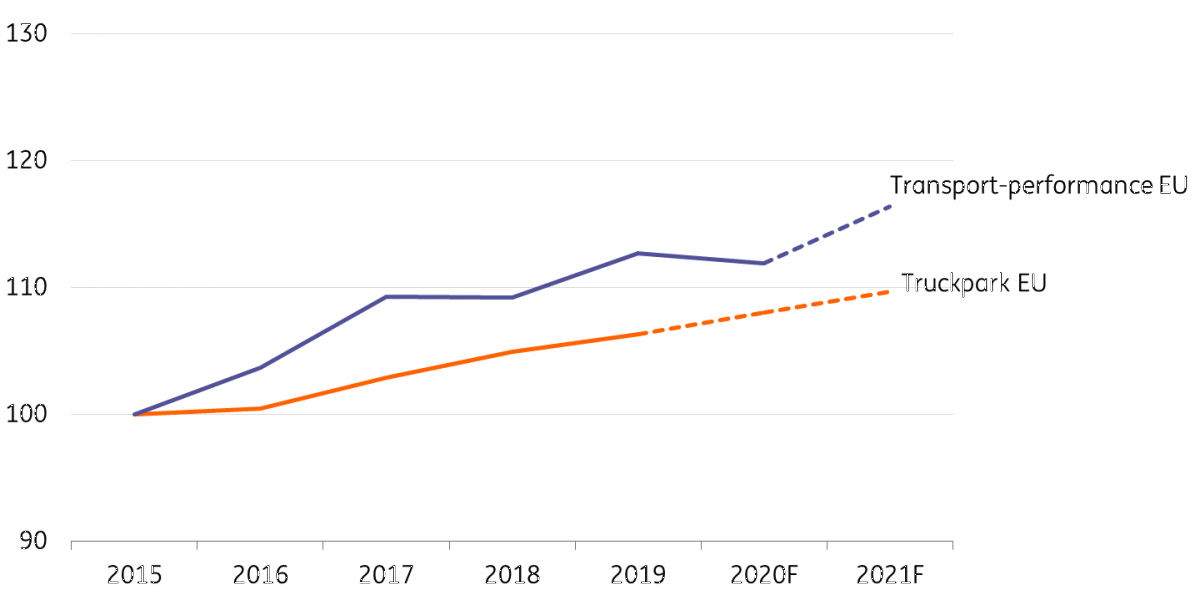

European truck fleet lags transport volume growth

The European truck fleet has expanded less than transport volumes since 2015. Among the larger transport countries, Poland (+20%) and Romania (+45%) showed the highest growth in rolling stock between 2015 and 2021, following the shift of international transport towards Eastern Europe. This turned Poland into Europe’s market leader in international road transport, with 1.2 million registered trucks (> 3.5 tonnes), including those of many western European subsidiaries.

Total fleet growth slowed throughout the pandemic with companies detaining trucks due for replacement. This is expected to continue throughout 2022, and combined with a limited inflow of new trucks, could indicate tight truck capacity.

Truck fleet development lags transport demand

Development of truckpark vs. transport performance in ton/km (EU 27), index (2015 = 100)

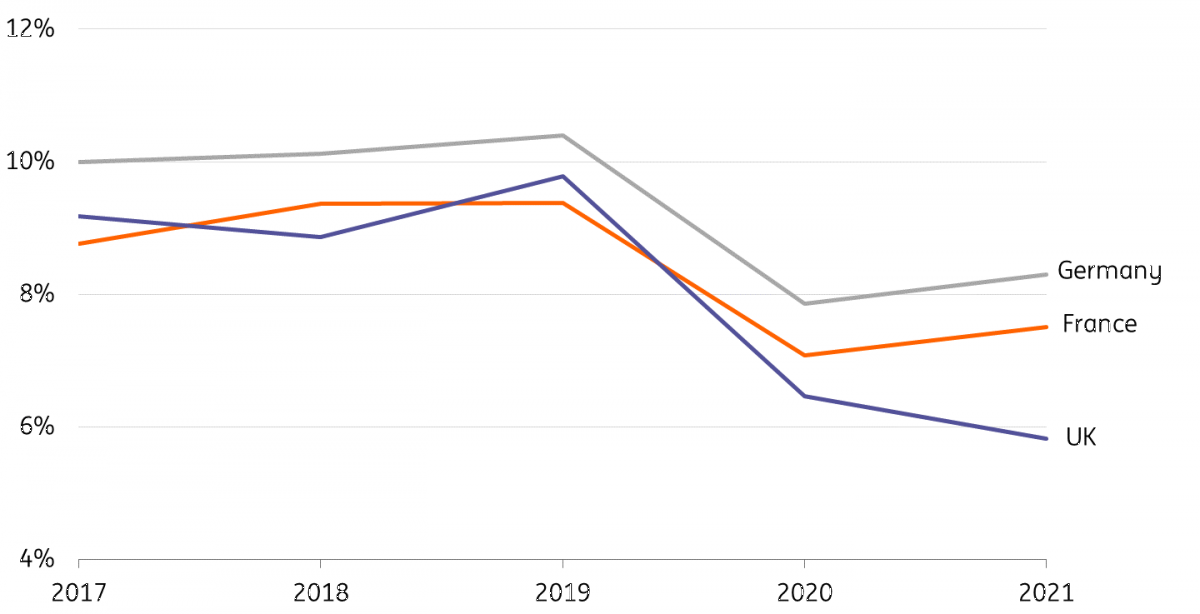

Recovery of truck registrations still a long way off in biggest European markets, with the UK most behind

Among the three biggest European markets, the largest initial drop in new truck registrations in 2020 was seen in the UK. Registrations have only shown a weak recovery thus far, still hovering at around a quarter below their 2019 level.

Truck registrations in the Netherlands remain more than a fifth down, and more than a third lower than pre-pandemic levels in Belgium. Remarkably, southern European countries (including Italy and Spain) recovered fairly well from low levels. However, new truck registrations have slumped in these countries since the financial crisis in 2009, leading to a relatively old installed base, so this recovery could be the result of a catch-up effect.

Replacement rates slowed due to the low inflow of new trucks

% rolling stock replaced by new trucks per year in the largest European truck markets

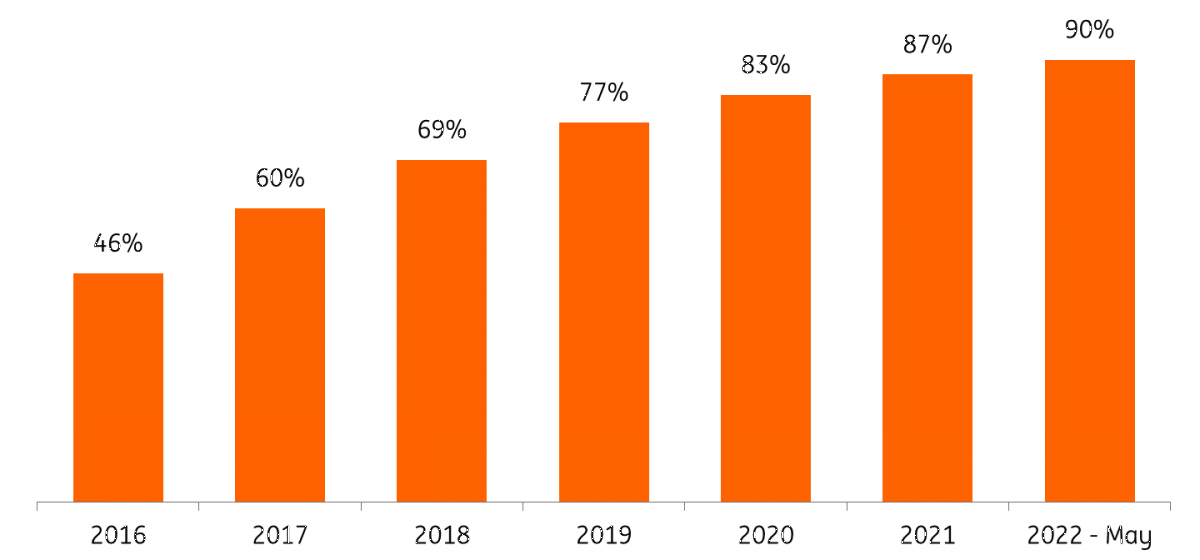

Stretching the investment cycle ages the fleet

Low inflow and plunging replacement rates of new trucks also lead to resumed aging of the fleet in European countries. Road taxing figures for Europe’s largest economy, Germany, show the share of Euro VI-trucks in total motorway traffic reaching 90% in 2022. Despite the lowest fares for new trucks, the share of Euro VI could have been higher, with replacement rates remaining relatively low for the third consecutive year.

Share of Euro VI-kms on European motorways close to 90%

Share of the cleanest emission class Euro VI (first generation: 2013) in total kilometers on German motorways

Order intake slows with transport headwinds – pent-up demand still there

Registrations were still a fifth lower in 2021 than pre-pandemic levels, as significantly higher prices combined with weakened growth perspectives and mounting uncertainty all contributed to a slowing order intake. Despite a long period of reduced deliveries for clients, this has not led to notable order cancellations. We believe that three years of underproduction and rebounded road transport volumes could also result in pent-up demand for replacements, which could signal a potential for the truck market to catch up in the coming years.

Fuel efficiency is an extra incentive to replace rolling stock. New models of Scania, Volvo, and DAF (the latter also makes use of the option to lengthen the tractive unit to improve aerodynamics) easily lead to a 10% fuel saving when replacing a seven-to-eight-year-old truck.

Soaring raw material prices led to significant price hikes for new trucks

Market prices of new trucks and trailers have risen significantly in the squeezed truck market. An average 400pk tractive unit trades around €100,000-110,000, an increase of some 15-25% from pre-pandemic levels. Higher commodity prices – raised further by the war in Ukraine – led to price hikes for important components such as steel, plastics, and rubber (tires). Prices are also higher due to more expensive new generation models (like the more aerodynamic DAF XF/DG), which also have their own impact and limited production capacity. Despite pricing power, manufacturers struggle to commit to fixed price quotations for deliveries a year in advance. In practice, it depends on both the manufacturer and the specific characteristics of a deal.

Due to the nature of higher elasticity, price increases of available used trucks tend to be more pronounced. Trucks used for less than three years are especially popular, and can even approach the same price levels as new equipment. As soon as the market normalises this, prices are expected to face a correction.

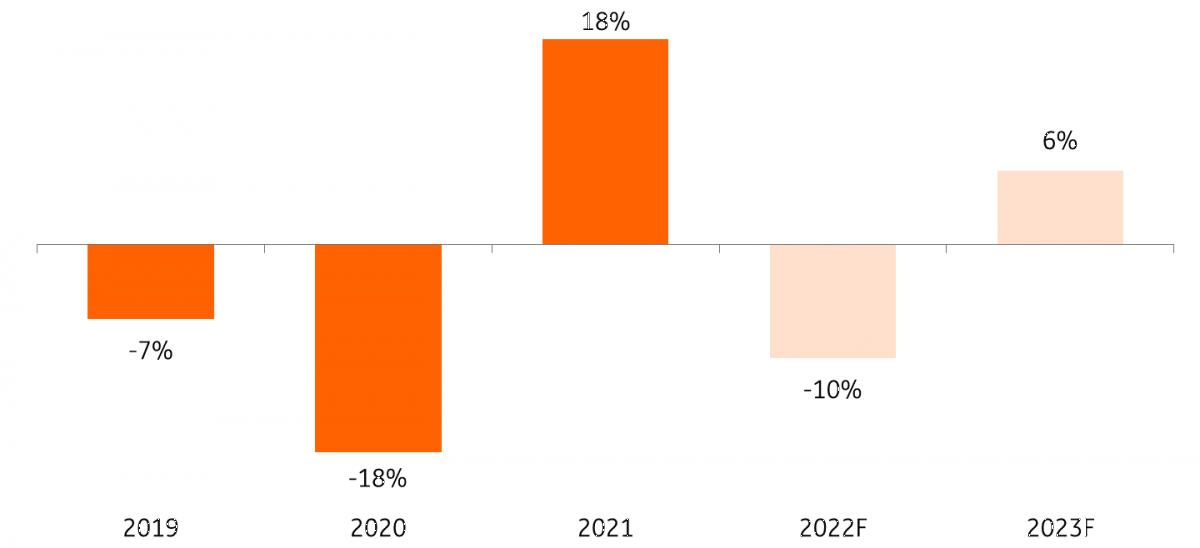

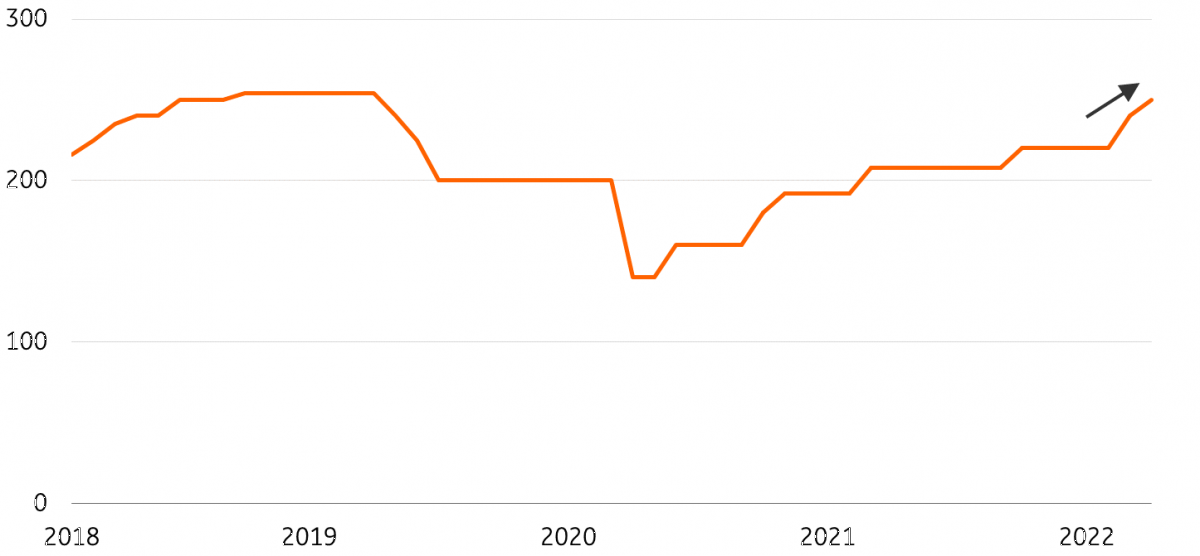

European truck production to end up lower in 2022

European production of medium and heavy duty vehicles > 3.5 tonnes

New interruptions push back European truck production in 2022

Although demand naturally drives production, supply is still the limiting factor for truck manufacturers and dealers in the current market. Following pandemic-related closures, manufacturers had to limit production due to chip shortages. Large numbers of almost finished products were parked to keep production up as much as possible. In 2022, the war in Ukraine added to production constraints. MAN (part of Traton and VW) in particular faced instant shortages of cable harnesses, leading to a production interruption at sites in Munich and Krakow during March and April of 2022. Volvo also experienced new difficulties on the sourcing side which limited production. Although chip shortages have partially subsided and the second half of the year may be better, total annual European truck production figures are not expected to increase in 2022.

In the meantime, delivery times may still run up to 12 months. The release of Russian production slots following imposed sanctions created some space for some clients to receive orders earlier, but this is not substantial. Daimler's exports to Russia, for example, only accounted for some 1% overall.

Production ambition DAF-trucks reveals market potential

Announced daily production numbers DAF-trucks

Strong orderbooks preludes production increase in 2023, even if intake slows

Assuming that supply conditions improve in 2023, order backlogs will enable manufacturers to ramp up production in 2023 despite economic headwinds. Although transport capacity remains tight as a result of slowing order intake, there do not appear to be any signs of notable cancellations. Traton reported a declined order intake for Europe in the first quarter, which may have been influenced by muted ordering at Scania. On a global scale, market leader Daimler still talked of a global ‘record high’ orderbook in May 2022.

European truck registrations expected to increase in 2023

Registrations of new trucks > 3,5 tonnes EU + EFTA + UK

Increase of new truck registrations in 2023 following higher production

Heavy-duty truck registrations in the EU, EFTA, and the UK (>3,5 tonnes) recovered to 341,500 in 2021 – an increase of almost 15% year-on-year, but still below the 10-year average. In the first five months of 2022, registrations were still a fifth below their pre-pandemic base, and just below the 10-year average. Following a decline in production, new registrations will also slip into a slight decrease again in 2022 (335,000). Manufacturers are also expected to finalise and deliver parked vehicles with improved chip supplies over the course of 2022. On the back of significant order backlogs and the gradual improvement of chip shortages, 2023 seems set to be a better year – even if order intake continues to slow.

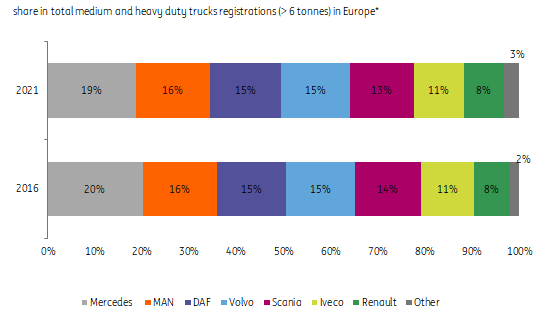

Mercedes still leads the European truck market

The European truck market is dominated by six companies and seven brands: Daimler (Mercedes), Paccar (DAF), Volvo Trucks, Traton (Scania, MAN), Stellantis (Iveco), and the Renault Group. Market shares changed modestly from year to year, but have grown slightly closer in the long run. Mercedes (Daimler) is still the market leader in medium and heavy-duty trucks (>3.5 tonnes), followed by MAN, DAF, and Volvo. DAF grew its market share in the heavy-duty truck segment (>16.0 tonnes), where Volvo and Scania also have a larger share.

Few changes in the consolidated truck market; Mercedes leads, MAN, DAF and Volvo follow

Truck market could normalise in the run up to 2024 – supply threats remain

If transport demand continues to stagnate and order intake slows, the market could turn from exceptional to normal again in the run up to 2024. Looming new frictions in fragile global supply chains remains a threat. As the truck industry is indirectly connected to supplies from Asia, Covid-19 policies may also lead to increased uncertainty. In operations, high sick leave rates combined with a tight labour market and risks of strikes also lead to risks for ambitious production schedules.

How are Volvo Trucks, Daimler Truck and Paccar performing and what is their outlook?

Volvo Trucks, Daimler Truck, and Paccar are three of the six companies dominating the European heavy truck market. We take a look at their financial performance and their outlook:

In short:

- Truck manufacturers showed broad year-on-year operational improvements in 1Q22.

- Orderbooks remain healthy with no cancellations seen so far.

- Supply chain issues receding but still feature this year.

A confident start to the year for Daimler Truck

Daimler Truck had a strong start to 2022, with an increase in unit sales, revenues, and adjusted operating profit in the first quarter of the year. During this period, the company had unit sales of 109,300 for trucks and buses (up 8%YoY), revenues of €10.6bn (up 17%YoY), and adjusted earnings before interest and taxes (EBIT) of €651mn (up 11% YoY). Encouragingly, during Daimler Truck’s annual general meeting (AGM) held on 22 June, the company’s management indicated that the first quarter might be the weakest of this year due to delivery bottlenecks, which also affected the prior year and were felt more acutely between January and March.

Daimler Truck feels that overall macroeconomic conditions continue to be relatively favourable for the global demand for commercial vehicles for 2022. The company anticipates an increase in the unit sales of the industrial business in the range of 500,000-520,000 in 2022 (from 455,400 units in FY2021). The truck manufacturer continues to target a significant increase at group level in FY2022 and has upgraded its full-year sales target to €48.0bn to €50.0bn following the 1Q results from €45.5bn to €47.5bn previously (and compared to €39.8bn in FY2021). Furthermore, Daimler Truck expects a “significant increase” in the adjusted EBIT in FY2022. The updated outlook reflects the currently-anticipated effects of the Russian invasion of Ukraine and the ongoing semiconductor shortages, while the additional uncertainty of a further potential Covid-19 pandemic still remains. On 27 February 2022, Daimler Truck suspended all business activities in Russia until further notice and took a charge of €170mn, with an anticipated further charge of €200mn to potentially be taken at a later point.

The company's management also commented during its AGM that, as a result of the supply chain bottlenecks, there was a significant number of unfinished truck inventory at the end of 1Q22, with some critical parts still missing. Daimler Truck expects that such inventories will remain elevated for the coming quarters, but will reduce gradually by the end of this year. Against this backdrop, the order backlog is very strong according to the company. Management believes that customers are so far behind in their fleet renewals that they are not in a good position to defer new purchases until later, in spite of the deteriorating overall macroeconomic outlook. On balance thus far, Daimler Truck is not observing order cancellations and therefore remains optimistic about the remainder of the year.

Paccar – still anticipating market growth this year

Paccar reported a good set of numbers for the first quarter of 2022, with worldwide net sales and revenues of $6.5bn (up 11%YoY), including net sales and revenues in the Truck, Parts and other segment of $6.1bn (up 13%YoY). Paccar had deliveries of 43,000 trucks during the quarter. According to the company, truck unit sales reflected higher deliveries in Europe, partially offset by lower unit deliveries in the US and Canada due to industry-wide shortages of semiconductor chips and component products. Paccar anticipates that the shortages will continue to affect deliveries in 2022.

The company’s truck revenues were $4.7bn in 1Q22, up 11%YoY, primarily due to higher realised truck prices. In the US and Canada, Europe and Mexico, South America, Australia and Other, truck sales increased by 1%, 29%, and 18%YoY respectively for the reported quarter.

With regards to profitability, the Truck, Parts & Other segment’s income before income taxes was $627m, up 19%YoY for the reported quarter. The Truck income (before income taxes) was $277m, up 2%YoY.

At the time of the 1Q announcement, the company’s outlook for FY2022 expected that the truck industry heavy-duty retail sales in the US and Canada will be between 260,000 and 290,000 units compared to 250,000 in 2021. In Europe, Paccar expects the 2022 truck industry registrations for vehicles over 16 tonnes to reach 270,000 to 300,000 units compared to 278,000 in 2021. In South America, Paccar expects heavy-duty truck industry registrations in 2022 to reach 125,000 to 135,000 compared to 127,000 in 2021. In 2022, the company expects its Parts sales to increase by 12-15%YoY, reflecting a robust freight demand.

Volvo Group also sees demand ahead of its available supply

In 1Q22, Volvo Group had sales of SEK105.3bn, up 12%YoY and up 11%YoY when adjusted for currency changes and a divestment of UD Trucks. Volvo Group's Trucks division contributed SEK69.6bn during the reported quarter, up 31% YoY on a comparable basis when excluding the effect of the UD Trucks divestment, and up 23%YoY when additionally excluding the currency effects. In 1Q22, the company had an adjusted operating income of SEK12.7bn, up 7%YoY, with the respective margin declining to 12.0% from 12.6% in the comparable prior-year quarter. The higher adjusted operating income reflected the effect of higher prices and sales volumes, partially offset by higher material and freight costs as well as lower earnings in joint ventures.

The Trucks division’s adjusted operating income was SEK8.7bn, up 16%YoY, with the respective divisional margin of 12.5% (compared to 12.8% in 1Q21). Volvo Group's unadjusted operating income was SEK8.6bn, down 29%YoY, driven by the Russia-related charges taken during the reported quarter. The company had total assets of SEK9bn related to Russia and took SEK4.1bn related provisions. The operating income in 1Q22 also reflected a positive effect of SEK1.3bn from currency movements.

Volvo Group noted that transport activity across most regions was quite good and that demand for trucks was high. The company said it had large order books and that current delivery times are long, making the group more restrictive with its order slotting. This had an adverse effect on order intake during the reported quarter (with truck order intake down 43%YoY in 1Q22, excluding UD Trucks) relative to the particularly elevated 1Q21 levels.

The supply chain continued to be strained, primarily due to shortages of semiconductors and other component parts combined with a lack of freight capacity. This caused production stoppages throughout 1Q22 which are expected to recur in the future. However, in 1Q22 truck deliveries increased by 6%YoY, to 55,600 vehicles (a record level for a first-quarter). Volvo Group also highlighted cost inflation and anticipates that inflationary pressures will continue. On a more positive note, Volvo Group received an order in March from Maersk for 110 Volvo Electric trucks, the single largest commercial order of the company's electric trucks.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

1 July 2022

Extraordinary times for the European truck and trailer market This bundle contains 3 Articles