Italy: The positive ‘reopening’ effect will be temporary

We expect the Italian economy to enjoy temporary support from a tourism-related reopening effect over the second and third quarters. This will evaporate, however and we're likely to see a contraction in the last three months of the year

Investment helps Italy avoid a first-quarter contraction

The Italian economy just managed to post a modest 0.1% Quarter-on-Quarter growth in the first three months of the year, with investment as the sole growth driver. Given the deteriorating external background, the contraction of private consumption was far from surprising. Households, notwithstanding improving employment conditions, had their disposable income eroded by an unanticipated inflation wave already before the start of the war in Ukraine. Consumer confidence declined accordingly, confirming a more cautious twist in consumer behaviour. This was mirrored by an increase in household savings rates, which climbed to 14.6% in the first quarter, moving further away from the 10% pre-Covid average.

Consumption's changing and non-durables and tourism will benefit

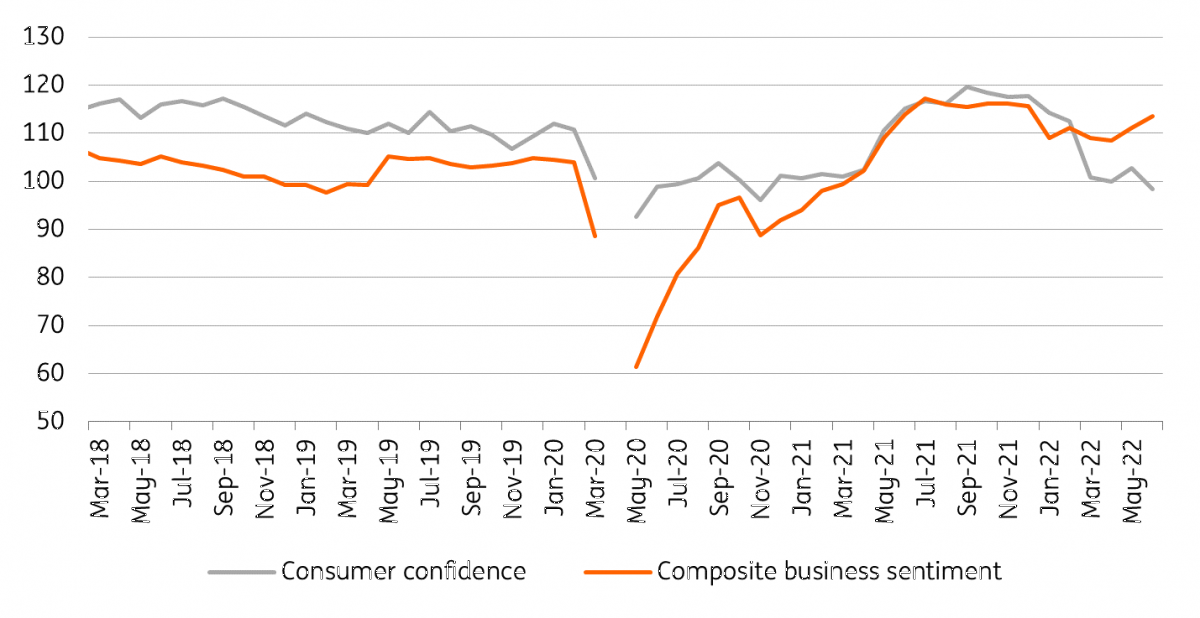

As we move into the second quarter, we're getting conflicting signals as far as confidence is concerned. Consumer confidence has fallen further while business confidence broadly stabilised in industry and improved markedly in services. How do we reconcile this? We suspect that the measures put in place by the Italian government to help households weather the inflation shock, such as temporary cuts to energy taxes and other fixed costs along with a lump sum to lower earners, have not been sufficient to compensate enough and subsequently improve their mood. At the same time, businesses have benefited from a continuous stream of incoming orders (particularly in industry) and of a re-opening effect as the last anti-contagion restrictions were lifted.

Mixed signals from confidence data

Growth will be supported by a tourism recovery in the summer

The acceleration of inflation over the second quarter - headline HICP inflation reached 8.5% in June and it doesn't look like it's going to fall anytime soon - has persuaded the Italian government to extend the compensation measures until the end of the third quarter. Conditions are right for a temporary modification in consumer behaviour, where budget-constrained households reduce consumption of durables in favour of non-durables and services, particularly tourism. Indeed, barring very negative surprises from the pandemic front, the summer of 2022 might mark a return of tourism back to pre-Covid levels. Tentative evidence from recent surveys run by the confederation of tourism operators and from balance of payments data seem to support this view. The continued acceleration of “re-opening” inflation (at 5.4% in June) is also possibly signalling that tourism-related demand already accelerated in the spring.

Industry should also be growth supportive

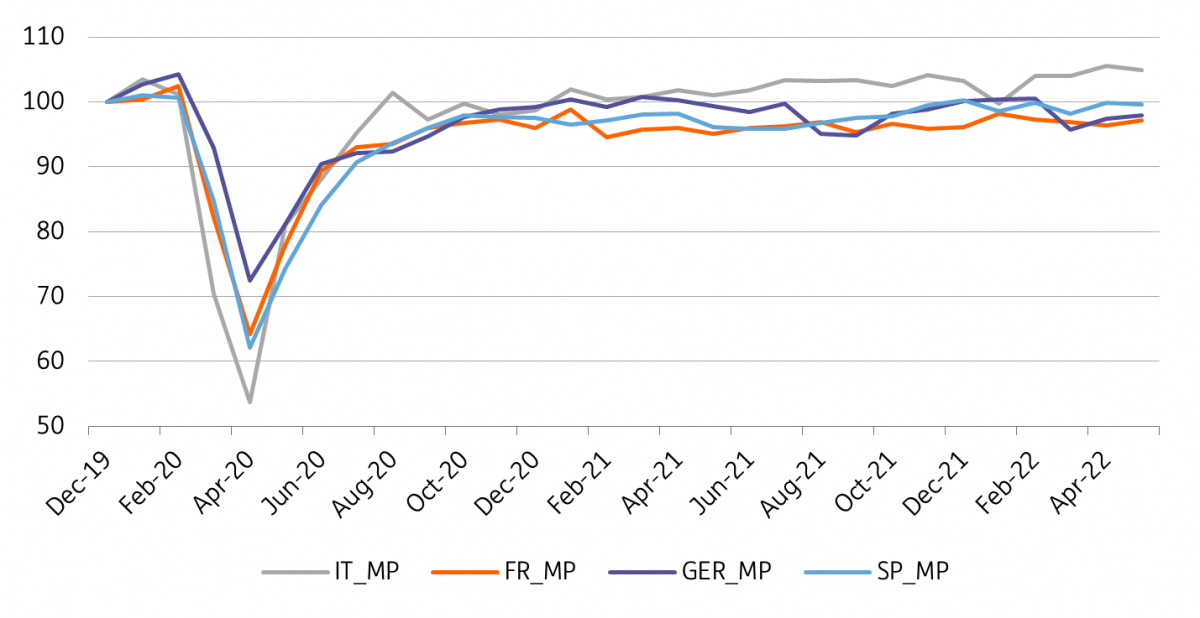

Another short-term factor temporarily supporting growth in the second quarter is the resilience of Italian industry, which has consistently overperformed peer core countries since early 2021, possibly thanks to a specialisation pattern less vulnerable to long-lasting supply chain disruptions. With May data now in the bag, it seems highly likely that in the second quarter, industry will be again a growth driver. In perspective, we should not forget that the inflowing European recovery and resilience funds will provide solid support to domestic industry, particularly at times when the energy transition and related investments have become a national top priority to make the country less dependent on Russian gas.

Italian manufacturing production resilience continues

Public finances will likely enjoy temporary favourable conditions, helped by inflation

In the meantime, the impact of unexpectedly high inflation and of the phasing out of one-off Covid-related emergency measures is showing up in public accounts, which posted a substantial YoY improvement of €44bn over the first six months of the year, notwithstanding the set of temporary measures put in place by the government As the so-called inflation tax is also working to reduce the real value of the debt, in 2022 the combined effect should be a reduction in the debt/GDP ratio to around 147.5% (from 150.4% in 2021). But make no mistake: to keep such a pace in less inflationary times, a combination of decent growth and sustained primary surpluses will be needed, as in pre-Covid days.

The Italian economy in a Nutshell (YoY%)

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

12 July 2022

Eurozone Quarterly: This is going to hurt This bundle contains 11 Articles