Italy’s election result not raising concerns for now

As largely expected, a centre-right coalition led by Giorgia Meloni has secured a clear victory in Italy's election. Meloni will now form a government which will count on a stable majority. For now, concerns about budget decisions and relationships with the EU are quite muted, and both Italian bonds and the euro have bigger short-term issues to deal with

Centre-right got an ample majority in both branches of parliament

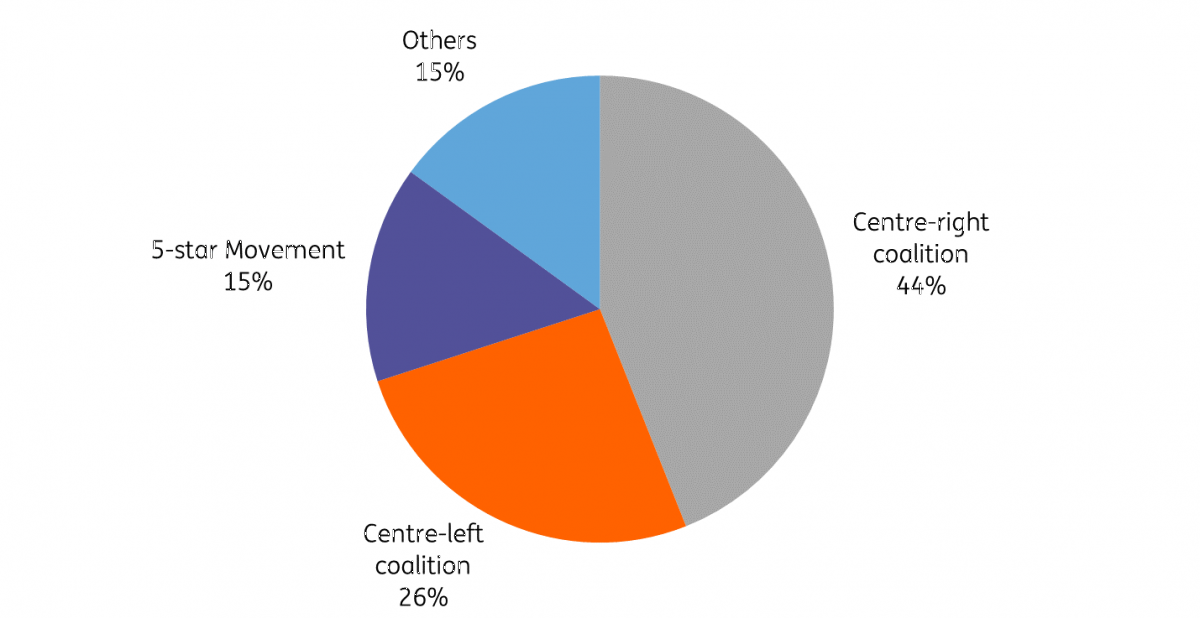

For once, actual Italian election data broadly confirms what opinion polls had anticipated. According to preliminary data available as we write, the centre-right coalition got an ample majority (44%), with the centre-left following some way behind (26%). The Five-Star Movement, which runs in isolation, came third (15%), followed by the centrists of Azione/IV (7.7%). As expected, with the current electoral system attributing a third of seats under a first-past-the-post rule, the ability (or a lack thereof) to form a wide coalition was a decisive factor.

The centre-right exploited it very well, mopping up an overwhelming majority of first-past-the-post seats. Based on preliminary data, the centre-right coalition should get a decent majority in both branches of the Parliament.

Meloni to get a mandate to form a government

The undisputed big winner in this election was Giorgia Meloni, the leader of Fratelli d’Italia. With 26% of the votes, she prevailed in her coalition by a huge margin over Lega (9%) and Forza Italia (8%). There will be no leadership issue, and she will very likely get the mandate from President Sergio Mattarella to form a new government.

This will not happen before mid-October, though, after the first gathering of the houses and the election of their speakers. A new Meloni government could thus be installed by the end of October.

Italian election results

A tight agenda awaits Meloni, with the budget at the top of the list

The scope of Meloni’s lead within her coalition will likely give her the upper hand in many decisions, but we suspect she will be very careful not to humiliate her allies for the sake of stability. Still, on some crucial matters, such as the fiscal stance, she will likely be in the position to effectively oppose calls for more deficit from Salvini, the leader of Lega, who was a big loser in the polls. As the new budget will have to be approved before year-end, we expect the outgoing Mario Draghi government to set up the macro framework and, possibly, the Planning Document setting the budgetary framework. This should prevent any meaningful deviation from the set track in the short run.

More critically, Meloni will over time have to clarify her stance on the international positioning of Italy. If adhesion to the Atlantic Pact seems not at stake, the relationship with Brussels and big eurozone countries will have to be clarified. If participation in the euro project is neatly reaffirmed in the programme, the notion of doing so while defending national interests has yet to be qualified. Not a very short-term issue, but a potential area of conflict for 2023, when the new European fiscal rules will be discussed.

Rates: too early to make long-term calls on policy

Italian bonds largely shrugged off the goldilocks result of this weekend’s election: enough votes for the right-wing coalition to ensure stability but not too much so it can change the constitution with a two-thirds majority. Italian spreads tightened into the election in a sign that they have made peace with the prospect of an FdL-led government, for now at least. Focus is now on the early decisions that Meloni’s government will take, including the FinMin appointment, and on the 2023 budget. Longer term, this government’s policies, especially towards Brussels and fiscal discipline, are an unknown quantity. But markets aren’t well equipped to make long-term calls on policy, especially with contradictory near-term signals.

Instead, the main driver of Italian bonds over the coming weeks and months is likely to be the broader tone in financial markets. In a context where central banks tighten monetary policy in unison, or even competing with each other in some instances, carry-oriented investors are understandably shy in picking up the additional yields offered by Italy’s bonds. The ECB’s newfound hawkishness is a particular worry, and so is the prospect of it reducing the size of its bonds portfolio through quantitative tightening.

FX: Italy is not a short-term concern for the euro

The Italian election results seem to have gone mostly unnoticed in the currency market. This is partly due to the predictability of the outcome, but may also denote how markets are giving Meloni the benefit of the doubt after a campaign where she firmly reiterated her intention to respect fiscal rules and maintain Italy’s foreign stance unchanged.

Quite crucially, like for government bonds (BTPs), the euro has bigger concerns to deal with – Russia-Ukraine developments and the energy crisis above all – and is now also feeling some spill-over effect from the meltdown in the GBP market over the past two sessions. With the ECB’s hawkishness having blatantly failed to offer the euro any solid support and the dollar staying strong, EUR/USD downside risks remain quite elevated in the near term, even without Italian politics adding any pressure.

We think that some Italy-EU confrontation on Meloni’s party's core themes (like immigration) may trigger some adverse market reaction further down the road, and that fiscal decisions may be scrutinised more if she presses forward with tax cut proposals, but it is simply too early for any risk premium to emerge on EUR/USD or even EUR/CHF.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more