Italy: Election time, finally

Italy is approaching the 4 March general election with the economy in full recovery mode, but there's a high chance of an inconclusive result

Domestic demand drive continued in 3Q17

Italy is approaching election time with the economy expanding at a decently good pace. But don't expect a clear-cut election victory for any party. Forming a new majority will take time and a caretaker government, headed by the current Prime Minister, Paolo Gentiloni (pictured with Germany's Angela Merkel last year) would help contain the risk of a confidence crisis.

Economic prospects are looking decidedly more promising. In the third quarter of last year, Italian GDP expanded by 1.7% YoY, driven by domestic demand. Interestingly, private investment continued gaining ground, overtaking private consumption as the leading contributor to quarterly growth. A solid export performance was behind the marginally positive contribution of net exports to quarterly growth. The unexpectedly sharp decline in inventories was a cause for temporary concern, as forward-looking indicators suggest a possible rebalancing in 4Q.

Confidence and employment data remained supportive in 4Q

However, economic momentum still seems to be in place throughout 4Q17. Manufacturing business confidence climbed further, propelled by the capital goods component; services business confidence, a closer proxy of domestic demand developments, continued catching up.

Improving economic conditions are reflected in further employment gains

The headline employment number returned to pre-crisis levels in November. Admittedly, the bulk of new jobs are temporary in nature but, nonetheless, they help boost disposable income and ultimately private consumption. Taking into account confidence improvements, disposable income developments, rising capacity utilisation and healthy foreign order books, we end up with a 0.4% QoQ growth estimate for 4Q17 GDP, which would translate into a 1.5% average yearly GDP growth for the whole of 2017.

Good chance of a symbolic marginal decline in debt/GDP ratio

Stronger than anticipated economic growth might have as a positive side effect in marginally reducing the debt/GDP ratio in 2017. A projected 2.1% deficit/GDP ratio and the impact of some debt buybacks done by the Italian Treasury over December could have been enough to drive a symbolic 0.2% decline in the debt/GDP ratio. We will have the verdict on 1 March, just three days before the day of the Italian general election.

Employment now back to pre-crisis level

The Italian electoral system

Italians will vote in March with a mixed electoral system, where two-thirds of the seats are attributed on a purely proportional basis, and a third with first-past-the-post rules where coalitions will be possible. In the current political setting, no party seems to be in a position to approach the absolute majority in isolation.

General elections, scheduled for March 4, will be the key Italian event in 1Q18

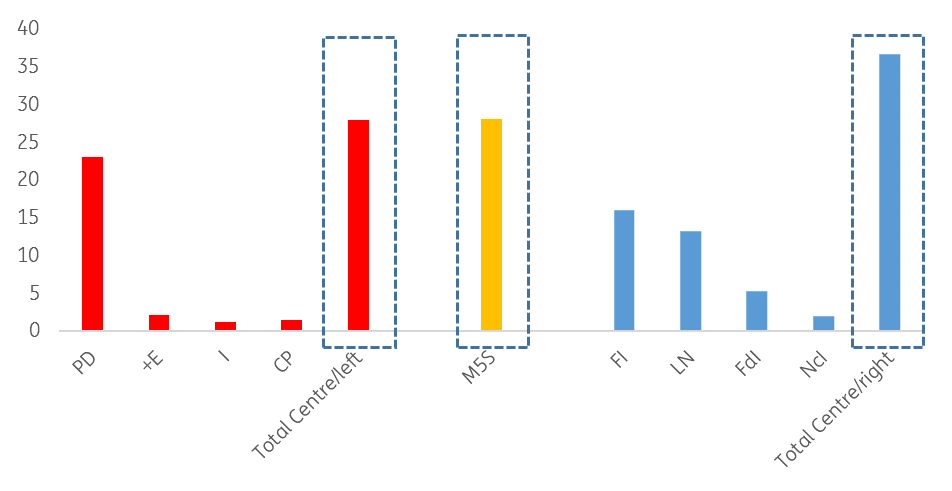

Still, forming a coalition is not proving easy. As we write, only the centre-right parties have been able to assemble a coalition to compete for first-past-the-post seats. This will put together Forza Italia, Lega Nord, Fratelli d’Italia and Noi con l’Italia. On the centre-left front, the attempt to form a coalition has so far scarcely proved to be fruitful. The PD will likely end up coalescing with part of the centrists and with liberals, but not with Liberi e Uguali, a new political formation born from the convergence of smaller parties positioned to the left of the PD party. Finally, as we've known for a while, the anti-establishment 5Star Movement will run in isolation.

An outright win is extremely unlikely

Managing to form a coalition is unlikely to be enough to earn an outright victory. Opinion polls suggest the centre-right grouping would currently earn 36.5% of votes in the proportional part. A centre-left coalition (including the PD and centrists, but without the left hardliners) could get 28% and the 5Star movement 28%. According to some estimates given the current situation, even the leading centre-right coalition would need to win at least 70% of available first-past-the-post seats to approach the absolute majority in the parliament. That's a very unlikely occurrence, in our view. The current political picture clearly seems conducive to a hung parliament.

The formation of any government will likely call for some form of broader coalition after the vote

Such a recombination of factors might well involve a break-up of original coalitions. Against this backdrop, the electoral campaign which has just started might see parties fiercely competing with (and mistrusting) other members of their own coalition, well aware that from day two the coalition itself might disintegrate. Such a framework increases the risk of the proliferation of (financially) untenable promises made during the campaign to maximise the electoral score to increase post-vote bargaining power.

The good news is that in this process the most extreme and potentially destabilising calls such as that of the (not admissible) referendum on 'Itexit', Italy leaving the European Union by the Five Star Movement are being progressively attenuated by their proponents. Some noise-filtering practice will be needed during the campaign to pin down what an eventual grand coalition could be able to converge upon.

January opinion polls indicate no outright winner, even with coalitions

A possible caretaker government

As happened elsewhere, an inconclusive electoral result might also mean an unusually extended time frame to craft a new majority. Over that period, with president Mattarella busy exploring possible solutions, the current Gentiloni government would remain in place to avoid a political vacuum, acting as an empowered caretaker. Such temporary continuity, and, no less importantly the fact that a flexible ECB will still be active with its Public Sector Purchase Programme, should all help reassure the market, limiting the scope for a substantial spread widening in government bonds. Should any attempt fail by the summer, the risk of another election in the autumn would likely increase, and market nervousness with it.

The Italian economy in a nutshell (%YoY)

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

18 January 2018

ING’s Eurozone Quarterly: All systems go This bundle contains 13 Articles