Is there any stopping thermal coal?

Thermal coal prices have surged higher over recent months, driven by stronger demand in Asia. Moving forward though we expect prices to weaken, as market tightness eases

Market update

Is there no stopping the move higher in the coal market, with Newcastle coal hitting a dizzying high of almost US$110/t? Strong Asian demand along with supply constraints due to weather and mine issues had been the catalyst. We have seen some price weakness more recently, and moving through 2018 we expect further pressure on prices, with an easing in supply tightness.

The Asian demand push

It is Asian demand which has largely supported global coal prices, and this is reflected in the Newcastle/API2 spread which has popped out to over US$18/t from just US$2/t in November 2017. The spread however is likely approaching its upper limits, with the strength likely to pull in further Western hemisphere supply to Asia, which would have otherwise made its way to Europe.

Over 2017 mine inspections and industry restructuring in China continued to weigh on domestic supply. Domestic output increased 3% YoY to 3,445mt, but this was still lower than the 3,695mt produced in 2015. As a result, the country had to turn increasingly to the seaborne market, and thermal coal imports over the year were up 2% YoY to total 201.2mt. These stronger imports were despite the fact that the government took steps to limit imports over the year. Regardless, Chinese stock levels remain at multiyear lows, with inventory at 6 major power generators standing at 8.6mt currently, down from 11.4mt at the same stage last year, and the lowest going as far back as January 2015.

Tighter stocks should continue to support domestic prices, until we pass peak heating demand. As a result of stronger domestic prices, the government is looking to cap domestic coal prices at CNY750/t (US$119/t), according to media reports. This compares to a price of CNY765/t on the domestic futures market. In the absence of a recovery in domestic production, the country would likely have to rely on further imports, which should offer support to Newcastle coal.

In South Korea total coal imports for 2017 were up 11% YoY to total 131.5mt, stronger flows were due to increased heating demand, nuclear outages, and the start-up of some new coal power capacity. Moving forward, the country should see coal demand trend lower. South Korea currently has 10 nuclear reactors shut for maintenance, with a capacity of a little more than 9.6 GW, the country has been slowly bringing capacity back online, and this is expected to continue over the course of 2018.

Meanwhile Japanese thermal coal imports over 2017 totalled almost 116mt, up 4% YoY. However the trend moving forward, should be the restarting of nuclear capacity in the country. Currently almost 94% of nuclear capacity is shut, and so a gradual return of this should see both coal and LNG demand suffer.

Newcastle-API2 spread (US$/t)

European energy disruptions support coal

The European coal market has had its own bullish drivers. There have once again been temporary issues with nuclear capacity in France, natural gas prices were well supported over 4Q17 as a result of a number of supply disruptions, and the dark- spark spread across large parts of Europe continues to favour coal power generation, with the exception of the UK, which is largely due to the carbon tax in the country.

Looking into 2018, and our more bearish outlook for the natural gas market should also mean weaker coal prices moving forward. Additionally we continue to see a fall in coal’s share in the power mix, and this is very visible in the UK, where we have seen the coal mix fall from 28.4% in 2015 to 8.1% in 2017. This trend will only continue in 2018. However the one upside risk we cannot discount is forced French nuclear outages in the lead up to winter later in the year.

Given the longer term trend in Europe is a shift away from coal power generation, Australian and Indonesian supply will have to increasingly compete with Colombian coal supply moving forward.

Netherlands dark-spark spread (EUR/MWh)

Growing thermal coal supply

2018 is set to see an increase in global coal output, with the bulk of the largest producers set to see increases. The big question mark however is what happens with Chinese production over 2018. As we have seen over the past few years, government intervention has had an impact on supply, and as a result on prices. What is likely is that the Chinese government continues to push for consolidation within the domestic industry.

Australian output set to increase

2017 saw a fair amount of coal supply disruptions and this, along with stronger demand, was the recipe to send prices higher. Australian thermal coal production is expected to fall by c..5% YoY to total 248.8mt in FY 2017/18. This fall was driven by industrial action at a number of Glencore’s Hunter Valley mines in New South Wales over the year.

Australian producers will certainly want to take advantage of the higher price environment and increase output over 2018. The Australian government estimate that thermal coal output will increase by 2.1% YoY to total 254.1mt in FY 2018/19, whilst export availability is forecast to increase by c.1% to total 203mt over 2018.

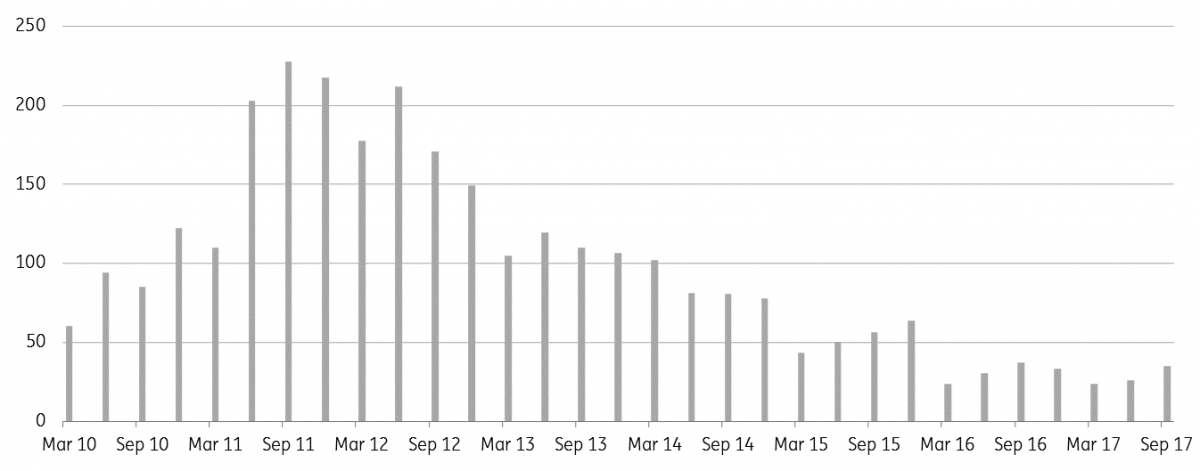

However in the longer term, growth in Australian output does look limited, with exploration expenditure remaining historically low. According to the Australian Bureau of Statistics, spending in coal exploration totalled AUD85m over the first 9 months of 2017. This compares to AUD91m and AUD150m for the same period in 2016 and 2015 respectively. Given the poor longer term demand outlook for thermal coal, it is no surprise that miners are reluctant to increase spending. Additionally miners may struggle to raise financing, with an increasing number of banks refusing to fund coal projects.

Australian expenditure in coal exploration (AUDm)

India continues drive towards self-sufficiency

India continues to set itself ambitious targets when it comes to coal output, which has forced state owned Coal India to revise lower its production target several times. For fiscal year 2018, India is expected to produce 600mt of coal, although realised output so far suggests this could be once again difficult to reach. Meanwhile for fiscal year 2019, the production target has been increased to 630mt. Growing domestic production does mean that in the longer term India will rely less on imports, however over 2017 the country drew down inventories. Currently power plant stocks stand at 14.68mt, down from 23.15mt at the same stage last year. These lower stock levels should be supportive for imports in the short term.

Floating Indonesian production targets

Turning to Indonesia, and while in theory the country has a production cap in place, miners continue to breach this target. While the 2017 production target was 413mt, miners produced 461mt. Moving forward the target for 2018 is set at 425mt, but the government has already made it clear that it is likely production will exceed 2017 output, with some new mines set to start operations. The government has said that it will not allow production to exceed 485mt this year. The Indonesian government is wanting to cap domestic output as part of a plan to ensure energy security in the future through holding reserves.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article