Is anyone playing by the rules of global trade?

Global trade rules are being used and tested in extreme ways. The US and China have acted before due process has taken place, but each are requesting consultations at the WTO to resolve the disputes

An eye for an eye

In the US’s escalating dispute with China about intellectual property practices, both countries are at pains to stress the justification for their actions in the rules of global trade, even if they aren’t waiting around for due process.

The US’s other recent actions on steel and aluminium imports are outside the rules of global trade, but with cover from the very same rules: the US has invoked the “security exception”. A country is allowed to opt out of its commitments under the global trade rules where it judges that the protection of its “essential security interests” are at stake. However, using this exception to raise tariffs on steel and aluminium is widely seen as a pretext for safeguarding domestic industry, and the tariffs as a tactic for forcing concessions in other trade negotiations.

Countries have reaffirmed their commitment to the global trade rules, but their responses to the US have also featured a jab or two below the belt. China has requested consultations with the US at the WTO under its Safeguards Agreement as a first step to claiming compensation for trade losses due to the steel and aluminium tariffs. But well ahead of this process being completed, China has also implemented tariff increases on 128 products it imports from the US, the equivalent of shooting first and asking questions later. In total, over 40 WTO members have raised concerns at the WTO about the US’s steel and aluminium tariffs.

Playing by the rules

Taking steel as an example, countries have raised concerns and even entered into disputes at the WTO about the effects of overcapacity in global production over a number of years. Alongside these activities, a forum for taking action on the root causes of the issue has emerged outside the WTO (the G20 Global Forum on Steel Excess Capacity). Rather than a failure of the global trade rules, countries taking justice into their own hands on traded steel is entirely in line with the WTO’s approach to disputes. Its process encourages countries to come to the table and have a dialogue about trade disputes, then enter into negotiations, not litigation, to solve them. This is the way that “almost half” of disputes are resolved - through negotiations, without progressing to any of the WTO’s further stages of dispute resolution.

The majority of trade disputes are triggered by variants of the same issue, namely a domestic industry being damaged or threatened with damage in a country which has seen an influx of (lower-priced) imports.

Global trade rules are being used and tested in extreme ways

At its most extreme, this is dumping, exporting at unfairly low prices. Where the trade flow doesn’t meet the definition of dumping, a country may still seek to mitigate damaging effects on its domestic industry temporarily (to help facilitate improvements in competitiveness or the reallocation of resources). This is known as safeguarding and can involve a country raising tariffs on imports, for a limited period. Importantly, in instances where safeguarding is appropriate (i.e. where domestic industries are being damaged), exporting countries are entitled to compensation for the loss of trade they experience while the import restrictions are in place. If this is not forthcoming, they can take equivalent action, for example by raising their own tariffs on imports. When a country is affected by safeguarding in another country and seeking compensation, it lodges a request at the WTO to enter into “consultations” as a first step.

The US import tariff increases on solar panels and washing machines followed the usual pattern of a safeguarding action. They followed US investigations into the import trends and threats of damage to domestic industries, and are time-limited (effective for 4 years on solar panels and 3 years on washing machines). China, the EU, Switzerland, South Korea, Malaysia and Singapore have expressed concerns about the tariffs, and the US duly entered into consultations with these countries. So far, so good for rules-based international trade, although a report that the consultations have not been conclusive means that countries will now need to escalate the dispute by requesting the formation of a disputes panel, and may also be considering retaliatory measures against the US.

War of words?

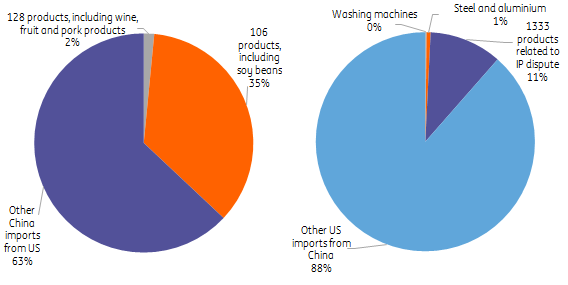

The products threatened with tariff increases in the dispute about intellectual property practices (1333 products from China and 106 US products) represent much more significant shares of US-China trade than US imports of Chinese aluminium and steel, and China's retaliatory increases on 128 products.

US and China imports affected by tariff increases and threats

While further tariff increases remain threats, the dispute about intellectual property is still (just about) proceeding through WTO channels. The US has requested consultations with China at the WTO, which would allow the two countries to discuss the US’s concerns about China violating global trade rules on intellectual property. The EU and Japan have requested to join the talks, having said they share the US’s concerns, though they have also stressed that any action taken should be consistent with WTO agreements.

The global trade rules are being used and tested in extreme ways. In using the security exception, the US has been cynical in its use of the global trade rules in the eyes of other countries. By retaliating against the US steel and aluminium tariffs with its own increases, China has acted before due process has been allowed to take place. The tariff increases that are currently being threatened in the IP dispute would be another serious step towards sidelining the WTO, if they are implemented. But all the while, the US, China and other countries have been at pains to stress that they are playing by the rules of the system, and anticipating, rather than rejecting, the enforcement of rules of global trade. Playing by WTO rules requires countries to enter into dialogues with one another about issues in trade, and allows for – indeed encourages – them to reach settlements “out of court”. If the dispute about intellectual property sees China and US come to the table to discuss their dispute along with the EU and Japan, this would be in the best traditions of rules-based international trade.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

6 April 2018

In Case You Missed it: Trump’s trade fight This bundle contains 6 Articles